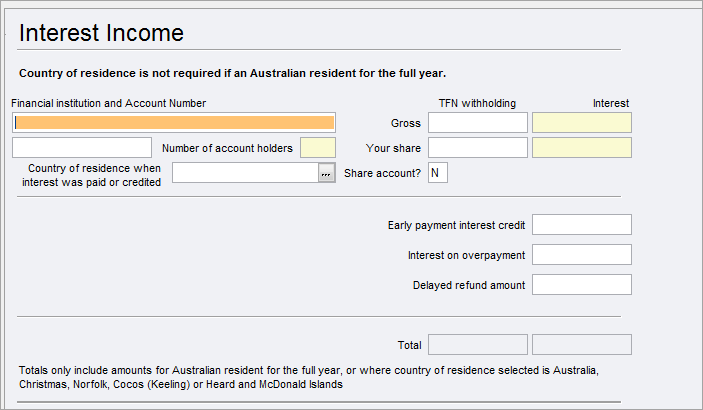

Tax provides functionality to share such income, and any TFN credits attached to it, with other returns.

The taxpayer's share of the total amounts entered integrates to the Interest item labels in the Individual return.

Three sets of fields are provided in this worksheet. To add extra entries, press [Ctrl+Insert] at any of the fields in the entry.

The fields in this worksheet accept cents. You must key the decimal point to avoid amounts being treated as whole dollars.

Share for this Return

This field is calculated by the system and will always be the amount that is added to the Total share for this return to be integrated to labels L and M in the main return.

Share account?: Entering Y at this field will open the Index of Joint owners. Details entered and recorded in this Index will be rolled over from year to year.

To create the transaction for Share details

From this Index click New, the Share details screen will be displayed.

In the General tab, Share to: field click [F10] or click on the ellipsis to open the Select Return Index.

Select the return to receive the share.

Enter the percentage share for that return.

Click [F6] to save the entry.

Click Cancel to return to the index if there are no other returns to share this interest amount.

Edit or Delete Shared Interest Entries

Refer to Index of Joint Owners.

Joint Owner: Joint owner will only be displayed where Share account? is Y