Gross dividends worksheet (div) 2023

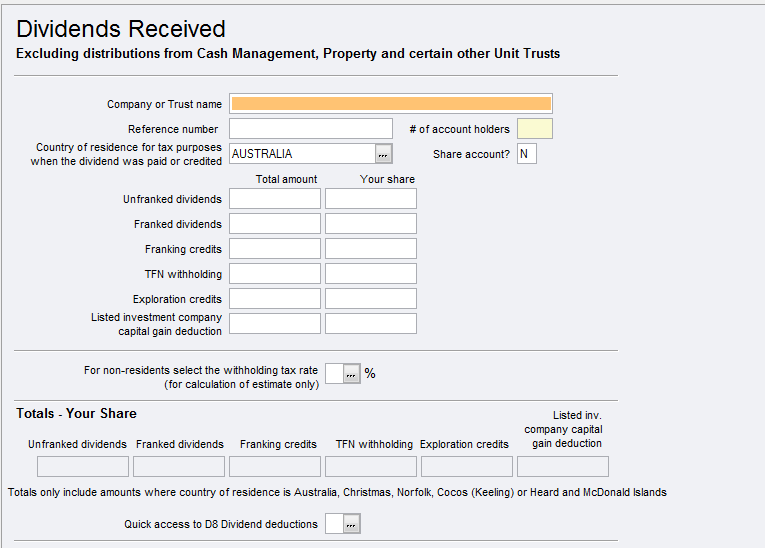

The Dividends received worksheet provides for the details of one or more dividend received transactions to be recorded.

For each transaction the following information is recorded:

| Field | Description |

|---|---|

| Company or Trust name | This identifies the Australian entity paying the dividend. To add entries to the worksheet click Ctrl+Insert. |

| Reference number | Enter the holder identification number for the dividend. |

#of account holders | Number of account holders receiving the dividend. This field must have a value of 1 or greater. This field cannot be a zero, otherwise, Your share will not calculate. |

| Country of residence for tax purposes when the dividend was paid or credited | Enter the country name where the taxpayer was a resident when the dividend was paid. |

| Share account? | Enter Y or N |

| Total amount | Enter the total amount. |

| Your share | This is a calculated field - Total amount/number of account holders. To avoid any validation errors, make sure that an amount exists at Your share if there's an amount at the Total amount. |

| Unfranked dividends | This is the amount on which the Australian company tax has not been paid. It should be detailed on the dividend statement sent by the company or trust paying the dividend. The amounts entered are totalled and transferred on integration to the relevant label in the main return. |

| Franked dividends | This is the amount of the fully franked dividend received (grossed up to include any franking credits attached to it. This field will be disabled if the country of residence is not Australia and one of its territories. |

| Franking credits | This is the total of franking credits attached to dividends that have been franked at the company tax rate of 30%. An amount equal to the franking credit will be automatically allowed as a tax offset to reduce any tax payable on the dividends and any other taxable income received. As small business companies now have a higher franking credit cap than their tax rate, care needs to be taken not to over-frank by allocating more franking credits than are in the franking account when paying dividends. This could result in your having to pay a franking deficit tax. The franking credit:

The Franking Credit calculated from the Franked amount can be overwritten. If the calculated Franking Credit is changed then any further alteration to the Franked Amount will not be reflected in the Franking Credit. Under these circumstances to have Tax recalculate the Franking Credit you should delete both Franked Amount and Franking Credit then enter the Franked Amount as required. This field will be disabled if the country of residence is not Australia and one of its territories. |

| TFN withholding | This is the amount of tax withheld where the taxpayer has failed to quote a tax file number (TFN). The amount withheld should be detailed on the Dividend statement received. This amount cannot exceed 48.5% of the Unfranked amount. |

| Exploration credits | Enter any exploration credits amounts. If you've entered an amount in this field, the tax offsets item T10 - Other refundable tax offsets will also be populated. This field will be disabled if the country of residence is not Australia and one of its territories. |

| Listed investment company capital gain deduction | Capital gain deduction for the listed investment company |

| Totals - Your share | The share amount for this return appears in this section only if the country selected is Australia or its territories. |

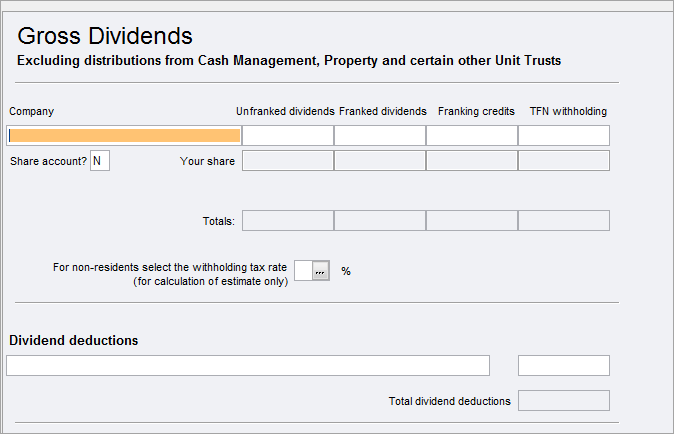

For each transaction the following information is recorded:

| Field | Description |

|---|---|

| Company | This identifies the Australian entity paying the dividend. To add entries to the worksheet click Ctrl+Insert. |

| Share account? | Enter Y or N |

| Total amount | Enter the total amount. |

| Your share | This is a calculated field - Total amount/number of account holders. To avoid any validation errors, make sure that an amount exists at Your share if there's an amount at the Total amount. |

| Unfranked dividends | This is the amount on which the Australian company tax has not been paid. It should be detailed on the dividend statement sent by the company or trust paying the dividend. The amounts entered are totalled and transferred on integration to the relevant label in the main return. |

| Franked dividends | This is the amount of the fully franked dividend received (grossed up to include any franking credits attached to it. This field will be disabled if the country of residence is not Australia and one of its territories. |

| Franking credits | This is the total of franking credits attached to dividends that have been franked at the company tax rate of 30%. An amount equal to the franking credit will be automatically allowed as a tax offset to reduce any tax payable on the dividends and any other taxable income received. As small business companies now have a higher franking credit cap than their tax rate, care needs to be taken not to over-frank by allocating more franking credits than are in the franking account when paying dividends. This could result in your having to pay a franking deficit tax. The franking credit:

The Franking Credit calculated from the Franked amount can be overwritten. If the calculated Franking Credit is changed then any further alteration to the Franked Amount will not be reflected in the Franking Credit. Under these circumstances to have Tax recalculate the Franking Credit you should delete both Franked Amount and Franking Credit then enter the Franked Amount as required. This field will be disabled if the country of residence is not Australia and one of its territories. |

| TFN withholding | This is the amount of tax withheld where the taxpayer has failed to quote a tax file number (TFN). The amount withheld should be detailed on the Dividend statement received. This amount cannot exceed 48.5% of the Unfranked amount. |

| Totals | The share amount for this return. |

Tax provides functionality to share such income and any Franking credits or TFN credits attached to it.

The taxpayer's share of the total amounts entered integrates to the Dividend labels in the main return.

Do NOT enter share of Distributions from Cash Management, Property and certain other unit Trusts in this worksheet. This income should be entered at Distributions from Partnerships and Trusts in the relevant return type.

The total amounts transfer to the relevant labels in the income tax return and are rounded on integration. TFN withheld is expressed as a dollar and cents amount in the main return.

All the amount fields accept cents. It is important to remember to key the decimal point, as otherwise the amount entered will be treated as whole dollars.

The franking credit is calculated from the Franked amount entered in the previous field. Once the Franking credit has been calculated by the system, if the Franked amount needs to be changed, then both the Franked amount and the Franking credit fields will need to be cleared, for the new calculation to proceed.

After entering Y at the Share account? field, the Index of Joint owners window appears. Perform the following steps to create the transaction for Share details:

From within the Index of Joint owners window, click New. The Share details screen is displayed.

In the General tab, Share to: field press F10 or click on the ellipsis to open the Select Return Index.

Select the return to receive the share.

Enter the percentage share for that return.

Press F6 to save the entry.

Click Cancel to return to the index if there are no other returns to share this amount.

To edit or delete the shared interest entries, refer to Index of Joint Owners 2023

For non-residents, click the ellipsis [...] to select the Withholding Tax rate from the For non-residents select the withholding tax rate field.

Withholding Tax is the amount of tax withheld by financial institutions or companies issuing dividends to non-residents.

If applicable, select the relevant withholding rate. Although the rate can vary from country to country, the tax withheld on dividends is generally calculated at a rate of 30%.

The rate of tax selected is applied to the Unfranked Dividends for estimate calculation purposes only.

If the taxpayer was not an Australian resident for tax purposes for all or part of the year do NOT include income paid or credited during that period unless:

- the dividend was fully franked, or

- the dividend was not fully franked but withholding tax was (or should have been) withheld from the unfranked amount

When the worksheet is printed, the Host return will show the details of the transaction and the details of the Share return: the Return Code and Name of the taxpayer the dividend income was shared to.

The Sharee's return will show the details of the transaction and the details of the Host return: the Return Code and Name of the taxpayer the dividend income was shared from.

Pre-fill this schedule using the Pre-fill manager 2023. The Pre-fill Manager enables you to download pre-fill reports for clients using the Practitioner Lodgment Service (PLS). You can view these reports in PDF format, and populate the pre-fill information into the client's Tax return.

Tax Pre-fill is dependent on available ATO data. Validate the tax return by pressing F3 for a list of the imported values and any errors before lodgment.