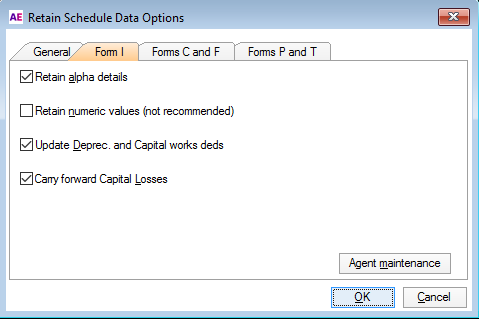

Form I RSD Options

Retain alpha details

Selecting this option rolls over all text entered in returns or schedules and worksheets, for example:

- Payment summary details.

- Financial institution details entered for Interest and Dividends,

- Rental property details

- Other text entered in worksheets.

Retain numeric values

We don't recommend using this option as all previous years amounts will roll into the next income tax year. This could lead to errors if an amount from the previous year that was not applicable to the current year was overlooked when reviewing the return.

Update Depreciation and Capital Works deductions

Unless you want to enter all your depreciating asset details each year, leave this option ticked. During the Year End and RSD routines, Tax moves Closing adjustable values to Opening adjustable values and automatically calculates depreciation for the current year.

Carry forward capital and foreign losses

This option should be left ticked so that Capital Losses, Foreign Losses and Excess foreign tax credits are carried forward to the new tax year in their respective categories and classes.

Agent Maintenance

This links to the Agents index.

Where the practice has more than one Tax Agent and that Agent's details are attached to certain returns in the Return Properties > Staff tab, the RSD program will search for any special requirements for individual Agents in regard to the coming year. Refer to Agents.