National Rental Affordability Scheme (NRAS) 2023

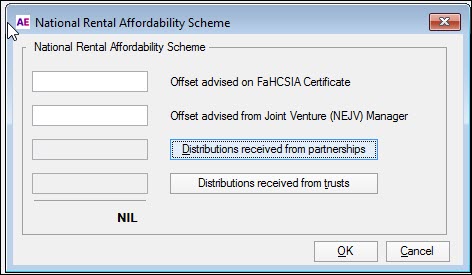

A holding dialog is provided at the relevant NRAS items in the Company, Fund, Self-Managed Fund, Trust and Partnership returns as detailed below. Distributions to individuals are entered in the Distributions from Partnerships worksheet (dip) and Distributions received from Trusts worksheet (dit).

The offset amounts you enter should be those advised by either the FaHCSIA or the Venture (NEJV) Manager. Where a share of NRAS offset has been distributed from a Partnership or Trust, that amount should be entered in the dip worksheet or dit worksheet respectively. The amounts entered must relate to the NRAS income year which covers the period 1 May to 30 April.

| Return type | Form Items and labels |

|---|---|

| Company | Item 12 - Label J and Calculation Statement, label E Refundable tax offsets |

| Fund (EF and MS) | Calculation Statement, label E3 which adds to label E Refundable tax offsets |

| Partnership | Item 49 - label F |

| Trust | Item 50 - label F |

CCH References

20-600 National Rental Affordability Scheme

20-605 NRAS Refundable tax offset