Early stage investor tax offset worksheet (esi) Individual 2025

The maximum offset (including current year and carried forward prior year amounts) that you and your affiliates can claim in 2017-18 is $200,000.

You'll find this worksheet at:

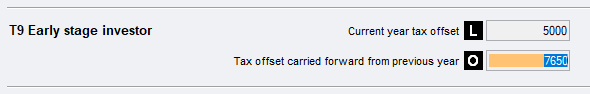

- Item T9: Early stage investor

- Preparation > Schedules > Early stage investor worksheet (esi)

- Navigation Pane > Worksheets > Early stage investor

Before completing the worksheet and claiming the ESIC tax offset, it's important to read Early stage investor tax offset on the ATO website.

CCH References

20-700 Outline of innovation incentives

Distributions from partnerships worksheet (dip) 2025

Trust income schedule (DISTBENTRT) and Distributions received from trusts (dit) 2025

Return to Early stage investor offset worksheet (esi) 2025#CompletingtheEarlystageinvestorworksheet(esi)