Improvements to Tax Notes in Statutory Reporter

This support note applies to:

- AO Statutory Reporter (NZ)

- AE Statutory Reporter (NZ)

- Workpapers (NZ)

We've made some improvements to the Tax Note in Statutory Reporter version 5.4.29.

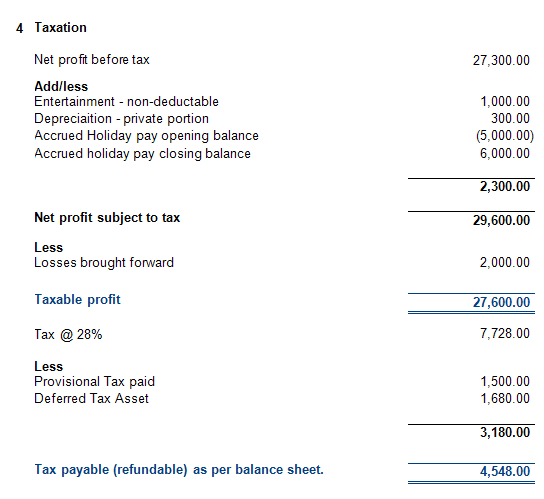

The Tax Note provides a reconciliation of profit in the Profit and Loss Statement to the Taxable profit amount shown in the Tax return.

The Tax Note allows you to make several types of adjustments such as:

- non-deductable expenses and non-assessable income

- timing differences (deferred holiday pay, provision for doubtful debts)

- losses brought forward.

to arrive at a taxable profit.

The steps below are a guide on how to set up your ledger for reporting in the Tax Note.

MYOB INTERNAL STAFF ONLY

CAT-28451