This item is for travel expenses incurred when performing work as an employee. They include:

- public transport, air travel and taxi fares

- bridge and road tolls, parking fees and short-term car hire

- meals, accommodation and incidental expenses while away overnight for work

- expenses for motorcycles and vehicles with a carrying capacity of one tonne or more, or nine or more passengers, such as utility trucks and panel vans

- actual expenses, such as petrol, repair and maintenance costs that you incur to travel in a car that is owned or leased by someone else.

Complete item D2 for work-related travel expenses during the current income year.

From 1 July 2018, if you have work-related travel expenses, the ATO requires you to lodge a Deductions schedule (DDCTNS, AE Tax schedule code ds).

We've removed the dissection grid provided in previous years.

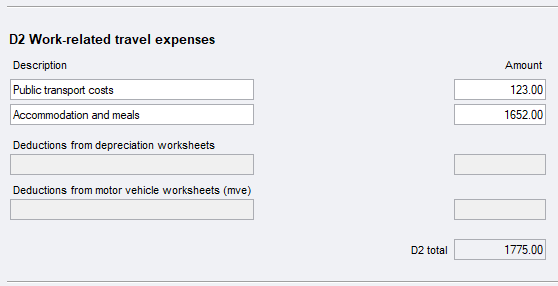

To open the DDCTNS at this item, click label B and click into the first details field.

You can have up to 20 entries. To add a row, press Ctrl+Insert. To delete a row, press Ctrl+Delete.

If you've allocated amounts to item D2 in the Motor vehicle worksheet (mve) or the Depreciation worksheet (d) we'll pass these to D2.

When you close the worksheet, MYOB Tax updates the value at label B.