Rental Schedules (ren, rep and RNTLPRPTY) 2023

Tax provides rental schedules for the different return types:

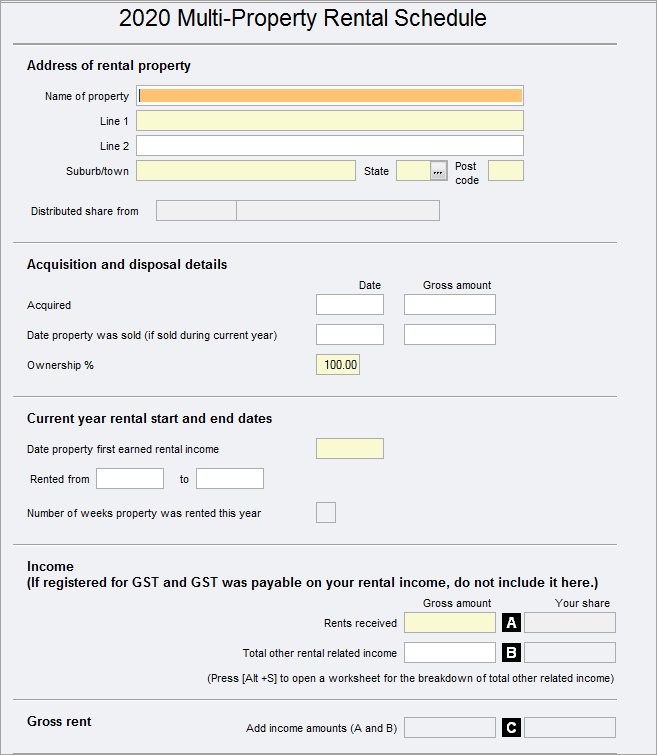

Multi rental property schedule(RNTLPRPTY) for Individual returns.

Rental Property Worksheet (ren) for Companies and Funds

Rental property schedule (rep) Partnerships and Trusts

The ATO requires that a Rental schedule be prepared and lodged for each rental property that is the subject of assessable income/loss:

Individual: From 1 July 2020, the PLS Multi-property rental schedule (RNTLPRPTY) replaces the ATO Rental schedule (RS) and must be lodged for Individuals owning one or more rental properties.

Companies: companies with rental income may use the Rental Schedule for Individuals to assist with their calculations, but they are not obliged to do so. This schedule does not integrate to the Company return.

Partnerships and Trusts: rental schedule BR is used for Partnership and Trust returns. Schedule BR is the same as Schedule B except it includes extra questions relating to the property.

Whilst the rental schedule is available for companies, funds, trusts and partnerships, it is not required to be lodged electronically for these entities.