Creating an asset

Depending on the type of depreciation calculation you choose to generate a schedule for, there are different types of assets you can create.

| If you are calculating depreciation for... | Asset types |

|---|---|

| Accounting & Taxation |

|

| Taxation only | |

| Accounting only |

|

- Go to the Client Accounting > Assets tab and double-click an asset year. The asset register appears.

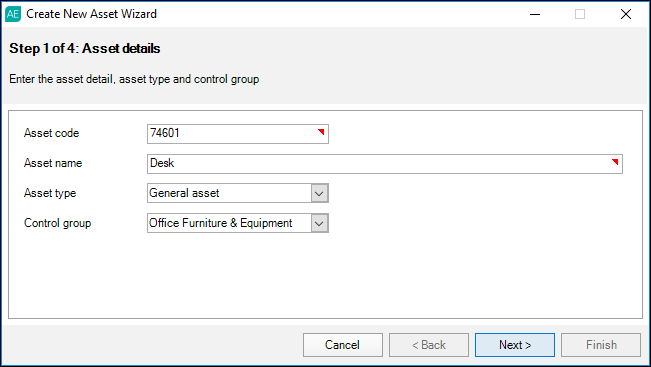

- On the TASKS bar, click Create new asset. The Create New Asset Wizard appears.

Enter an Asset code and an Asset name.

These are mandatory fields. Asset code can be up to 50 alphanumeric characters. Asset name can be up to 200 alphanumeric characters.

From the Asset type drop-down list, select General Asset.

From the Control group drop-down list, select a control group.

Click Next.

Enter the taxation and/or accounting details for the asset and click Next.

Field Description Acquisition date Enter the date the asset was acquired or purchased, as a date prior to the year-end date, in DD/MM/YYYY format. Start date Enter the date you want to start calculating depreciation. The acquisition date is entered by default. Depreciation method Select the depreciation method from the drop-down list. This defaults to the method selected for the control group. Cost (tax)

Original Cost (accounting)Enter the cost of the asset. Opening written down value This field is only available if the depreciation Start date is prior to the current financial year. Motor vehicle/Cost limit (tax) If your asset is a motor vehicle, select the Motor vehicle checkbox and, if applicable, enter the Cost limit of the vehicle. Effective life (tax)

Useful life (accounting)If you calculate depreciation using the effective life, enter the number of years and/or months to depreciate over. Or, if you're entering the taxation details, you can select the ATO commissioner's effective life. Depreciation rate year 1 % Enter a percentage between 0 and 100% to depreciate the asset for Year 1 (first year). Depreciation rate year 2 % Enter a percentage between 0 and 100% to depreciate the asset for Year 2 and subsequent years. Adjusted base cost (tax)

Residual value (accounting)Enter a value if you're using the Prime Cost (Tax) or Straight Line (accounting) depreciation method and your asset Start date is prior to the year start date. This field is only available if the asset Start date is prior to the asset register year start date.Private use % If applicable, enter the private use percentage between 0 and 100% for the asset. Private use bal sheet a/c Select a balance sheet account to post the private use portion of depreciation to. For example, account 50004 Partner A - Drawings. To search for an account, use the magnifying glass icon to open the Find Chart of Accounts window. Accumulated depreciation Read-only calculated field.

Accumulated private use If the start date of the asset is in a prior financial year, you can enter the accumulated private use in this field. Otherwise, this is a read-only calculated field. Optionally, enter any general details. You can enter the item's serial number, the number of units this asset entry covers, a location, insurance details and any notes.

Don't see a location to select? Check that you've entered a location in Maintenance > Association > Location.

- Click Finish. The Create New Asset Wizard closes and the newly-created asset appears on the Assets Listing page for the selected year.

- Go to Client Accounting > Assets and double-click an asset year. The asset register appears.

- On the TASKS bar, click Create new asset. The Create New Asset Wizard appears.

Enter an Asset code and an Asset name.

These are mandatory fields. Asset code can be up to 50 alphanumeric characters. Asset name can be up to 200 alphanumeric characters.

- From the Asset type drop-down list, select Low value pool asset.

From the Control group drop-down list, select a control group.

Click Next.

Enter the taxation details for the asset and click Next.

Field Description Acquisition date Enter the date the asset was acquired or purchased, as a date prior to the year-end date, in DD/MM/YYYY format. If the date entered is prior to the year start date, this asset will be added as a previously-depreciated asset and will be depreciated using the Year 2+ rate. Start date The year start date is automatically entered. Low value pool assets are always depreciated for the full year, regardless of when they were purchased, so you don't need to enter a start date. Cost Enter the cost of the asset. An asset can only be added to the low value pool if the cost is less than $20,000. If the cost is more than $20,000, you'll receive a warning message, but you can still add the asset by clicking Yes on the warning message. Opening written down value Only available if the depreciation Acquisition date is prior to the current financial year. Asset came from existing LV pool Select if the asset has been added to the low value pool in a prior year. This checkbox is only available for any previously-depreciated assets that are being added to the pool. By selecting the checkbox, the following rules will be applied: - The pool contribution won't be reduced again by the Private use %, because it was already reduced in the original pool.

- No journal will be created to transfer the asset into the pool, because the pool account balance is already correct when the original trial balance was placed into the general ledger.

- If a change in private use is later applied, selecting the checkbox adds the tax year to the pool value based on the acquisition date rather than the year it was added to the register.

This checkbox will be selected by default if you've migrated a low value pooled asset from AMS (NZ only), AE Assets 2.4 or AO Classic.

Private use % If applicable, enter the private use percentage between 0 and 100% for the asset. Pool contribution (Taxable value) Calculated automatically. Calculate decline in value (read only section) Depreciation rate (DV) % Calculated based on the Start date. Where the asset has been acquired and allocated to the pool during the year the rate is 18.75% (i.e. half the pool rate) for the first year. For subsequent years the depreciation rate is 37.5%

Calculated depreciation Calculated by multiplying the Pool contribution (Taxable value) by the Depreciation rate. Total depreciation Calculated as the sum of the calculated depreciation. Termination value Populated when the asset is sold. Taxable termination value Calculated when the asset is sold. (Termination value * (1 - Average private use %). Closing written down value Calculated by subtracting accumulated depreciation from the asset's opening written down value. If applicable, enter the accounting details for the asset.

Click Next.

Optionally, enter any general details. You can enter the item's serial number, the number of units this asset entry covers, a location, insurance details and any notes.

- Click Finish. The Create New Asset Wizard closes and the newly-created asset appears on the Assets Listing page for the selected year.

- Go to Client Accounting > Assets and double-click an asset year. The asset register appears.

- On the TASKS bar, click Create new asset. The Create New Asset Wizard appears.

Enter an Asset code and an Asset name.

These are mandatory fields. Asset code can be up to 50 alphanumeric characters. Asset name can be up to 200 alphanumeric characters.

- From the Asset type drop-down list, select Small business pool asset

From the Control group drop-down list, select a control group.

Click Next.

Enter the taxation details for the asset and click Next.

Field Description Acquisition date Enter the date the asset was acquired or purchased, as a date prior to the year-end date, in DD/MM/YYYY format. If the date entered is prior to the year start date, this asset will be added as a previously-depreciated asset and will be depreciated using the Year 2+ rate. Start date By default, the Year start date is automatically entered. Small business pool assets are always depreciated for the full year regardless of when they were purchased, so you don't need to enter a start date.

Cost Enter the cost of the asset. If the cost of the small business pool asset is less than $20,000 you can claim an immediate write-off. To do this, click < Back and change the asset type to a General asset. When entering the taxation details, select Immediate write off as the depreciation method. Opening written down value Only available if the Acquisition date is prior to the current financial year. Asset came from existing SB pool Select if the asset has been added to the small business pool in a prior year. Only available for any previously-depreciated assets that are being added to the pool. Selecting the checkbox applies the following rules: - The pool contribution won't be reduced again by the Private use %, because it was already reduced in the original pool.

- No journal will be created to transfer the asset into the pool, because the pool account balance is already correct when the original trial balance was placed into the general ledger.

- If a change in private use is later applied, selecting the checkbox adds the tax year to the pool value based on the acquisition date rather than the year it was added to the register.

This checkbox will be selected by default if you've migrated a low value pooled asset from AMS (NZ only), AE Assets 2.4 or AO Classic.

Motor Vehicle / Cost limit If your asset is a motor vehicle, select the Motor vehicle checkbox. The Cost Limit will be automatically filled with the ATO value relevant to the current year. If the asset was pooled in an earlier year you can edit the cost limit to calculate using the limit that was applied when the asset was first pooled. Selecting this checkbox applies the following rules: - The Pool contribution (Taxable value) is limited to the cost limit.

- depreciation for the first year includes the motor vehicle immediate write-off amount in addition to the Year 1 rate, up to the value of the cost limit.

Private use % If applicable, enter the private use percentage between 0 and 100% for the asset. Private use adjustment If you need to make an adjustment to the private use, click the elipses (...) to open the Private use adjustment window. Pool contribution (Taxable value) Calculated automatically. Calculate decline in value (read only section) Depreciation rate (DV) % Calculated based on the Start date. Where the asset has been acquired and allocated to the pool during the year this rate will be 15% (i.e. half the pool rate) for the first year. For subsequent years the depreciation rate is 30%

Calculated depreciation Calculated by multiplying the Pool contribution (Taxable value) by the Depreciation rate. MV immediate write off If you purchased a motor vehicle, an immediate write off of $5,000 is used in the calculations up to 31 December 2013. If you purchased a motor vehicle on or after 1 January 2014, no immediate write off is calculated.

Total depreciation Calculated as the sum of the calculated depreciation and MV immediate write off. Termination value Populated when the asset is sold. Taxable termination value Calculated when the asset is sold. (Termination value * (1 - Average private use %) Closing written down value Calculated by subtracting accumulated depreciation from the opening written down value of the asset. If applicable, enter the Accounting details for the asset.

Click Next.

Optionally, enter any general details. You can enter the item's serial number, the number of units this asset entry covers, a location, insurance details and any notes.

- Click Finish. The Create New Asset Wizard closes and the newly-created asset appears on the Assets Listing page for the selected year.