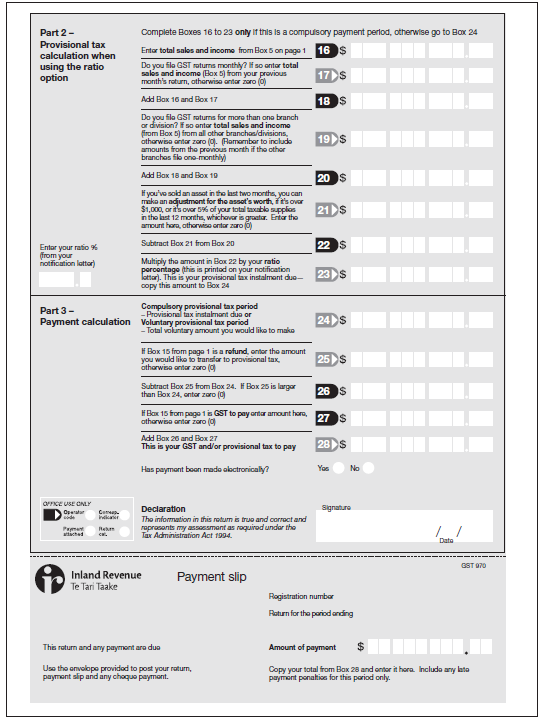

Box 16

Transfer the total sales and income from Box 5 on page 1.

Enter this figure in Box 16 of the return.

Box 17

If you file your returns monthly, take the total sales and income figure from Box 5 of your previous month’s return.

Enter this figure in Box 17 of the return.

Box 19

If you file GST returns for more than one branch or division of your business, get the total sales and income from Box 5 of their returns. Remember to include amounts from the previous month’s returns if they file one-monthly.

Enter this total figure in Box 19 of the return.

Box 21

If you’ve sold an asset during the taxable period, (or the last two months if you file monthly) this will reduce the amount of your total GST supplies for calculating your provisional tax. You can make this adjustment if:

the asset wasn’t revenue account property

the value of the asset is greater than

an amount equal to 5% of the total taxable supplies in the last 12 months, or

$1,000.

Enter this figure in Box 21 of the return.

Box 22

Use the ratio percentage on the notice you received from Inland Revenue.

Enter this amount in the box to the left of Box 23 of the return if it’s not already printed there.