Item 1 - salary, wages, commissions, bonuses etc

See Item 1 Income on the ATO website.

- Read the on-screen text and select Yes at the 416 or 462 working holiday visa question. We'll calculate tax at 15% on WHM income up to $37,000 earned during the current income year.

- Enter the Payer's ABN, WPN, Tax withheld and Amount.

- We'll populate Item 1 with the details and type H.

- Go to Item A4 in the Adj/Credits tab and select Label D - Working holiday maker net income. The working holiday maker net income worksheet opens

- Income from Item 1 is populated in the working holiday maker net income worksheet.

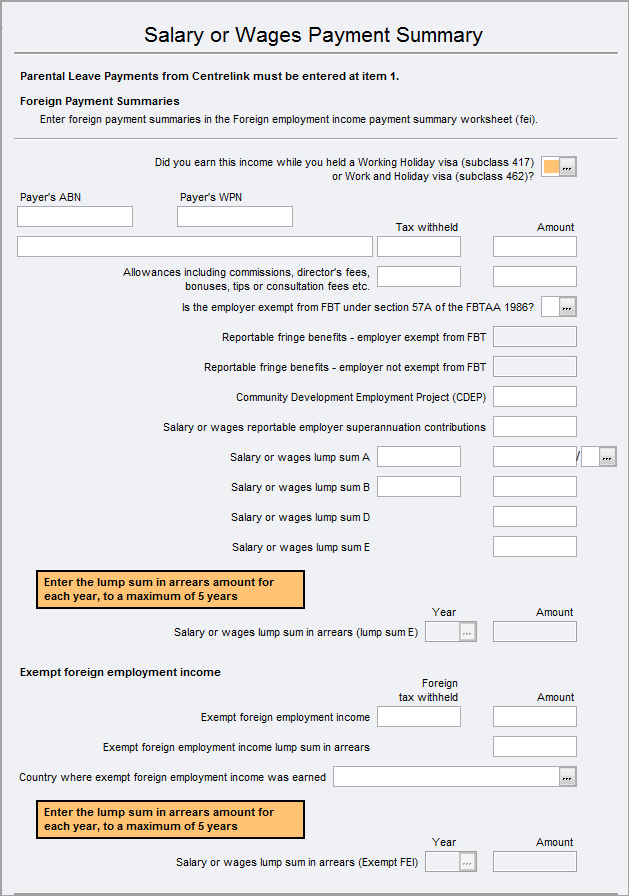

Complete the Salary and wages payment summary (egc) to report Australian income at Item 1. You can report up to 57 payments using this worksheet.

New fields in the worksheet

There are some new fields in the egc worksheet:

| Fields | Description |

|---|---|

| Is the employer exempt from FBT under section 57A of the FBTAA 1986? | Select Y/N at this question. This will enable/disable the Reportable fringe benefits - employer exempt and Reportable fringe benefits - employer not exempt from FBT |

| Community Development Employment Project (CDEP) | This amount is also reported at Item 5 - Australian Government allowances and payments like Newstart, Youth Allowance,Jobseeker and Austudy payments. |

| Salary or wages lump sum D | Genuine redundancy payments |

| Salary or wages lump sum E | lump sum in arrears (LSIA) payments |

| Salary or wages lump sum in arrears - Year/Amount | This filed will be enabled if you've entered an amount at Salary or wages lump sum E. |

| Exempt foreign employment income tax withheld and amount | This amount is also reported at Item 20 - Foreign source income and foreign assets or property |

| Exempt foreign employment income lump sum in arrears | This amount is also reported at Item 20 - Foreign source income and foreign assets or property |

| Country where exempt foreign employment income was earned | This amount is also reported at Item 20 - Foreign source income and foreign assets or property |

| Salary or wages lump sum in arrears (Exempt FEI) - Year/Amount | This field will be enabled if you've entered an amount at Exempt foreign employment income lump sum in arrears. |

Each payment can be broken down to a maximum of 5 years. Press CTRL + INSERT to add a record.

To open the egc worksheet:

- Click label C, D, E, F, or G at item 1: Salary or wages—Label G

- Select Preparation > Schedule > Salary and wages payment summary.

- Go to Preparation > Schedule > Income details schedule > Enter Y at Section A. Salary or wages payment summaries.

You can use the ATO Pre-fill to download reports and check what the ATO has received from the employer. See What data pre-fills into Tax?

Lump sum payments that you show at item 3 are amounts paid for unused annual leave or unused long service leave. If you have received such a lump sum payment it will appear at either 'Lump sum A' or 'Lump sum B' on the payment summary or statement you received.

Lump sum A

The amount shown at 'Lump sum A' was paid to you:

for unused long service leave, or unused annual leave, that accrued after 17 August 1993 if that amount related to a payment that was made in connection with a genuine redundancy payment, an early retirement scheme payment or the invalidity segment of an employment termination payment or a superannuation benefit;

for unused long service leave that accrued after 15 August 1978 and before 18 August 1993, or

for unused annual leave that accrued before 18 August 1993.

Lump sum B

The amount at 'Lump sum B' was paid to you for unused long service leave which you accumulated before 16 August 1978.

Type Code

If the amount shown at 'Lump sum A' related to a payment that was made as a genuine redundancy payment, an early retirement scheme payment, or the invalidity segment of an employment termination payment or a superannuation benefit enter R in the Type column. Check with your payer if you are not sure.

Otherwise enter T in the Type column

In MYOB Tax, you will also enter Reportable Fringe Benefits and Reportable Superannuation contributions that are notified on the PAYG Payment Summary. These amounts are passed to the Income Test Items IT1 and IT2 respectively.

From 1 July 2017, Reportable fringe benefits are reported separately in accordance with their exemption status under section 57A of the FBTAA 1986. Enter this amount at the correct field as defined on the Payment Summary.

If you received any reportable fringe benefits amounts of $3,773 or more, enter those amounts at the relevant field in the Reportable fringe benefits box. Do not enter amounts that are less than $3,773 as this will affect the calculation of the Adjusted taxable income (ATI) that is used for defining eligibility for some offsets, for example, dependency offsets and SAPTO.

Complete the Foreign employment income payment summary (fei) to report Foreign employment income at Item 1. You can report only 3 foreign employment payment summaries. F - Foreign J - Joint petroleum A - Australian resident for the whole year C - Changed residence during the year R - Resident of another country for the whole year T - Timor-Leste resident for the whole year. Foreign employment income lump sum E This field is enabled only if you've entered an amount in Foreign employment income lump sum E. Each payment can be broken down to a maximum of 5 years using Ctrl + insert.

Fields Description Foreign employment income type Foreign employment income residency details Foreign employment residency from .. to. If you select C in the residency details, this field will be enabled to enter the dates. Foreign employment income country of residence If you select C in the residency details, select the country of residence. Foreign employment income Enter the tax withheld and amount. These details will be populated at Item 1 with code F and in Item 20 Label U. Foreign employment income tax paid Enter the foreign tax paid amount. This field is enabled only if the residency is A or C.

This field is populated at Item 20 for the correct calculation of the Foreign Income Tax offset (FITO)Is the employer exempt from FBT under section 57A of the FBTAA 1986? Select Y/N at this question. This will enable/disable the Reportable fringe benefits - employer exempt and Reportable fringe benefits - employer not exempt from FBT Foreign employment income reportable employer super contributions Enter employer super contributions. Foreign employment income lump sum A Enter an amount and choose a code R - Genuine redundancy payments or T - For any other reason. Foreign employment income lump sum D Enter a lump sum amount. lump sum in arrears (LSIA) payments Deductible expenses (D1 to D5) incurred in earning foreign employment income Enter any deductions related to foreign income. This is used to calculate the net foreign employment income. This information is not lodged to the ATO. Foreign employment income net amount The field is the total of Foreign employment income + lump sum A + lump sum E - Deductible expenses incurred in earning FEI Foreign employment income other non-refundable tax offset This field is enabled only if you've selected C or R in the residency status. Foreign employment income ps lump sum in arrears (lump sum E) - Year/Amount

See Lost or missing PAYG withholding payment summary on the ATO website for more information.

If you enter amounts for salary or wages, an occupation code, representing the main occupation must be provided. If you are unsure then select the occupation code that represents the highest earnings. The full list of codes recognised by the ATO is provided as an [F10] list. A search function is provided and keying one or more words of the job description in this and clicking the Search button will provide a list of all Occupations containing the words.

When paid by your employer, PPL will be included in gross payments and not listed separately like, bonuses, etc.

PPL will be listed separately only if it comes from the Family Assistance Office (FAO) in which case you will have a PAYG Payment Summary issued by Centrelink. These Centrelink payments must be entered at item 1 as salary and wages and not at item 5 as such payments do not lead to a beneficiary offset.