MYOB AE/AO release notes—2019.0 (Australia) BETA

Release date—4 July 2019

This is the latest version of MYOB Practice Solutions for:

- Accountants Enterprise (AE)—MYOB AE 2019.0 (including Tax 6.47 and Tax 8.31)

- Accountants Office (AO)—MYOB AO 2019.0

Product | Version number |

|---|---|

MYOB AE/AO | 2019.0 |

| AE/AO Tax | 2019.0 (for a 2019 tax return) 2018.3 (for a 2018 tax return) |

Client Accounting | 5.4.32.105 |

Document Manager | 5.4.32.105 |

Practice Manager | 5.4.32.105 |

Tax Homepages | 7.0.11.246 |

| Stat Reporter Formats | 35 |

For MYOB AE/AO

Open MYOB AE/AO.

Click Help and select About.

Click Plugins.

Check the version number of individual products.

For AE/AO Tax

- Open a tax return.

- Click Help and select About.

- Check the version number is 2018.3 for a 2018 return and 2019.0 for a 2019 return.

Click to view tax changes for...

- We've made changes to the International dealings schedule (IDS):

- Section A—Changed questions 2 and 13f.

- Section B—Changed question 19a to indicate if a taxpayer has any financial arrangements that didn't give rise to a debt interest.

- Section C—Changed questions 21, 22, 23 and 29.

- Section E—Added a question, 40d, about amounts denied under section 160ZZZL of the ITAA 1936.

- Section G—Added this section as part of the implementation of the OECD hybrid mismatch rules.

Additions

- There's a new deductions schedule.

You'll need to know how to complete IITR deductions. Click here to learn how!

- A new income category at item 24 of the First home super saver scheme (FHSS).

- Low and middle income tax offset.

Removals

- We've removed the Interests and dividend deductions (BJ) schedule.

Other changes

- We've updated the following:

- The Medicare levy low income threshold.

- The income tax thresholds for residents, non-residents and working holiday makers.

- Private health insurance rebate for 2018–19.

- HELP, TSL, SSL or ABSTUDY SSL and SFSS Thresholds 2018–19.

- We've added a reportable tax position schedule for companies with a turnover greater than $250 million.

- We've changed the base rate entity from companies with an aggregated turnover threshold of less than $25 million, to those with less than $50 million.

- If you're an individual entity and sell your main residence to downsize, you can put the sale proceeds toward a superannuation contribution of up to $300,000.

- For individual entities, the total superannuation balance (TSB) is made up of balances from the limited recourse borrowing arrangement (LRBA).

- We've increased the bank account name to allow 200 characters (SMSF only).

- We've added the following:

- In the SMSF auditor section, the label Was Part A of the audit report qualified?

- In the assets and liabilities sections, the label Crypto-Currency.

- At label 7C, a drop-down for selecting the electronic service address.

We'll continue developing Tax 2019 after the beta release. The following will be available in the 2019.0 general release:

2019 pre-fill changes of the individual return.

Changes to the work-related self-education expenses worksheet (sed).

Add D4 to the deductions schedule.

Some depreciation required for the deductions schedule changes are incomplete.

Tax Letters.

Reports.

Tax Tracking (AE non integrated release sites only).

Increase in instant asset write-off threshold and turnover.

GR

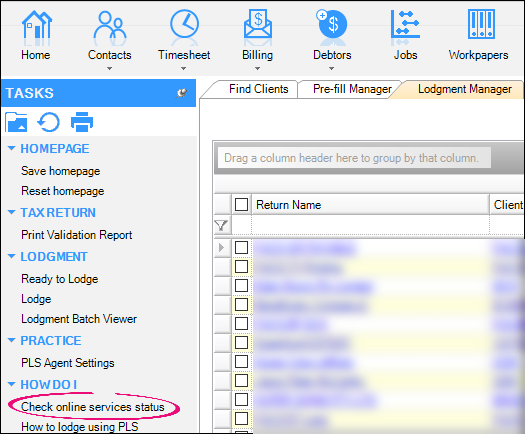

We've added and updated links in the AE/AO Tasks bar, in the How Do I section. These links take you to some handy help and info pages. For example:

What we've changed:

- Added Check online services status on the Lodgement Manager homepage.

- Added How to complete IITR deductions on the Tax homepage.

- Added Agent Reports homepage on the Agent Reports homepage.

Renamed Getting started to Getting started with PLS activity statements on the Activity Statement Obligations homepage.

Quantity values from workpaper journals are stored in the online ledger, instead of in the local database.

When you post journals with quantity values—for example, when you want to capture sales—they are posted online.

If you view transactions in Workpapers, the View Transactions window displays a Quantity column if there are quantities included.

How it works in 2018 and 2019

When you run a report in the 2019 year, quantity values will come from the online ledger; when you run a report for the 2018 year, quantities come from the offline data table, as they did previously.

Requirements for quantity values to be stored online

Your system will use this functionality when you create a new period, if:

your configured ledger is an Essentials Accounting or Connected ledger.

all existing full-year periods are completed, or you're not using yearly workpaper periods.

We've enhanced the layout of the Prepayments workpaper.

- We've positioned the descriptions closer to their associated date selectors, so it's easier to see which date selector the descriptions are referring to.

- We've removed some unnecessary space in the date selector fields.

CAT-22507

Not available in beta.

We've added an exciting new feature—Statutory Report Designer! It lets you create new reports for your practice.

To use the designer, your client manager will need to help you get set up and organise training for you. These consulting sessions are paid services.

Contact your client manager to find out more.

CAT-29298, CAT-29246, CAT-29382, CAT-29297, CAT-29241

Have the details in the HELP, explaining the nuances of half-year stuff in the crossover of old and new funct. Also can refer to consultants.

Paragraphs are colour-coded to make it easy to tell if they've been edited.

- Orange indicates a practice-level change.

- Blue indicates a client-level change.

- Black indicates no changes have been made.

We removed the word Accountants from footer paragraphs in practice reports. We found it's not usually needed.

We've made minor compliance updates to financial statements for sole trader, partnership and company entities. For all three entities, we've updated a paragraph in the sale of goods section. For partnerships we also now display paragraphs previously missing from the revenue and other income section.

No Document Manager changes in this release.