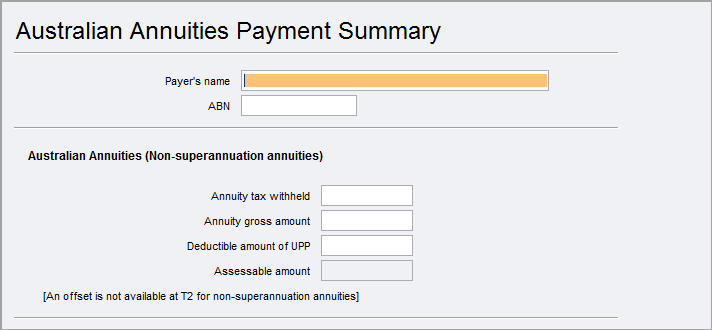

Australian annuities payment summary (aap)

As per the ATO's requirements, Australian annuities payment summary (aap) worksheet has been separated from the Australian superannuation income streams worksheet (asi). These changes are made to report the non-superannuation annuities and superannuation annuities in two different worksheets.

Australian annuities (also called non-superannuation annuities) are paid to you by Australian life insurance companies and friendly societies.