Foreign Income distributed from a Trust to a Company is excluded from total income

This support note applies to:

- AE Tax (AU)

- AE Tax Series 6 & 8(AU)

- AO Tax (AU)

Where foreign income has been distributed from a Trust return to a Company return in MYOB Tax version 2018.0, the amount of foreign income received is excluded from Total Income in the Company return.

This issue is caused by the foreign income amounts not appearing in the Foreign Income worksheet.

When distributing foreign income from a Trust to a Company return, an entry in the Foreign Income worksheet is created, however, this contains the Foreign Tax Credit amounts only.

We're aware of this issue and we're looking into a solution.

As a workaround,

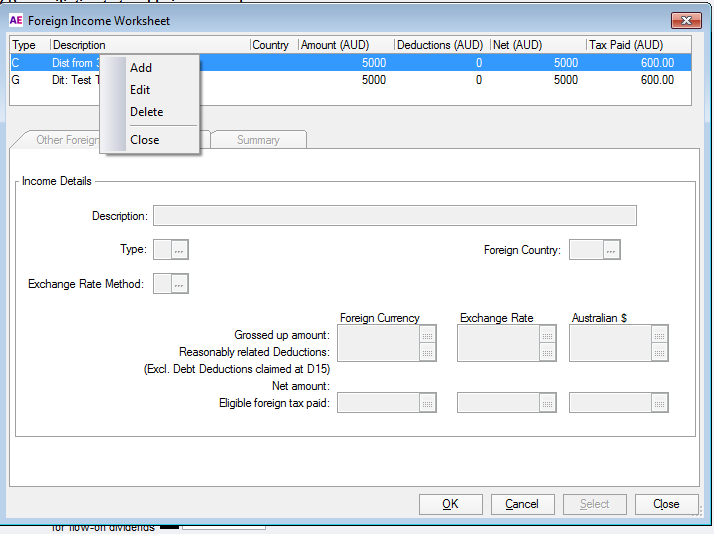

- Open the Foreign Income worksheet from Preparation > Schedule.

- Right-click and delete the entry with Type C.

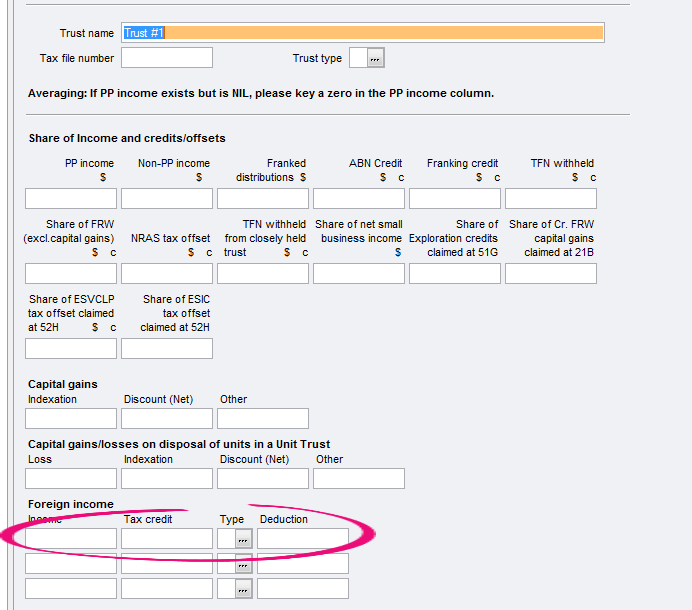

- Enter the foreign income amounts manually in the Distribution from Trust schedule.

MYOB INTERNAL STAFF ONLY

Insert PR #160899583517

SR# 160897472844