Item 32 - Non-Concessional MIT Income (NCMI) (Trust return)

What does the Stapled Structures Act cover?

The Stapled Structures Act includes the following:

Schedule 1 ensures that trading income that is converted to passive income via a stapled structure or distributed by a trading trust, and income from agricultural land and residential housing (other than affordable housing), will be subject to a 30% withholding tax rate. Fund payments, to the extent that they are attributable to non-concessional MIT income (NCMI), will be subject to a 30% withholding tax rate.

See Item 31 - Non-Concessional MIT Income (NCMI) on the ATO website.

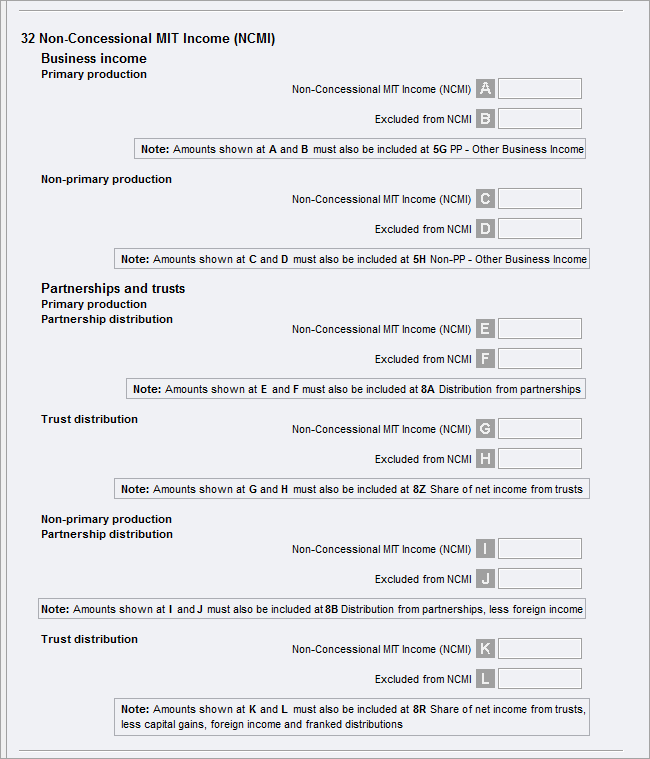

Data entry into the labels:

| Income category | Label at this item | Include this in another label in the return |

|---|---|---|

Business income | Label A: Primary Production – Non-Concessional MIT Income (NCMI). Label B: Primary Production – Excluded from Non-Concessional MIT Income (NCMI). | Item 5 Label G - Other Business income |

Label C: Non-Primary Production –Non-Concessional MIT Income (NCMI). Label D: Non-Primary Production – Excluded from Non-Concessional MIT Income (NCMI). | Item 5 Label H - Non-PP – Other business income | |

| Primary production (Partnership distributions) | Label E: Primary Production – Non-Concessional MIT Income (NCMI) Distribution from Partnerships. Label F: Primary Production – Excluded from Non-Concessional MIT Income (NCMI) Distribution from Partnerships. | Item 8 Label A - Distribution from partnerships |

| Primary production (Trust distributions) | Label G: Primary Production – Non-Concessional MIT Income (NCMI) Share of Net Income from Trusts. Label H: Primary Production – Excluded from Non-Concessional MIT Income (NCMI) Share of Net Income from Trusts. | Item 8 Label Z - Share of Net Income from Trusts |

| Non Primary production (Partnership distributions) | Label I: Non-Primary Production –Non-Concessional MIT Income (NCMI) Distribution from Partnerships less foreign income. Label J: Non-Primary Production – Excluded from Non-Concessional MIT Income (NCMI) Distribution from Partnerships less foreign income. | Item 8 Label B - Distribution from Partnerships less foreign income. |

| Non- Primary production (Trust distributions) | Label K: Non-Primary Production –Non-Concessional MIT Income (NCMI) Share of Net Income from trusts, less capital gains , foreign income and franked distributions. Label L: Non-Primary Production – Excluded from Non-Concessional MIT Income (NCMI) Share of Net Income from trusts, less capital gains , foreign income and franked distributions. | Item 8 Label R - Share of net income from trusts, less capital gains, foreign income and franked distributions. |