MYOB AE 2020.0—Post-installation

Confirm that the release version is correct on both your server and your workstations after you've installed.

Open MYOB AE.

Select Help > About from the menu bar.

The install version should be 2020.0.

The version number should be 5.4.35.161.Click the Plugins button to access the version number of individual products.

Product

Version Number

Client Accounting

5.4.35.161

Practice Manager

5.4.35.161

Document Manager

5.4.35.161

Corporate Compliance

3.2

Statutory Reporter Formats

Definition version 38

Tax - Classic

2020.0 (for a 2020 tax return)

2019.2 (for a 2019 tax return)

Tax Calculator

2020.0 (for a 2020 tax return)

2019.2 (for a 2019 tax return)

Tax Homepages

7.0.13.211

If you use MYOB Accountants Enterprise with Tax:

In C:\Program Files (x86)\MYOB\SBRSender\Server\Service\<SQL_Database_Name> check the file version of MYOB.Tax.Sbr.Common.dll is 7.0.13.211.

This check must be run on the server where your SBR Sender Service resides.

To find the file version, navigate to the directory, right-click on the file, select Properties and click the Details tab.

If you have more than one database, check the version is correct for each database.

The RSD routine rolls over return and worksheet information from the previous tax year to the new tax year.

Check the RSD options

MYOB AE Tax defaults the options that should be chosen so that your 2019 tax ledger contains as much historical information as possible. We strongly recommend that you accept these defaults.

If you’ve set your own defaults in a previous year, we'll use those defaults to rollover to 2020. If you weren't happy with the results of the rollover last year, review the defaults and read the information below for more details.

These options are used if you rollover the whole ledger, a batch of returns, or an individual return as you start working on it.

How to run the RSD routine

The following instructions are based on the default options for RSD. You can change the defaults, but read the explanations to understand the consequences of changing them.

In MYOB AE select Maintenance > Tax > Administration if you open your Tax 2020 ledger via System Release.

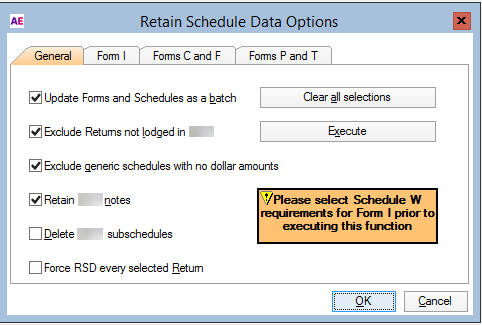

Select Utilities > Practice default options > Retain schedule data. The General tab opens providing options appropriate to all form types.

Select or deselect the Update forms and Schedules as batch checkbox, as required. If you deselect the Update forms and Schedules as batch checkbox, then only the return that has focus will be processed.

Leaving the Update forms and Schedules as batch checkbox selected does not have any effect on those practices that only roll forward returns when they first operate on themSelect or deselect the Exclude returns not lodged in 2019 checkbox, as required. This option applies only to Batch RSD and its importance cannot be understated.

If you deselect the Exclude returns not lodged in 2019 checkbox, every 2019 return will roll over to the 2020 ledger. This includes incomplete, unlodged returns.

Subsequently, work performed on returns in the 2019 ledger will not be present in the 2020 copy of the return. In order to have the final version of the 2020 return, together with the 2020 tax paid/refund amounts and PAYG Instalments paid information, you will have to perform the Force RSD routine for each such return when you open it to start work for 2020.We strongly recommend that you don't change this option.

Select or deselect the Exclude generic schedules with no dollar amounts checkbox, as required. By default the Exclude generic schedules with no dollar amounts checkbox is selected. To ensure the integrity of values in the main form that are lodged with the ATO, we strongly advise that you allow the RSD program to exclude blank generic schedules from the rollover routine.

Rolling blank Generic Schedules from year to year is dangerous!:

Information that you think is at the return label can be overwritten if you integrate from a schedule or worksheet that has a zero balance.

If you roll blank schedules from one year to the next without reviewing them in the new year, values imported from a general ledger directly into the labels on the face of the return could be wiped out if integration from a blank schedule occurs.

This option excludes from rollover blank generic schedules because they have the potential, if opened after a return label has been completed and/or lodged, of overwriting the value at the label in the return.

If you deselect the Exclude Generic schedules with no dollar amounts checkbox, every generic schedule will be rolled over into the new 2020 ledger. We strongly suggest that you do not deselect this option.

Select or deselect the Retain 2019 notes checkbox, as required.

Whilst this option is selected by default, it may be changed in the situation where you have a lot of unnecessary notes being rolled from year-to-year and find that there is never time to do Note Maintenance to remove the Notes that no longer apply to your client.

If you subsequently find you need a Note that was prepared in a previous year, you can open that year and cut and paste the Note into the current return.Select or deselect the Force RSD every return checkbox, as required.

This option should only ever be selected where a return has previously been through the RSD process and you have changed the prior year return because of an amendment to it, or you have been instructed to perform the routine again because of a change to MYOB AE Tax. You should never attempt to Force RSD on a lodged return.

When you select this option, every return that is included in the batch will be overwritten with the 2019 return details and if you have already commenced work on any of the returns in the batch, that work will be lost.

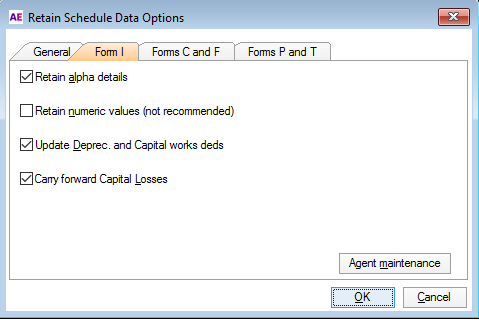

An example of when you would use this feature other than for a single return is where you are in a position of having to perform the RSD routine again for the entire ledger or for a range or batch of returns.- Click the Form I tab. This tab provides checkboxes for:

Retain alpha details: Selecting this checkbox rolls over all text entered in returns or schedules and worksheets, for example, Payment summary details, Financial institution details entered for Interest and Dividends, all Rental property details and any other text entered.

Retain numeric values: It is not recommended to select this checkbox as it will roll the same amounts that were entered in the 2019 return into the newly rolled over 2020 return. This could lead to errors if an amount from the previous year that was not applicable in the current year was overlooked when reviewing the return.

Update Deprec. and Capital works deds: Unless you want to enter all your depreciating asset details each year, leave this checkbox ticked. During the Year End and RSD routines, MYOB AE Tax moves Closing adjustable values to Opening adjustable values and automatically calculates depreciation for the current year.

Carry forward Capital Losses: This checkbox should be left ticked in order that Capital Losses are carried forward to the new tax year in their respective categories.

Click Agent Maintenance. The Agents window opens listing additional lodging agents in the practice.

Highlight the Agent from those listed.

Click Properties.

Open the Defaults tab.

Click the Forms C and F tab. Complete the options on this tab for:

Retain alpha details

Retain numeric details

Update Depreciation and Capital Works deductions

Carry forward Capital losses.

Click Execute to open the Record selection window.

Press Enter twice to accept the default range of first to last return, or

Type the codes for the first and last returns in the range to be processed, or

Select By item and create a batch of returns to be processed.

Selecting the Clear All Selections option will clear every tab on the RSD dialogue and will void the entire RSD process. Therefore, you would only do it if you wanted a clear screen to make new selections. This can also be easily be done by unticking a checkbox you do not want and ticking those you do.

In order to be able to run Tax Letters in 2020, you’ll need to update Tax letter views.

To do this:

Open your Tax 2020 ledger.

Select Tax Letters > Create/Update Views.

PM Plus users don’t need to perform these steps as the method to retrieve data is updated automatically.

To create the new event for Tax 2020 (newly installed current year -TA20) and roll over the steps from the previous year:

- From the Return index for the current income year, highlight the Tax Tracking ledger and press Enter. The Event browser window opens.

Select File > New. The Events properties window opens.

In the Event field, type TA20.

Press Tab. The Copy from previous Event? dialog displays.

Click Yes, to roll forward the steps for AE Tax from the prior year.

Overtype the Date and Description to suit the new income year.

Click Apply.

Click Cancel.

You’ve completed the TA20 event and rolled forward the steps from AE Tax 2019. Tax Tracking is ready for the new year.

Customised AE Tax reports are not rolled from one tax year to the next. If you generated reports in 2019 and wish to use them again in 2020 you'll need to:

create the reports again in 2020 or

export the reports from 2019 and import them into 2020 with your required changes.

These instructions are based on standard table reports. If functionality like graphs, pie charts or logos do not work after importing, edit them in the new year's report. The copied report may also require editing for fields which have become redundant in a new tax year.

An overview of the process is:

Identify if the report is portrait or landscape.

Identify the ReportId for the folder where the report is destined to be imported, for example, Tax 2020.

Export the report from Tax 2020.

Edit the report, update the ReportId and change field names from 2019 to 2020.

Import the report.

Repeat this process for each customised report that you want to continue using in the new tax year.

Each report has a ReportId. This identifies the folder where the report belongs. If the ReportId of the imported file is incorrect, the report won't display.

- In Practice Manager, select Reports > Report Export & Import.

- Select Tax2020 > Tax Reports only.

- Select any report and click Export. The Export Report window opens.

- Make a note of the directory and file name and click Save. The prompt Export complete displays.

- Click OK.

- Navigate to the directory, right-click on the file and select Open.

- Select 'Select a program from a list of installed programs' and click OK.

- Select Wordpad and click OK. The report opens in Wordpad.

- Select Edit > Find. The Find window opens.

- Type ReportId and click Find Next.

Example below:

<VPMReportData ReportId ="5147" Title="Lodgment Report by Manager" Description="Lodgment Report by Manager for I, P, T, C and F" BasedOnTemplateId="10" />

Note the ReportId (in this case, ‘5147’). - Close Wordpad.

Follow these steps:

- Backup your Practice Manager SQL database.

- Select Reports > Tax 2019 > Tax reports only > Lodgment Report by Manager.

- Click Edit.

Pay attention to whether the report is MYOB - Landscape or MYOB - Portrait. - Click Cancel.

- Select Reports > Report Export & Import.

- Select Tax 2019 > Tax Reports only.

- Select the report you want to copy and click Export. The Export Report window opens.

- Make a note of the directory and file name and click Save. The prompt Export complete displays.

- Click OK.

- Navigate to the directory, right-click on the file and select Open With.

- Select Wordpad and click OK. The report opens in Wordpad.

- Select Edit > Find. The Find window opens.

- Type ReportId and click Find Next.

- Edit the ReportId to the value identified at Step 10 in Identifying the ReportId section above (5147).

- Select Edit > Replace. The Replace window opens.

- Type 2019 in the Find what field.

- Type 2020 in the Replace with field and click Replace All.

- At the prompt ‘Wordpad has finished searching the document', click OK.

- Click Cancel to close the Replace window.

- Select File > Save and then close Wordpad.

- In Practice Manager, in the Report Export & Import tab select Tax reports only and click Import. The Import Report window opens.

- Select All Files.

- Select the edited report and click Open. The Base on Template window opens.

- Select the template type identified at Step 10 in Identifying the ReportId section above (10) and click OK. The Import successful prompt displays.

- Click OK.

- Select Reports > Tax 2020 > Tax Reports only.

- Select the Lodgment Report by Manager copied from Tax 2019 which displays a last modified date of today and click Run.

- Confirm the report contains the correct details.

- Repeat all these steps for each required report.

Year | Tax reports only | Tax & practice management reports |

|---|---|---|

| 2020 | 5147 | 6146 |

| 2019 | 5137 | 6136 |

2018 | 5127 | 6126 |

2017 | 5117 | 6116 |

2016 | 5107 | 6106 |

2015 | 5097 | 6096 |

2014 | 5087 | 6086 |

2013 | 5077 | 6076 |

2012 | 5067 | 6066 |