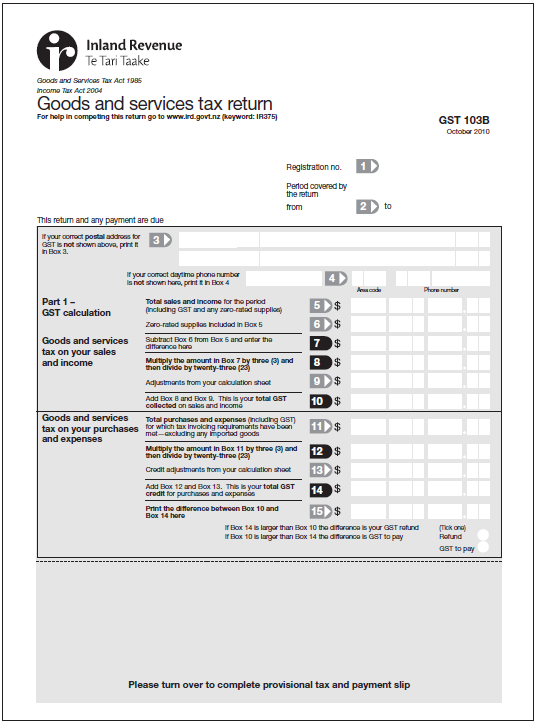

Page 1 of your GST 103

Your personal details are printed in the top panel. They include your GST number, the period covered by the return, due date, mailing address and daytime phone number. You can update your details in Boxes 3 and 4. If you’re sending in a return that doesn’t have your details and return period preprinted, please make sure you fill in these details.

If you’re completing the return online you’ll need to complete these details in Boxes 1 to 4.

Example: Page 1 GST103B