IR7 Question 18 Income and expenditure from residential property

This question applies to owners of residential rental property, including overseas property subject to the residential rental property deduction rules in subpart EL of the Income Tax Act 2007.

Most residential rental properties are subject to the residential property deduction rules (also known as the ring-fencing rules). The rules generally limit the amount of residential deductions you can claim in the year to the total amount of residential income earned in that year. If the residential property makes a loss it must be carried forward to the next year in which residential income, including income from properties held on revenue account, is earned.

The residential property calculations are made at the partner or owner level as they may have other residential income and deductions that need to be included. There are two levels of exclusions from the rules.

Any rental income or loss and net income or loss from a taxable disposal is fully excluded from the rules if the property is:

- the main home;

- property subject to the mixed-use asset rules (holiday home rented out part-time);

- property owned by companies other than close companies;

- property owned by government enterprises;

- certain employee accommodation.

For these types of property, the existing rules apply with the rental income or loss shown at Box 19B and net income or net loss from a taxable disposal shown in Box 20B.

Any rental net loss and net loss from a taxable disposal is partially excluded from the new rules if it is for:

- property that will always be taxed on sale, being revenue account property of a person in the business of building, developing or dealing in land;

- other revenue account property the person has notified us they want the exclusion to apply to.

For these types of property any rental net loss is shown at Box 19B and taxable disposal net loss is shown at Box 20B. Net rental income and net income from a taxable disposal plus any depreciation recovered is shown as residential income at Box 18B.

Refer to the Rental income - IR264 guide for information on when the rules apply, how to calculate your income, the amount of deductions you can claim this year, and the amount of any excess deductions that must be carried forward.

The residential property deduction rules also apply to a partnership or LTC that has borrowed money to acquire an interest in certain entities with significant rental property holdings - a residential land-rich entity - and has interest expenditure on the borrowed money.

Residential land-rich entity - a close company, partnership or LTC that holds more than 50% of its assets by value in residential land directly or indirectly. They come under the interposed entities rules as part of the residential property deduction rules.

For more information about the interposed entity rules, see page 60 of the Tax Information Bulletin Vol 31 No.8 September 2019.

Completing Question 18 your return

Tick the method/s you have used to calculate your residential property income and deductions.

You use one of the following:

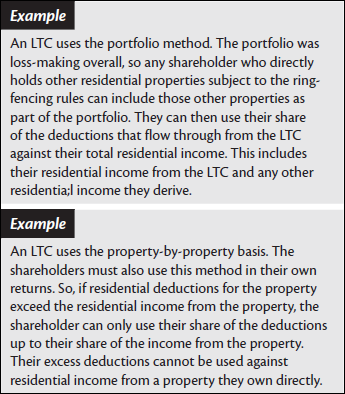

- Portfolio basis - combine the income and deductionsfor all rental properties in the portfolio.

- Individual, property-by-property basis - income and deductions of individual property calculated separately to other property. You need to maintain separate records for each property to choose this option. The details for each property need to be provided to the partners or owners.

- Combination of the property-by-property basis and portfolio basis - choose to apply different methods to different property. Some properties are held in a portfolio and others are held on property-by-property basis.

For a partnership most of the calculations for excess rental deductions are made in the partners return. The partnership needs to provide sufficient information for the partners to complete their return correctly. If a partner wants to use the individual method the partnership needs to maintain separate records for each rental property and pass each property’s details to the partner.

For an LTC, the owners need to complete their return using the same method chosen by the LTC for their share of the income and deductions. An owner can choose a different method for other rental properties they own.

The Residential property deductions worksheets - IR1226 can be used to calculate the information required to be shown in your return.

Write the total residential income in Box 18B. This is the total of the following amounts:

- all residential rental income from a portfolio and/or individual property;

- all depreciation recovery income for assets disposed of from a portfolio and/or individual property;

- net income from the taxable sale/disposal of a property in a portfolio and/or individual property; and

- all net residential rental income, depreciation recovery income and net income from the taxable disposal of property from residential property excluded because it is held on revenue account.

Only include the net income from a disposal once.

Write the total eligible deductions for residential rental properties in Box 18C.

Include the amount of any interest paid on an investment in a residential land rich entity that relates to residential rental activity in Box 18B. Include the amount of other interest paid in Box 19B.

The partners or owners share of these are shown in boxes 26G and 26M on the IR7P or IR7L.