Item 8 - Partnerships and trusts

See Item 8 Partnership and trusts on the ATO website.

Distributions from partnerships and trusts

If you prepare an income tax return for any partner in a partnership or any beneficiary of a trust, and you also prepare the partnership return or trust return, when you distribute the income or loss from the partnership, we'll:

- separate and sum up the different income types, offsets and credits and pass them to the xP the Distribution statement worksheet

- from the xP, distribute those amounts to the the dip or dit in each partner's or beneficiary's return, that you act for.

- filter the values in the dip and dit worksheets to labels in the main return at item 8.

Alternatively, you can complete the labels in the worksheets manually.

The dip view for a partnership offers quick access to the Foreign income worksheet (for).

The dit view for the trust contains all the fields required for the share of distributions from other trusts and managed investment trusts (MITs). :

share of capital gains (distributions from trusts only)

share of foreign income and foreign tax paid on that foreign income

share of early stage venture capital limited partnership tax offset

share of early stage investor tax offset

share of exploration credits

share of credit for foreign resident withholding (excluding capital gains).

For the above items, we auto-create an entry in the relevant worksheet or pre-fill the amount in a field on the return. For example, we create transactions for the following:

Capital gains worksheet (g) (distributions from trusts only)

Foreign income worksheet (for)

Early stage venture capital limited partnership tax offset worksheet (esv)

Early stage investor tax offset worksheet (esi)

Credit for foreign resident capital gains withholding dialog.

We roll the dip and the dit over from year to year. This means that we retain the names and TFNs of the partnerships and trusts. If you've received no distribution in the current year, we don't print the worksheet.

If what you show at item 8 includes an amount brought to account under the TOFA rules, you must also complete item 31: Taxation of financial arrangements (TOFA).

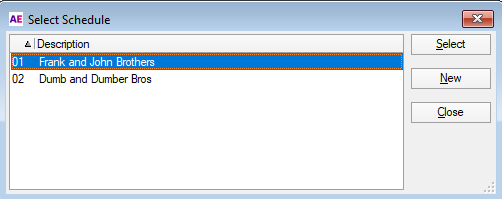

You can have more than one dip or dit for each partnership or trust. The index contains the identifying details for each of them: