V335 - An overall trust loss cannot be distributed between trusts

This support note applies to:

- AO Tax (AU)

- AE Tax Series 6 & 8 (AU)

- AE Tax (AU)

In MYOB Tax you may experience the error V335 - An overall trust loss cannot be distributed between trusts when validating a tax return.

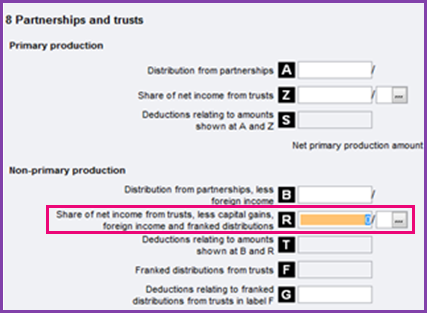

The ATO definition of this error is : The sum of Primary production share of net income from trusts (Item 8 Label Z) plus Non-primary production share of net income from trusts (Item 8 Label R) plus non-primary production franked distributions from trusts (Item 8 Label F) plus net capital gain (Item 21 Label A) plus attributed foreign income (Item 22 Labels M, U, X) plus other assessable net foreign source income (Item 23 Label V) plus Australian franking credits from a NZ franking company (Item 23 Label D) is less than zero which indicates that an overall trust loss is being distributed between trusts. Adjust distributed amounts at Item 8 Labels Z, R and F until the overall negative amount no longer exists (i.e. make the sum equal to zero).

This error can happen when loss is being distributed between 2 trusts.

- Trust A has a capital gain together with an income loss, and the overall income of Trust A is a gain

- This gain is now being distributed to Trust B, which has a capital loss greater than the gain being distributed from Trust A

- The net result of the distribution will be an overall loss for Trust B.

This happens because MYOB Tax immediately offsets the capital gain against the capital loss, and the validation check assumes that Trust B has only received a loss from Trust A.

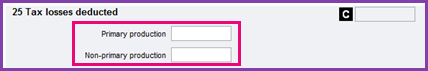

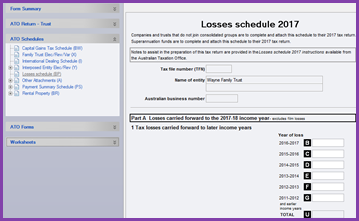

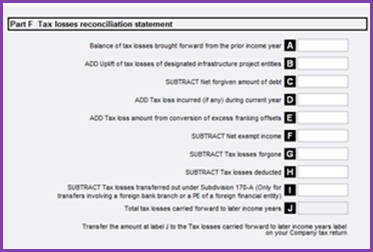

To fix the error you will need to remove the loss from Item 8 in Trust B, then add the loss amount to the Losses schedule(BP).