Loss carry back offset (Company tax returns)

Corporate entities can offset their tax losses against previous tax liabilities through a refundable tax offset. This will allow eligible corporate entities to offset their current tax losses immediately rather than carry them forward.

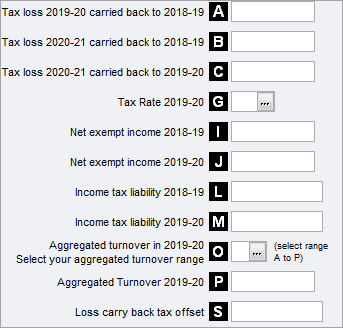

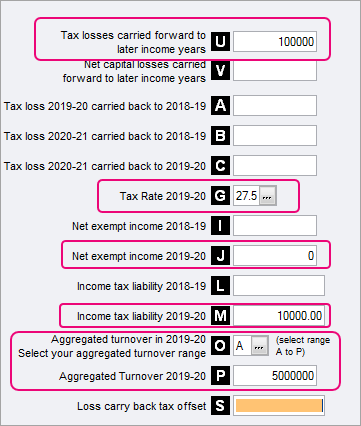

Eligible corporate tax entities can claim the loss carry back tax offset by carrying back tax losses made in 2019–20, 2020–21 and 2021–22 years to a prior year's income tax liability in the 2018–19, 2019–20 and 2020–21 years.

An aggregated turnover threshold of less than $5billion in turnover in the loss year (or the income year before that year) applies.

Eligibility

Corporate tax entities with less than $5 billion aggregated turnover.

How much refundable offset can you claim?

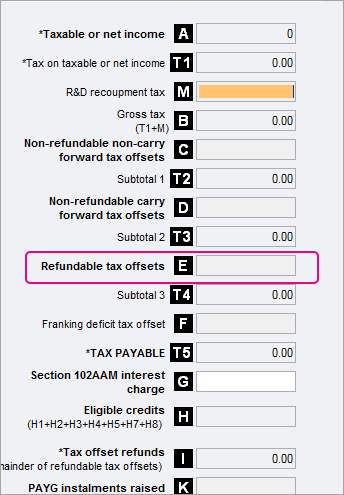

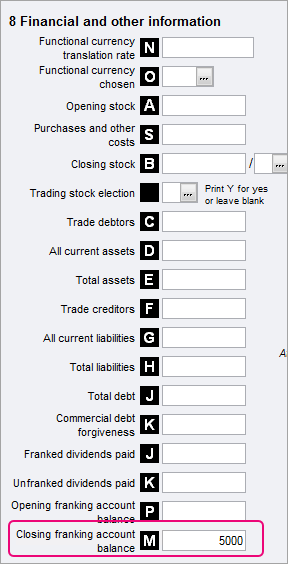

The maximum refundable tax offset you can claim is the lower of the amount of income tax liability in the tax year you're carrying forward to and the closing franking account balance (Item 13 Label S) for the current year.

Tax losses that have been carried back are no longer available to be carried forward. (These losses will need to be entered in the Losses schedule (Part F - SUBTRACT tax losses forgone) and Consolidated group losses schedule (Label I of Part F)

For corporate tax entities who are required to complete a losses schedule or a consolidated group losses schedule they will need to deduct the losses carried back from their losses carried forward

Calculating the offset

Use the Loss carry back worksheets - lcb & lcc (for 2021 Company returns) to calculate the offset.

For manual calculation, see below