MYOB AE/AO Release Notes—2018.1 Beta (AU) 2018.2 (NZ)

Version 2018.1 (AU) | 2018.2 (NZ) | 6.46/8.30 SP2 (Series 6/8)

This is the latest version of MYOB Practice Solutions for:

New Zealand—27 September 2018:

Accountants Enterprise (AE) – MYOB AE 2018.2

Accountants Office (AO) – MYOB AO 2018.2

Australia—10 September 2018 (Beta 1):

Accountants Enterprise (AE) – MYOB AE 2018.1 (including Tax 6.46 SP2 and Tax 8.30 SP2)

Accountants Office (AO) – MYOB AO 2018.1

If you use Australian Tax

Once you upgrade to this new version of MYOB AE/AO, ELS will no longer be available for activity statements. PLS will be the new lodgment method.

What should I do?

We recommend that you lodge existing activity statements via ELS before upgrading.

What if I don't lodge my ELS activity statements before upgrading?

You will need to pre-fill using our new Activity Statement Lodgment Report (ASLR) and pre-fill service, then lodge via PLS.

See Getting started with PLS activity statements for further information.

The Activity statement ELS report has been replaced by the Activity Statement Lodgment Report (ASLR) and pre-fill service. The ASLR report lists outstanding activity statement obligations for agents.

Schedule the report to be run at a specific time each day from the new ASLR homepage. From this homepage, you can create and pre-lodge activity statements for PLS.

Scheduling the report

The report can only be run once per day for each agent. If you reschedule it to run again on the same day, you'll get an error from the ATO (CMN.ATO.ODRPT.EM1001 — Only one 'Whole of Agency' report can be requested per day).

Run the ASLR report after hours. This means your pre-filled activity statements will be ready the following day.

In PLS, activity statements have a new mandatory field called Form Type – the pre-fill service automatically populates Form Type.

Activity statements are now lodged from the Lodgment Manager homepage.

See Getting started with PLS activity statements or press F1.

We've created a new print attribute Exclude pre-fill labels. When selected, it won't print the pre-fill description for data pre-filled from the ATO.

To prevent pre-fill labels from printing:

- Follow the menu path Utilities > Practice default options > Print options.

The Print tax form options window displays. - Select the relevant print job and click Properties.

The Print Options window displays. - Select the Attributes tab.

- Select Exclude pre-fill labels.

Click OK. - Repeat steps 2–4 for the required print jobs.

We are continuing to develop PLS reports. We're fixing some known issues and will be delivering further improvements including:

- Adding Update status, PLS Reports, and Print PDF to the ASLR tasks bar

- Adding Manager, Employee, Office, Department, Family Group, and Company fields to the ASLR field chooser

- Adding Form type to PDF printing

- TFN displays in the ASLR homepage when Show sensitive data task permission is enabled

- Income tax client report implementation

- Exclude pre-fill label to be applied to the Cost of Managing Tax Affairs worksheet (cmt) in 2018.

Select Help > My Academy at the top of the AE/AO screen to access our Accountants Enterprise/Office learning centre. Browse our extensive catalogue of free MYOB courses, to help you get the most out of your software.

What is it?

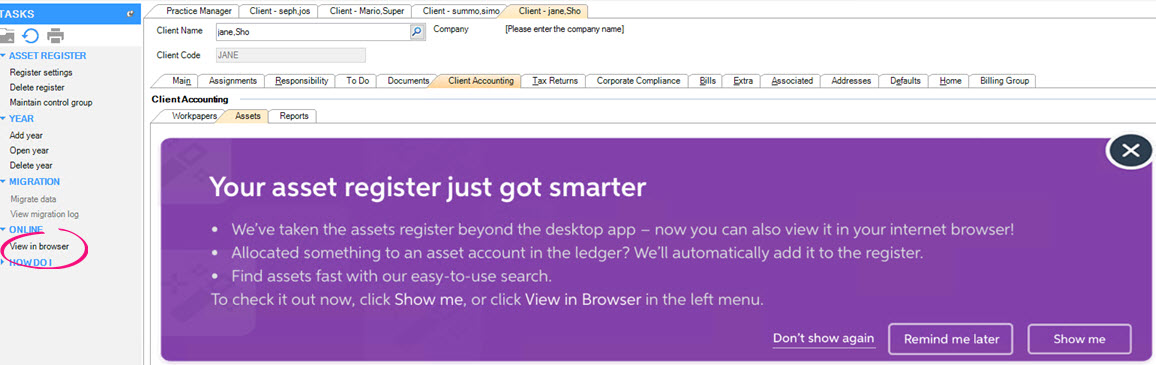

Your assets register just got smarter!

We've introduced:

- Easy to use and efficient workflows in a new browser-based interface

- Tight integration with your MYOB integrated AE/AO or MYOB Ledger so that adding new assets is more automated than ever before

- A new global search feature to find assets faster, and viewing or editing details is a simple click away.

Can I use it?

- This feature is available to you if you have signed up for our beta test program.

If you would like to trial this new feature as part of our beta test program, email us at betasupport@myob.com. - You must have an integrated AE/AO or MYOB Ledger.

- If you are a Super User or an Administrator you will automatically see the banner below.

How do I start using it?

- If you have access to this feature, a banner is displayed in the Assets tab. The options are:

- Cross – closes the banner for the current session. The banner will re-appear if the same client is re-opened

- Don’t show again – the banner will close and never be displayed again for this client.

- Remind me later – closes the banner for the current session. The banner will re-appear if the same client is re-opened

- Show me – closes the banner and launches your asset register in your default browser.

- Alternatively, click the new View in browser link in the Tasks bar to launch Assets online in your default browser.

- We've added the current date and time to the Adjusted Trial Balance report:

- In Practice Report Settings > Non-Transaction Data Preferences, we've fixed the Shareholders field. We've changed it from 'is Director of/has Director' to 'is Shareholder of/has Shareholder'.

- In the Manage Account window, when you tab through creating a new account, the cursor will move to the account code field, ready to add another account.

- You can now resize the Manage Client File Imports > Mappings window using the resize handles in the corner of the screen.

If you open a second Mappings window, it will open to the default size, and won't remember any resizing you have done. - The opening balance review will now check account codes first rather than account description so that accounts with the same codes will now match.

- We've corrected spelling mistakes in the New Zealand MAS MYOB Standard charts for MYOB Ledger.

- In View Transactions, the account description will now be displayed alongside the account code.

- We've disabled the Company field on the debtors screens if the client only has one company. We've also improved cursor placement and tabbing when you're entering multiple transactions.

- Clicking Enable AE Ledger and Assets in Maintenance > Client Accounting > Client Accounting Settings will now also enable assets migration.

New Zealand only

- We've added tax account groups on the workpaper/trial balance period Tasks bar (for MYOB Ledger, AccountRight Live Ledger and Essentials Accounting Ledger).

- We've created a new task permission to control access to the tax account groups which can be found in Client > Client Accounting > Tax Account Groups.

- Australia only

- A new account group structure has been created to be used to map the account codes into the tax integration workpapers.

The new tax account group structure can be found on the Tasks bar in the Client Accounting tab, in the workpaper period/trial balance period and in the Practice report settings. - We've updated the 4 tax integration workpapers to pull figures from the new tax account group structure:

- Income tax integration - Company

- Income tax integration - Partnership

- Income tax integration - Trust

- Income tax integration - Individual.

- We've created a new task permission to control access to the tax account groups which can be found in Client > Client Accounting > Tax Account Groups.

- A new account group structure has been created to be used to map the account codes into the tax integration workpapers.

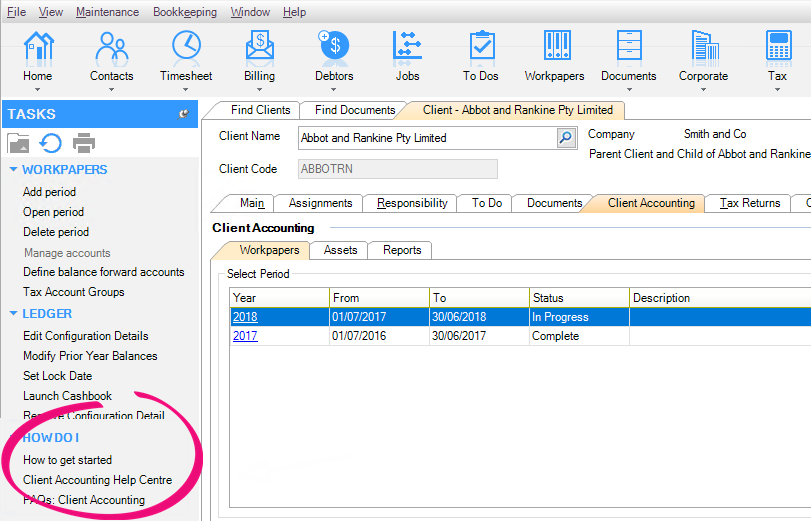

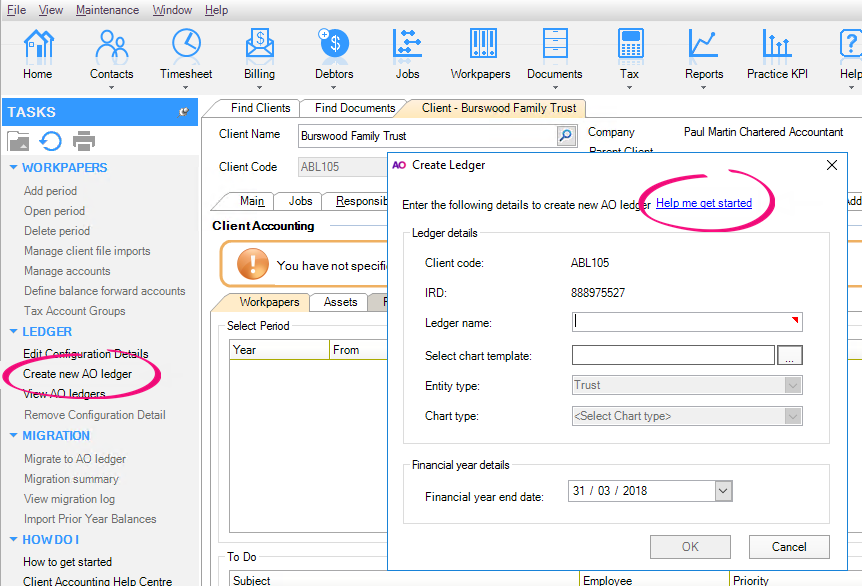

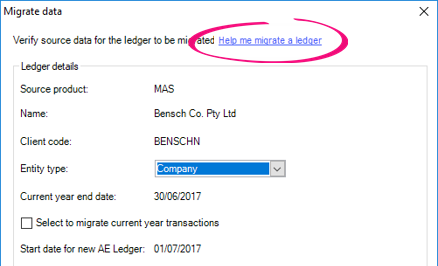

We've added some new in-product links that take you directly to our online help.

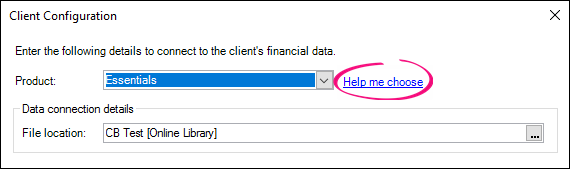

Help me choose – links to the appropriate ledger workflow help, depending on what product your client uses:

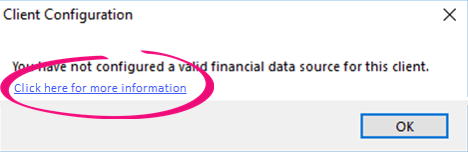

Click here for more information - links to more information in the help if you see this error:

How to get started links to online help relevant to your configured ledger for:

FAQs: Client Accounting – provides a list of the FAQs relevant to your configured ledger for:

Client Accounting Help Centre – links to an overview of Client Accounting

Help me get started – links to help specific to creating a ledger:

Help me migrate a ledger – guides you through the steps of migrating a ledger.

- We've changed the way we report equity for trusts in the Balance sheet and the Statement of changes in equity. Previously, we couldn't separate Retained Earnings from Trust Capital/Corpus without the Statement of changes in equity appearing out of balance. We've added a new account group Funds Settled under Balance sheet > Equity > Trust Funds. This enables the separation of Trust Capital/Corpus from Retained earnings and reserves in the Balance sheet. You can rename the Funds Settled account group. To make sure the Statement of changes in equity is correct each year, we've split Funds Settled between Opening balance and Movements. This split is necessary for the Statement of changes in equity, but they are added together on the Balance sheet.

- We've removed redundant account groups from the Statutory Reporter mapping:

- Trade and other receivables and Inventories from the Non-current assets section

- Trade and other payables and Tax provision from the Non-current liabilities section.

- We've updated the default account group mapping for the standard MAS chart, to take account of Deferred Income / Expenditure and Losses brought forward for the Tax note.

- We've corrected Minutes of a trust by removing extra total lines below Distribution of income.

- The Rental Statement report for a property with $0 net profit for all of the years that are being reported on will now display the accounts correctly.

- The cover page has changed from 3 paragraphs to 4:

- Cover Page –Customparagraph for logo

- Cover Page

- Cover Page 02

- Cover Page 03.

- Create your own style set If you want to change the cover page headings to a different case. For example:

- Cover Page 02 = Performance Report / Financial Statements (title case)

- Cover Page 03 = For the year ended (sentence case).

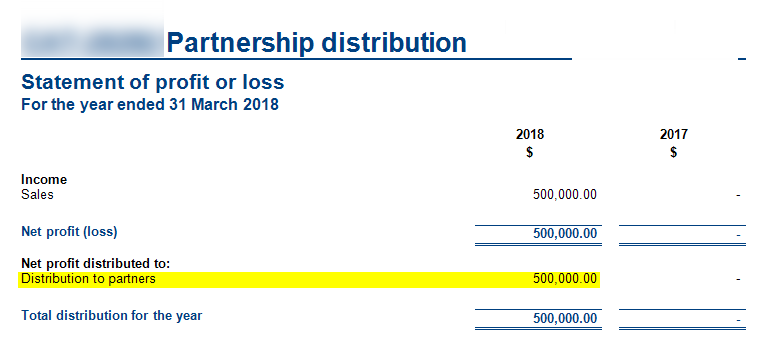

- In the profit and loss statement, you can now choose to summarise profit distribution. To achieve this, create a custom group of beneficiaries in the account group mapping.

- The Solvency Certificate report will now print correctly (including the report header) even if the Dividends Paid account group is zero.

- We've removed commas from the address field on the compilation report.

- In all reports, when displaying client name it now uses Mailing name by default. If Mailing Name doesn't exist, it will use:

- First Name Last Name for individuals

- Pre Name Main Name for organisations.

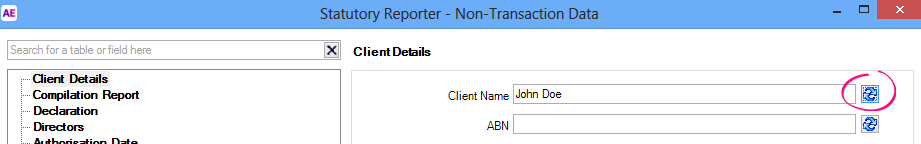

If you're an existing user, click the refresh button next to Client Name in Non-Transaction Data if you want to start using Mailing Name.

- We have added the Active checkbox under the Directors tab in Non-Transaction Data. Reports will now display the correct singular or plural wording for directors depending on whether the Active checkbox is selected.

- For reports, a director, partner, or trustee will only be listed as a signatory if you have selected the Director/Trustee/Partner is signatory checkbox in Non-Transaction Data. This rule does not apply to a sole trader or society as they only have one signatory.

- We've fixed a problem where non-transaction data wasn't always printing correctly in reports.

- The Business Directory alignment of name and address has been improved.

- The consistency of non-transaction data being populated in reports has been improved.

When you deselect the Property, Plant and Equipment note on the reports list, the detail from that note will now be displayed in the balance sheet.

- We have added the Active checkbox under the Directors tab in Non-Transaction Data. Reports will now display the correct singular or plural wording for directors depending on whether the Active checkbox is selected.

The word “Accountants” has been removed from each of the footer paragraphs in practice reports.

We've updated the address field on the compilation report, so that suburb, state and postcode are on a single line.

We're now showing closing balance instead of movement amount in the Appropriation section of the Income Statement for all AccountRight files.

In all reports, when displaying client name it now uses Mailing name by default. If Mailing Name doesn't exist, it will use:

- First Name Last Name for individuals

- Pre Name Main Name for organisations.

If you're an existing user, click the refresh button next to Client Name in Non-Transaction Data if you want to start using Mailing Name.

The Minutes of Meeting - Trust report now prints the Held at address all on one line.

- For minutes and resolutions, a director, partner, or trustee will only be printed if you have selected the Included checkbox in Non-Transaction Data > Note (there are no minutes for partnerships or individuals).

- We've fixed a problem where Non-transaction Data wasn't always printing correctly in reports.

We've made general formatting improvements to the:

Liability for accrued benefits note for SMSF.

Directors Declaration.

- The OK button is now enabled for approved workpapers.

- On the Add Journal screen, click the tab key to move through Account, Dr Amount, Cr Amount, GST Type/Code and Description. Tabbing now skips GST rate to improve efficiency.

- We've improved support with pdfDocs so that when you open a pdf with a bookmark, it will open to that bookmark.

- We've fixed some calculation errors in the following templates:

- GST Reconciliation — GST on expenses (linked from Entertainment - adjustment required), will now increase the amount of GST payable rather than reducing it.

- Wages Reconciliation — in the General Ledger Reconciliation section, any field without a value now displays as zero, making it easier to edit.

- FBT Contribution on Motor Vehicle — the value for Contribution per above is now based on Cost (ex GST) rather than Cost (incl GST).

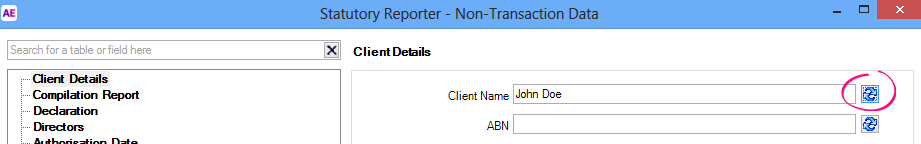

- We've added a new workpaper, AML/CFT Checklist. Use it to record information relating to your AML/CFT compliance program.

Anti-money laundering / Countering Financing of Terrorism (AML/CFT) legislation takes effect on 1 October 2018. It aims to deter money laundering and the financing of terrorism.

In MYOB AE/AO, we've got new features to help you report your AML/CFT obligations:

- Recording due diligence

- In Clients > Contacts click the AML tab.

For each client, select the I have completed due diligence checkbox and select the level of due diligence completed from the drop-down (including Politically Exposed Persons).

All updates are recorded with a date and timestamp in the audit trail.

See AML tab online help for more information.

- In Clients > Contacts click the AML tab.

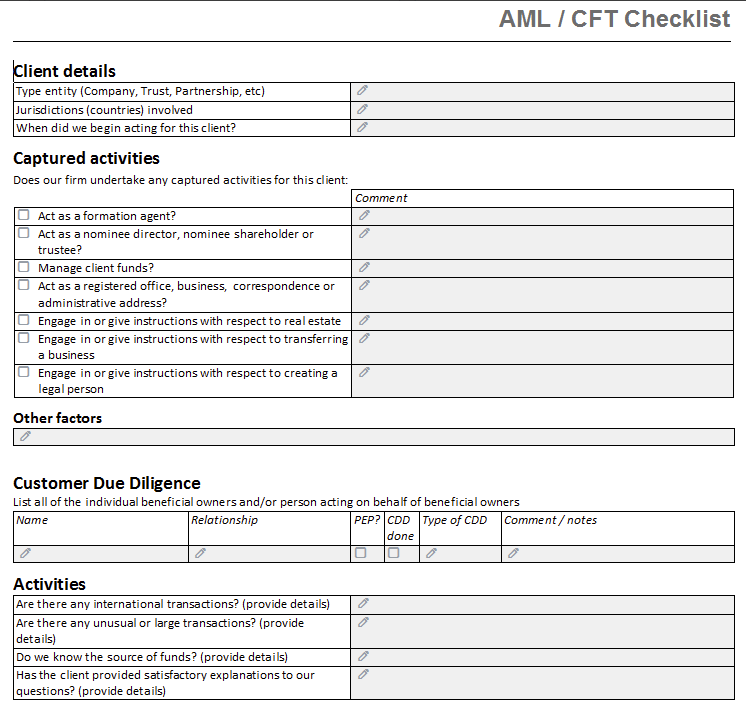

- Verify identities

- We've added Drivers License and Passport Number to the Extra tab. These fields will store information used to verify the client's identity for AML purposes.

- Viewing the AML information

This information is available in the:- Clients > Contact search windows.

Use the Field Chooser to add AML Complete, AML Date and AML Status columns. - Associations tab

For example, to determine if each trust beneficiary has had due diligence performed, they can be associated as beneficiaries to the trust and the AML Complete, AML Date and AML Status columns can be viewed on the trust's Associations tab. - Client and Contact reports.

You can filter by AML Complete, AML Date and AML Status when you run reports. See Filtering options in our online help for more information.

- Clients > Contact search windows.

- In MYOB AO, you can now tab to the Finish or Cancel button in the Create client wizard.

- (NZ) NZBN (New Zealand Business Number) has been added to the field chooser on the Find Clients tab.

- (NZ) Tax email has been added to the field chooser on the Find Clients tab.

Improvements

- We've added the bulk check-in feature to the Documents > Administration homepage.

The Document Manager administrator must have access to documents requiring check-in. They can check-in from any computer – it doesn't have to be the computer used to check-out the documents. - If you send an email from a secondary email account and save it to Document Manager, it will now save correctly. Previously, it showed as checked-out and didn't have a Sent date.

MYOB Practice Solutions product version numbers:

Product | Version number |

|---|---|

(AU) MYOB AE/AO | 2018.1 |

(NZ) MYOB AE/AO | 2018.2 |

Client Accounting | 5.4.29.123 |

Corporate Compliance | 3.2 |

Document Manager | 5.4.29.123 |

Practice Manager | 5.4.29.123 |

Statutory Reporter Formats | (AU) 32 (NZ) 15 |

(AU) Tax Homepages |

|

How do I find out what version I have?

Open MYOB AE/AO.

Select Help > About from the menu bar.

Click the Plugins button to access the version number of individual products.