Activity statement form types in PLS 2023

ATO has introduced 19 activity statement form types in PLS. These are designed to support the reporting requirements for various obligations.

In a PLS activity statement, form type is a new mandatory field. This field must be completed when creating an activity statement manually and must match the ATO records.

Choosing the form type

You have 3 options to choose the form type. Ideally, use option 1 or 2 where the form type is pre-filled from the ATO data.

Option 1: Pre-fill using the data from Activity Statement Lodgment Report

The easiest way to use our Creating an activity statement in the obligations homepage 2023 data to pre-fill the activity statement. This automatically pre-fills form type, taking the guesswork out of knowing which form type to choose.

Option 2: Add the activity statement manually by performing a Single request

You can perform a single request to add the activity statement manually. This is used for adding one client at a time, instead of multiple clients. This automatically pre-fills form type. Perform a single request to add activity statement obligations for 2014 and earlier.

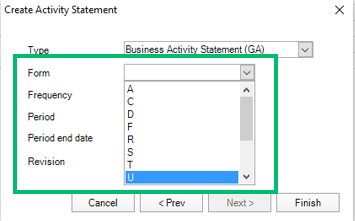

Option 3: Create the activity statement manually and choose the form type

Creating an activity statement is the same as you would do in ELS. The only difference is that you'll have to fill in the mandatory form type field. The form type you've selected must match ATO records.

If you use this option and you're not sure which form type to choose, refer to the table below or call the ATO on 13 72 86 (fast key code 1 4 1).

You may find the form type in your last notice of assessment.

If you accidentally chose the incorrect form type, you'll need to delete and re-create the activity statement.

We've created this table to help you understand the differences in form type between ELS and PLS. Use it as a guide to choose the correct form type.

Click the PLS form type to see a sample form type on the ATO website.

Form name | Form type ELS | Form type PLS | Obligations |

|---|---|---|---|

Monthly Business activity statement | GA | GST, PAYGI, PAYGW, FBTI, WET, LCT, Deferred COIN | |

Monthly Business activity statement | GA | GST, PAYGI, PAYGW, FBTI, WET, LCT, Fuel tax credit | |

Quarterly Business activity statement | GA | GST, PAYGI, PAYGW, Deferred COIN | |

Quarterly Business activity statement | GA | GST, PAYGI, PAYGW, FBTI, WET, LCT, Deferred COIN | |

Quarterly Business activity statement | GA | GST | |

Quarterly Business activity statement | GA | GST, PAYGW | |

Quarterly Business activity statement | GA | GST, PAYGI, PAYGW, Fuel tax credit (FTC) | |

Quarterly Business activity statement | GA | GST, PAYGI, PAYGW, FBTI, WET, LCT, Fuel tax credit (FTC) | |

Quarterly Business activity statement | GA | GST, Fuel tax credit (FTC) | |

Quarterly Business activity statement | GA | GST, PAYGW, Fuel tax credit (FTC) | |

Quarterly PAYG instalment notice | GA | Quarterly PAYG instalment notice (amount only) | |

Quarterly GST instalment notice | GA | GST instalment (amount only) | |

Quarterly GST and PAYG instalment notice | GA | GST and PAYG instalment amount | |

Instalment activity statement | GB | PAYGI, Deferred COIN | |

Instalment activity statement | GB | PAYGW | |

Instalment activity statement | GB | PAYGI, PAYGW, FBTI, Deferred COIN | |

Annual instalment activity statement | GI | PAYGI (instalment amount) | |

Annual GST return | GR | Annual GST return, WET, LCT | |

Annual GST return | GR | Annual GST return, WET, LCT, Fuel tax credit (FTC) |

See Activity statements supported by the PLS on the ATO website.