Item 3 - Status of company

The status of a company is defined in several sections of the income tax law. It is important that you complete this item correctly, as the information is used by the ATO for multiple purposes including assessment, verification activities, and for the purposes of the annual corporate tax transparency report.

For more information on answering the questions in item 3, see Status of company on the ATO website.

The labels in this item are:

Select from the list provided at the label. These are:

| Code | Details |

|---|---|

| 1 | the company is a resident |

| 2 | the company is a non-resident with no permanent establishment |

| 3 | the company is a non-resident carrying on a business in Australia through a permanent establishment, |

Select the relevant code from the list provided at the label.

- A friendly society that carries on life insurance business must describe its status as Public 10. Otherwise, its status is Non-profit 03.

- Code 7 Corporate unit trust applies only to trusts that are corporate unit trusts as defined in section 102J of the ITAA 1936.

- Code 8 Public trading trust applies only to trusts that are public trading trusts as defined in section 102R of the ITAA 1936.

Only one code may be selected. If more than one code applies to the Company, select the code that appears first.

Selecting the incorrect code may result in clients not receiving a necessary service or material from the ATO, or it could lead to the incorrect targeting of audits.

Complete the Head or Subsidiary Status directly at label Z1 or Z2.

To determine the eligibility of the entity to be:

The head of a consolidated or MEC group, select Preparation > Schedule > Consolidation Eligibility worksheet (ce).

A subsidiary of a consolidated or MEC group, select Preparation > Schedule > Consolidation Eligibility worksheet (ces).

At label Z, select the relevant code from the list:

1 Consolidated head company if it was a head company of a consolidated or MEC group at any time during the income year.

2 Consolidated subsidiary member if 1 does not apply and the company was a subsidiary member of a consolidated or MEC group at any time during the income year.

If neither is applicable leave the status blank.

To notify the ATO of members joining or leaving the group, each time the membership details change:

Select Preparation > Schedule > Consolidation Group Membership Register (cgm).

Select Create BN/EX.

The Consolidated or MEC group losses schedule (BX) is attached at item 7 label R and at item 13 label U.

Consolidation losses worksheet (clw) is opened from Preparation > Schedule and selecting it from the index.

- Type of return: The application uses the following information to determine the rate of tax applicable to the company:

- Life assurance company?: Answer Yes or No.

- Eligible insurance business inc.: Enter the relevant amount.

- Mutual life assurance company?: Answer Yes or No.

- Non-PDF tax. inc. (part-year pooled development funds only)

- SME income component (PDFs only): Enter the relevant amount.

Select the relevant code from the list at the label.

| Code | Details |

|---|---|

| 0 | Non-applicable |

| 1 | Multiple businesses |

| 2 | Ceased business |

| 3 | Commenced business |

The significant global entity (SGE) concept is used to give clarity to taxpayers about whether they are within the scope of the measures to which the definition applies.

From 1 July 2018, the definition of a “significant global entity” (SGE) is to be expanded. The Treasury Laws Amendment (Making Sure Multinationals Pay Their Fair Share of Tax in Australia and Other Measures) Bill 2018 was introduced into the House of Representatives on 20 September 2018.

Schedule 7 of the Bill amends the definition of “significant global entity” in ITAA97 so that it applies to groups of entities headed by an entity other than a listed company in the same way as it applies to groups headed by a listed company, and is not affected by the exceptions to requirements applying to consolidated or materiality rules in the applicable accounting rules.

An entity is an SGE if it is:

a global parent entity with an annual global income of A$1 billion or more, or

a member of a group of consolidated entities for accounting purposes and one of the other group members is a global parent entity with an annual global income of A$1 billion or more.

The SGE concept is part of the following measures:

Multinational anti-avoidance law (MAAL)

General purpose financial statement (GPFS)

Country-by-country (CbC) reporting

Increased administrative penalties for SGEs.

See Significant global entity on the ATO website.

If you are an SGE you must complete item 5 on the company tax return.

Answer this question for Country by Country (CbC) reporting entity indicator. It's used to administer CbC and General Purpose Financial Statements (GPFS) obligations.

You must complete Item 5 Label G if you indicate the company is a cbc reporting entity.

This field is greyed out and is controlled by the response to the Small business eligibility test.

The company will be a small business entity if it is carrying on a business and has an aggregated turnover of less than $10 million. If you are an eligible small business entity, it is important to indicate it at this label as it is used when assessing pay as you go instalments.

There are special rules for calculating the annual turnover if the company has retail fuel sales or business dealings with associates that are not at market value.

For more information about calculating turnover, see Small business entity concessions or contact the ATO.

This field is greyed out and is controlled by the response to the Base rate entity eligibility tests.

From 2017-18, the lower company tax rate of 27.5% applies to companies that are a base rate entity. See Eligibility changes for the lower company tax rate on the ATO website.

These changes do not apply to companies that are subject to a specific rate of tax, for example, companies in trustee capacity and certain life insurance, PDF, non-profit companies and medium credit unions.

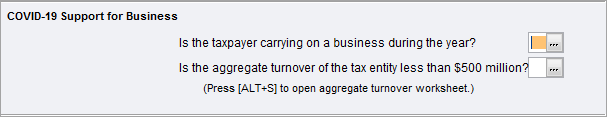

For COVID-19, measures introduced in March 2020 provide businesses with an aggregated turnover of less than $500 million for 2019-2020 to or deduct the cost of depreciating assets at an accelerated rate.

Complete the 2 questions to be eligible for accelerated depreciation rate for new assets first used and installed for a taxable purpose on or after 12 March 2020.