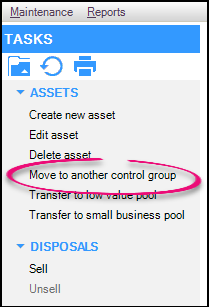

Moving an asset to another control group

If you have allocated an asset to an inappropriate control group, you can correct the error by transferring the asset to a different control group. Or you may notice when editing the asset that the Control Group is greyed out, indicating that this field cannot be changed. You can however transfer the asset to another control group in the year the asset was created.

When transferring an asset to a different control group, no modification to data is made for any taxation dependent variables.

When transferring an asset to another control group, MYOB Assets Live:

debits the new control group account with the cost of the asset

credits the original control group account with the original cost of the asset

debits the original accumulated depreciation account with the accumulated depreciation and the year-to-date depreciation

credits the new accumulated depreciation account with the accumulated depreciation and the year-to-date depreciation

debits the new depreciation expense account with the year-to-date depreciation

credits the old depreciation expense account with the year-to-date depreciation

debits the original private use expense account with the year-to-date private use amount

credits the new private use expense account with the year-to-date private use amount.

The selected asset can only be transferred in the year it was created. You can only transfer an asset if more than one control group exists.

You must transfer an asset to a different control group from the original one.

An asset cannot be transferred to another control group if it has been sold in a future year.