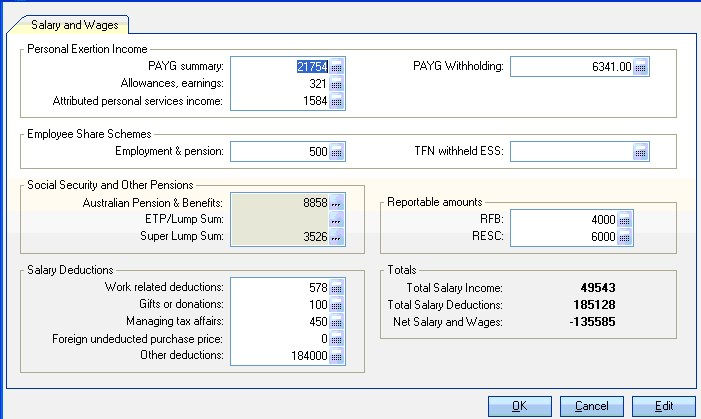

Salary and Wages Income Data Entry

Not available in Accountants Office

An ellipsis beside the amount field indicates a further data entry or dissection dialog. This dialog provides access to further worksheet dialogs for:

Personal Exertion Income

For all the following fields, if the Tax return is prepared, the amounts will be pre-filled from the tax return in the Ledger.

PAYG Summary: Enter the total of the gross salary income that is indicated on the PAYG Summary. This figure corresponds to the Gross Salary field on an individual tax return.

PAYG Withholding: This field corresponds to the item 1 amount in Tax Withheld column in the individual return and is the sum of all amounts withheld from income at items 1 to 9.

Allowances, Earnings: This field corresponds to the Item 2 amount in the Individual return, Gross amount column.

Attributed personal services income: This field corresponds to the item 9 amount in the individual return, Gross amount column.

Employee Share Schemes

ESS Discount: This field corresponds to the item 12, label B amount in the individual return,

TFN Withheld: This field corresponds to item 12, label C in the individual return.

Social Security, ETP & Lump Sums

Australian Pension & Benefits: Click the ellipsis to open the dialog to enter all Pensions and allowances equivalent to Items 5 and 6 in the individual return.

ETP/Lump Sum: Click the ellipsis to open the dialog to enter all Employment Termination payments and any lump sum B amounts.

Super Lump Sum: Click the ellipsis to open the dialog to enter all Superannuation Lump Sum payments.

Reportable amounts

RFB: This is the amount of Reportable Fringe Benefits reported on the PAYG Payment Summary.

RESC: This is the amount of Reportable employer superannuation contributions reported on the PAYG Payment Summary.

Salary Deductions

Work Related Deductions: This field corresponds with the D1 to D5 fields in the individual tax return.

Gifts or Donations: This field corresponds to item D9 in the individual return.

Managing Tax Affairs: This field corresponds to item D10 in the individual return.

Foreign Undeducted Purchase Price: This field corresponds to item D11 in the individual return.

Other Deductions: Enter the amount of allowed deductions not specifically covered above. This field corresponds to item D15 in the individual return. Refer to Total Deductions.

Totals

This is a summary of the amounts that make up Net Salary and Wages income.