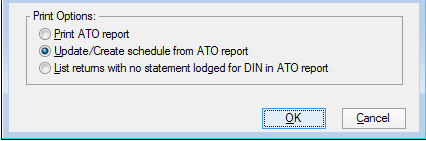

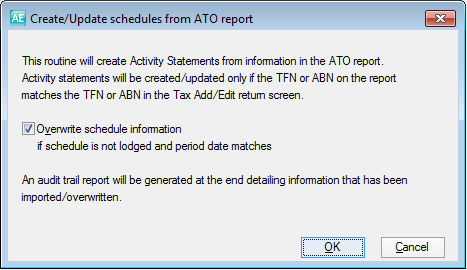

Preparation example: Generate BAS/IAS (AB/AI)

On the Activity Statement homepage (AE) / page (AO), the Generate BAS/IAS task pre-fills the settings to create a BAS form for your Tax clients whose ABN matches those recorded on the ATO report. Alternatively, an IAS will be generated for your Tax clients whose TFN matches those recorded on the ATO report. No Activity Statement will be created for Tax clients where these do not match.