Business income statements and payment summaries (bip)

ATO has decommissioned the Payment summary schedule (PS) and replaced it with Business Income Statements and Payment Summaries (bip).

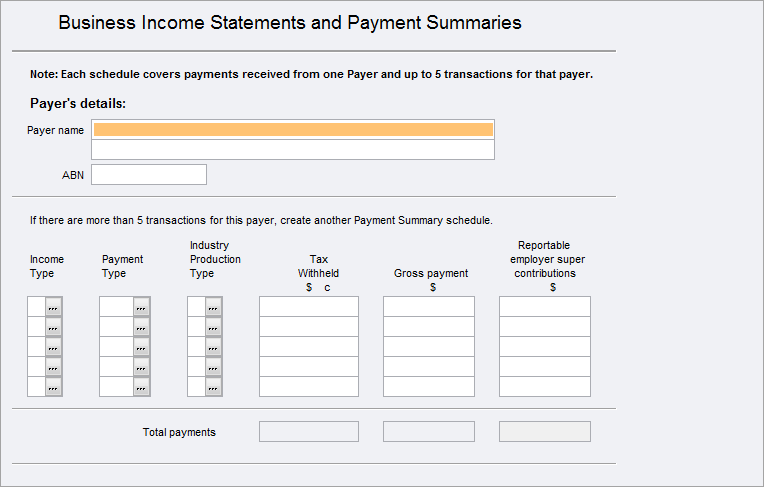

Complete the Business Income Statements and Payment Summaries (bip) to enter payment summary data at Item 14 - Personal Services Income (Individual Return) or Item 15 - Net income or loss from business.