Applying 2021 changes to depreciation in tax

You're here to find out how to apply the different depreciation incentives in MYOB Tax.

The order of applying the depreciation, if more than one incentive applies:

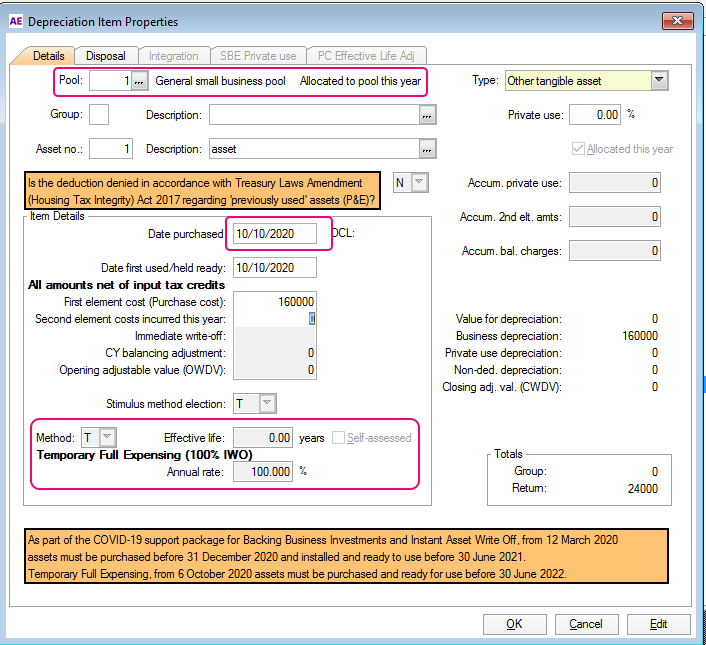

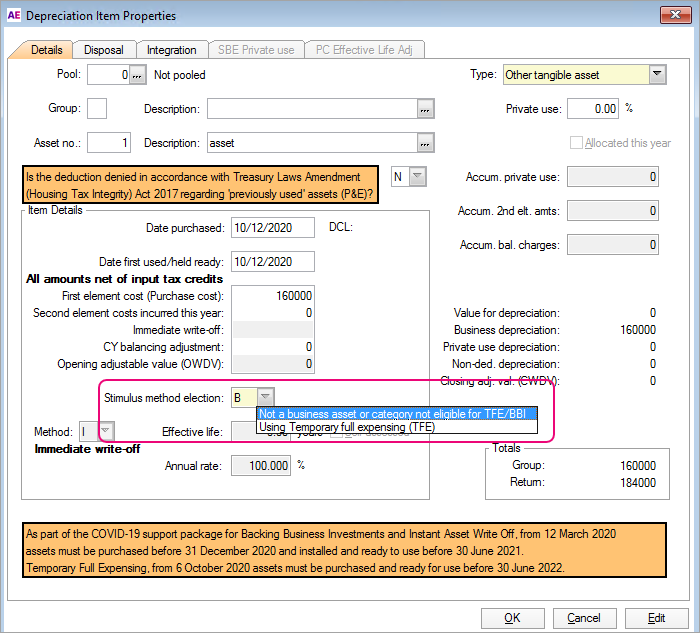

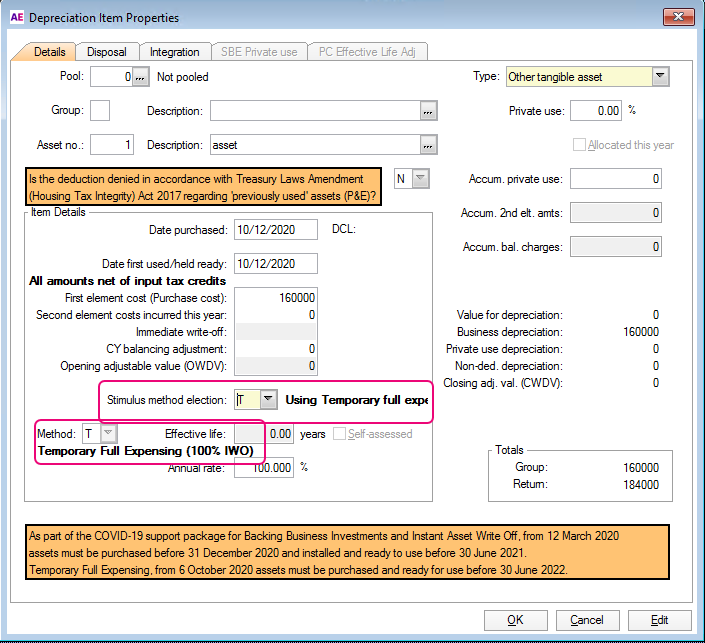

- Temporary full expensing (TFE)

- Instant asset write-off (IAWO)

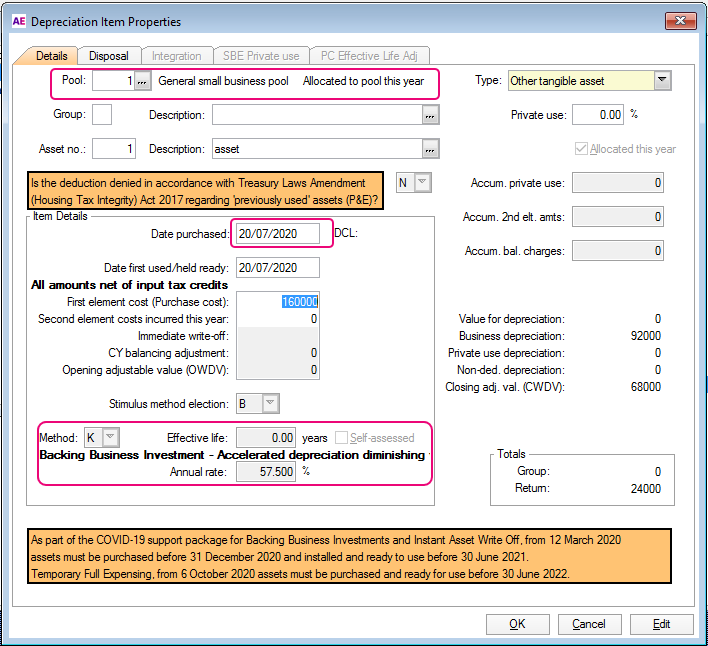

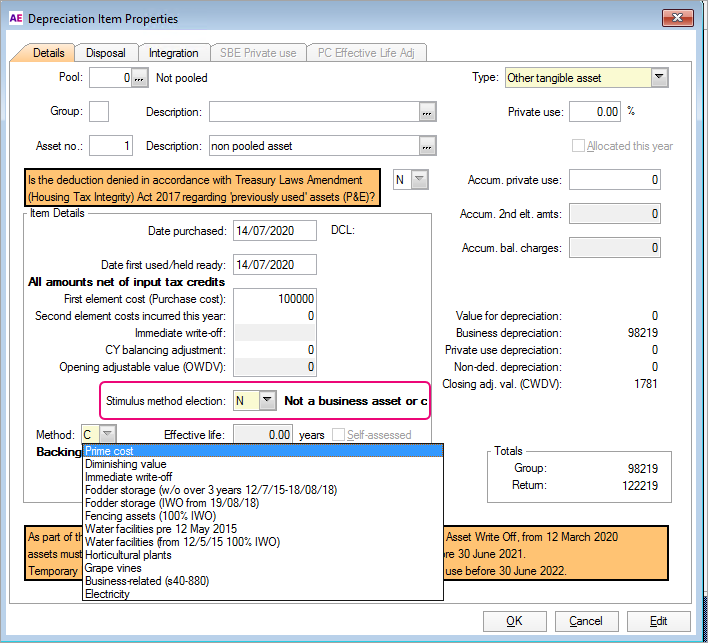

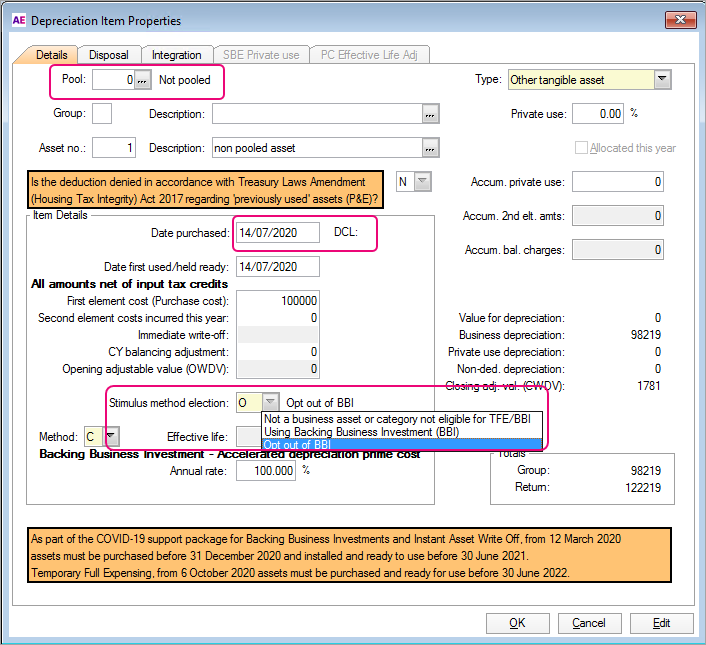

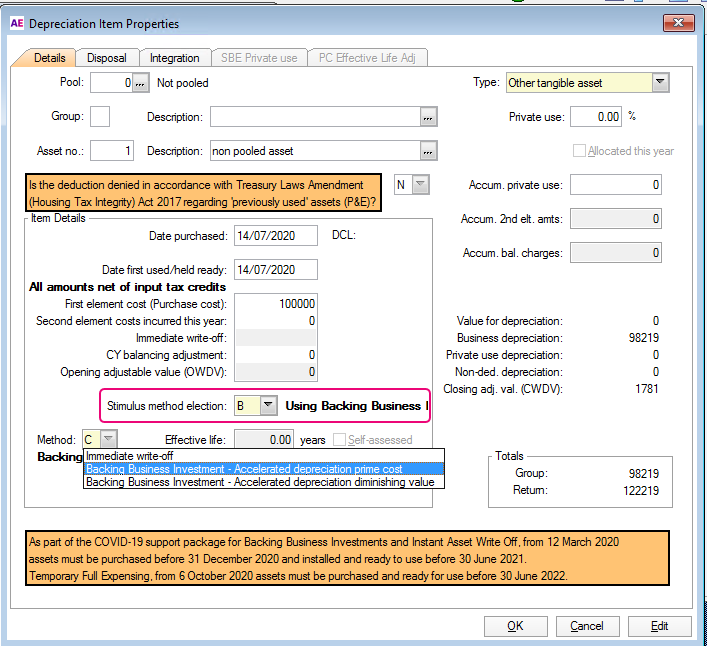

- Backing business investment (BBI)

- General depreciation rules

Based on the rules and thresholds, we've made changes to the depreciation worksheet to help you choose the correct threshold.

Small business using simplified depreciation rules