Item 15 - Net income or loss from business

See Item 15 - Net income or loss from business on the ATO website for more information.

The amounts at item 15: labels:

- B: Primary production income/loss and C: Non-primary production income are entered at item P8.

- D, W, F: Use a generic schedule to complete.

- F: Use business income statements and payment summaries (bip).

- A is for sole trader small business entity income which is used to calculate the taxpayer's Small business income tax offset (SBITO).

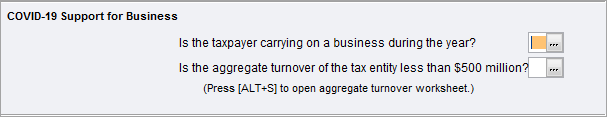

Small Business - Eligibility

COVID - 19 changes

Business income

If the taxpayer received income from carrying on a business as an artist, composer, inventor, performer, production associate, active sportsperson or writer, the net business income/loss must be included at item 15: label C and the Taxable professional income (eligible income for averaging purposes) must be entered at item 24, label Z. For full details on calculating Professional eligible income, refer to Item 24 - Other Income.

| To enter data in | complete |

|---|---|

| Label D - Tax withheld - voluntary agreement | a generic schedule. |

| Label W - Tax withheld where Australian Business Number not quoted | a generic schedule. |

| Label E - Tax withheld - foreign resident withholding (excluding capital gains) | business income statements and payment summaries (bip) |

| Label F - Tax withheld - labour hire or other specified payments | a generic schedule. |