MYOB AE/AO release notes—5.4.41 (Australia)

Release date—22 November 2021

Want to save a print-friendly version of this page?

To see all the content on this page at once, click the print page (

This works best in Google Chrome or Microsoft Edge internet browsers.

Hotfix update — If you use client accounting

After installing this release, make sure you install AE/AO Client Accounting KB73400898 hotfix (Australia & New Zealand). This release addresses an issue where the headers and section totals were missing after installing 5.4.41.

This release (5.4.41) includes the following changes.

Includes all of the previous releases.

To implement the director ID requirement, we've included a new field called Director ID in the Extra field.

After installing this release:

- you'll see this field in the Main tab, and also in the Extra tab in the client details.

- you can run a report to find the associations who are directors in your database, so you can send them a reminder about the director ID. See Director ID changes to AE/AO and reporting on Associations

What if I've already created the extra field?

Depending on the name of the field, the settings (not the data) will be overwritten after you install the 5.4.41 update.

- If you've called the extra field - Director ID, (which is the same as the MYOB default), the settings (not the data) will be overwritten.

- If you've called extra field type is called anything other than Director ID (such as directorID, DirectorsID), you'll need to copy the data into the Director ID field that is created by the system and delete the one you've created

Updating Quantities

If you have a New Essentials/MYOB Business file configured, and when you add a journal with quantities and post it, New Essentials/MYOB Business ledger was not updating with the quantities. This means the Statutory reports were incorrect.

After installing this release when you add a new workpaper period and post a journal with quantities it will then post it into New Essentials/MYOB Business ledger. This will not affect any existing workpapers with quantities, so when you add a new workpaper it will not double up the quantities.

Existing workpapers: If you add a journal with quantities to an existing workpaper, it will not post it the New Essentials/MYOB Business

- For ledgers that are yet to be migrated from Essentials Accounting to New Essentials, the quantities will be posted correctly in the New Essentials file for any new and existing workpapers (full and partial financial years).

Migrating custom account groups

If you have any customised chart of accounts in your practice account group, you can copy them from MYOB Essentials (Pre March 2020) into the New Essentials/MYOB Business ledger.

This will override any practice account group settings but will not override any client account groups. This change will happen to all clients regardless of the industry and entity types.

To copy the custom account groups

- Go to Maintenance > Maintenance Map > Client Accounting > Practice Report Settings.

- On the Tasks bar, select Account Groups. The Statutory Reporter - Account Groups or (NZ) Statutory Reporter - Tax Account Groups window opens.

- Select MYOB Business/AccountRight/Essentials (New) from the Product from the drop-down.

Click Apply Chart of Accounts from the banner.

You'll not see this banner if you selected anything other than MYOB Business/AccountRight/Essentials (New) in the Product drop-down.

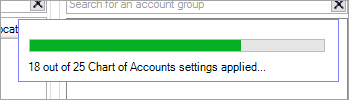

- Select Apply Chart of Account if you want to apply your practice level custom account groups. A progress bar will appear with the status of the update.

KNOWN ISSUE

There is a display issue where the progress bar will always show a total of 25 accounts updated. This will be fixed in a future release. In the meantime, all your customised account groups in the chart of accounts will still be copied in the background despite the progress bar showing a total of 25.

- In Trial balance, when clicking View transactions > Export to Excel, the excel sheet was not opening. This is now fixed.

- The Summary Department report showed incorrect net profit or loss for each department. This is now fixed.

- When adding a journal in AE/AO, accounts that have been made inactive in New Essentials were shown in the list. This is now fixed.

If an account is deactivated in New Essentials after you add a journal in AE/AO, then when you post the journal, you will see an error that stops you from posting the journal to New Essentials.

Compliance changes

ATO validation rules

- Self Managed Fund return (version 2021.2)

- Two new SMSF aliases are added to Item 7C Electronic service address alias:

- BGLSF360

- wrkrSMSF

- Two new SMSF aliases are added to Item 7C Electronic service address alias:

- International Dealing schedule (IDS) (version 2021.2)

The following rules have been updated

- International Dealing schedule (IDS) (version 2021.2)

| CMN.ATO.IDS.440560 - International related party dealings information is not required. | If you've answered Y at Q 2B label A Are you a small business entity, not a significant global entity and your international related party dealings... ? then you can't complete Q11G label A Have you returned a foreign exchange gain or deducted a foreign exchange loss in relation to dealings with international related parties? |

| CMN.ATO.IDS.440561 - International related party dealings information is required. | If you've answered N at Q 2B label A Are you a small business entity, not a significant global entity and your international related party dealings...?, then you can complete Q11G label A Have you returned a foreign exchange gain or deducted a foreign exchange loss in relation to dealings with international related parties? |

| CMN.ATO.IDS.440005 - Expenditure and revenue information incomplete | This will now allow successful lodgment when an amount is entered at Q 3 Did you have dealings with international related parties, apart from the dealings with related parties located in specified countries and/or Q 4: Did you have dealings with international related parties located in specified countries? and there is only an expenditure or revenue amount at Q11 label G.: Have you returned a foreign exchanged gain or deducted a foreign exchanged loss in relation to dealings with international related parties? |

- Company tax return (version 2021.5)

- CMN.ATO.CTR.430225 Tax on taxable or net income incorrect. Check rate calculation and Company entity type.

Rule updated: To include a zero check for field Item 19: Retirement Savings Accounts - Label V: net taxable income from RSAs.

- CMN.ATO.CTR.430225 Tax on taxable or net income incorrect. Check rate calculation and Company entity type.

- Company tax return (version 2021.5)

Rates

- HELP repayment rates: the ceiling for 8% has been corrected to $114,809.

PLS Rejections

Individual return

- CMN.ATO.GEN.XML04 where a Distribution from Managed fund (dim) schedule exists with no organisation name or monetary values. Two validation messages have been implemented:

- V17: Mandatory value not present when the Managed fund name is missing.

- CMN.ATO.INCDTLS.000245: Managed Fund Distributions Total amounts and Managed Fund Distributions Your Share amounts must be provided.

- CMN.ATO.GEN.XML03 error when an invalid character entered in Personal Superannuation Contributions worksheet (psc) at:

- Full superannuation fund name

- Superannuation account number

- VR.ATO.IITR.730406 / CMN.ATO.IITR.730406

This error happened when there were cent values at Item 13L or 13N. This is now fixed.

- CMN.ATO.IITR.311085 - Total CGT discount applied amount is incorrect.

This error was incorrectly triggered when selecting Affordable housing in the capital gains worksheet. This is now fixed. IITR.730412 - The Share of net income from trusts less capital gains, foreign income and franked distributions.

This issue happened when there were cents at Label 13 U and the amount was rounded down, instead of rounding up. This is now fixed.

- CMN.ATO.IITR.311085 - Total CGT discount applied amount is incorrect.

Family trust election

FTER.408395: At least one declaration of trustee must be supplied.

This error will appear if you've selected E or V at Item 1: Are you using this form for Election, Revocation or Variation?

Client update form (CUADDR)

CMN.ATO.CUADDR.EM40507/CMN.ATO.CUADDR.EM40507: Address incorrect indicator is not supplied.

This error happened if you haven't completed the Incorrect address indicator. This is a new field in the CUADDR - Change Address form. You need to complete this field if the ATO has an existing address record for that taxpayer.

Select N if you want to change the existing address record for the taxpayer.

Select Y if the address is unknown. When removing a relationship for a taxpayer where their address is unknown, lodge a CUADDR to ensure no further correspondence is sent to the tax practitioner.

Leave it blank if the ATO has no current address record for the taxpayer.

Trust return:

FTER.408395 - At least one declaration of trustee must be supplied.

This error happens in the Family trust election/Revocation (Schedule X) when you select Revocation (R) at Item 1. If you try to complete Item 5 as per the error details, you may receive an error V2102 error when validating. This is now fixed.

Printing

- Individual return: MYOB Prefill report incorrectly prints the warning message that the client has a novated lease.

- Partnership return: Item 49 was not printing all labels unless Item 49 Label A and Label B are completed. This is now fixed.

- Trust return: #Error appears instead of Trust tax return on the title of Page 9 when printing the ATO PDF copy. This is now fixed.

- The TFN was still printing in the Summary of entered items when Hide TFN is selected. This is now fixed.

Prefill

- Tax2021 - Prefill of Interest income only prefills the totals and not the records when prefilling for the first time. When you delete the interest schedule and prefill again, the records appear. This is now fixed

Rollover

- Rental property: The Gross amount value at the Acquired label was not rolling over. This is now fixed.

- The Opening Written Down Value (OWDV) and the Depreciation method were incorrect when a non-pooled asset that is written off in 2020 is rolled over into 2021. This is now fixed.

Need help?

- Call our support team on 1300 555 666.

- Submit a support request via my.myob.