Working holiday makers net income worksheet (whm)

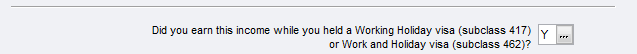

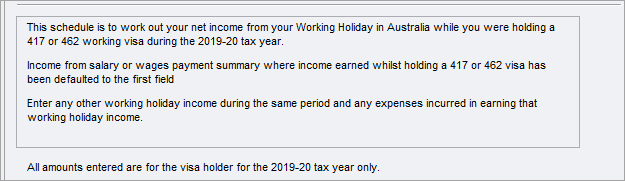

The working holiday maker net income worksheet is completed at item A4 in the Individual return. Integration to this worksheet is from Foreign or Australian PAYG Payment Summaries with the Code H, entered at Item 1 - Salary or wages.

Click the label to open the worksheet. Enter any work-related deductions at items D1 to D10 that directly relate to earning working holiday maker income.

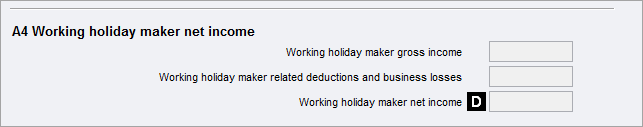

Tax at the special whm rate is calculated on the net income amount entered at A4, label D.

For income earned in 2019 – 2020 and earlier income years:

Amounts at A4 label D up to $37,000 attract tax at the rate of 15%.

Amounts greater than $37,000 attract tax at standard non-resident rates commencing at 32.5%.

For income earned in 2020 – 2021 and later income years:

Amounts at A4 label D up to $45,000 attract tax at the rate of 15%.

Amounts greater than $45,000 attract tax at standard non-resident rates commencing at 32.5%.