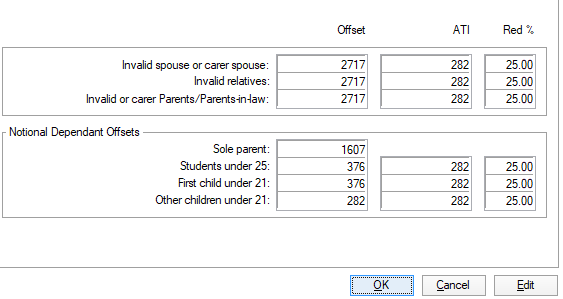

The Dependant Offsets dialog lists all classifications of dependant rebates.

Notional dependant rebates are used in calculating the base amount for Zone or Overseas forces rebate.

the maximum offset for the class of dependant

the maximum Adjusted Taxable Income (ATI) which a dependant may derive before the offset cuts out

the percentage by which the offset is reduced for the excess above the basic Adjusted Taxable Income

Offset: This is the maximum offset available.

ATI: This is the base Adjusted Taxable Income above which the offset will begin to shade out.

Reduction%: This is the shading out percentage.