CMN.ATO.IITR

Individual return errors

If you can’t find the error you’re looking for, see the ATO’s list of PLS errors

All private health insurance policy details required.

If you have Tax claim code No dependants, Dependants, Claiming your share of rebate or Claiming your spouses share of rebate, then make sure you’ve completed Health insurer ID, Membership number, Your premiums eligible for Australian Government rebate, Your Australian Government rebate received, and Benefit code.

At P9, Check the Business loss activity details and if the correct code has been selected.

Australian superannuation income stream amount is invalid.

Details: Australian superannuation income stream tax offset amount at item T2 is greater than zero, and the Australian annuities and superannuation income streams income amount at Item 7 Labels J, N, Y or Z are either missing or equal to zero.

Solution

Check the following items as per the condition and relodge

T2

Item 7 Label J,

Item 7 Label N,

Item 7 Label Y,

Item 7 label Z

Gross interest amount must be provided.

This error occurs in the interest income worksheet where there are 2 or more ATO pre-fill data and an incorrect total is integrated into Item 10 in the tax return.

Solution

This is a refreshing issue.

Go to the interest worksheet.

Click the blank TFN withholding field (the non-ATO pre-fill field) and press tab.

Press F6 to close out of the worksheet.

Assessable foreign source income amount is incorrect

Details: This error occurs in the Trust distribution schedule.

Solution

Make sure you’ve entered zeros in the mandatory fields (marked with a orange background)

CMN.ATO.IITR.730089

Assessable foreign source income must be provided.

Details: This error occurs when there's foreign income worksheet in the Distributions from Managed fund worksheet.

Solution

This is a refreshing issue.

Open the Distributions from managed fund worksheet.

Tab through the fields.

Press F6 to close out of the worksheet.

Country of residence for tax purposes when interest was paid or credited must be provided.

This error occurs for a part-year resident.

If the interest income worksheet was pre-filled by ATO prefill and Country of residence for tax purposes when interest was paid or credited field is blank

Solution

We're aware of this issue and working on a solution.

In the meantime, complete the Country of residence for tax purposes when interest was paid or credited field in the interest worksheet.

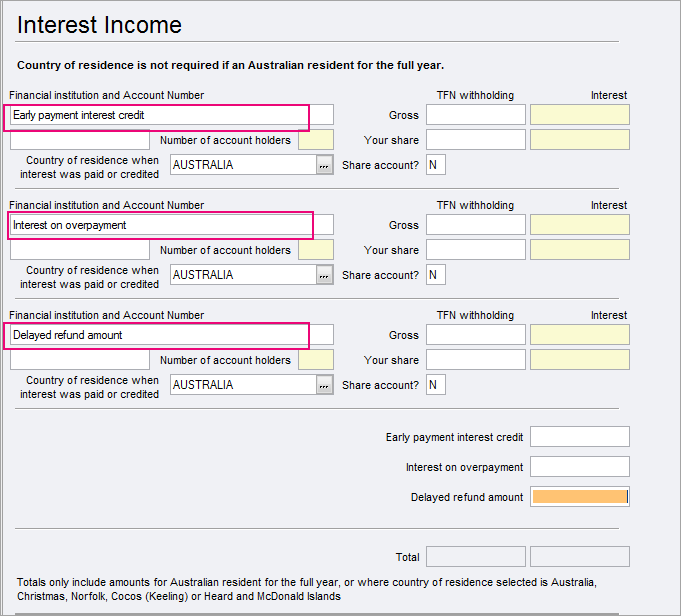

Country of residence for tax purposes when interest was paid or credited must be provided.

This error occurs for a part-year resident.

In the interest income worksheet, where there are amounts at

Interest on overpayment

Early payment interest credit

Delayed refund amount

Solution

We're aware of this issue and working on a solution.

In the meantime,

Create separate records for each amount in the labels.

Enter the country of residence: Australia.

TFN amounts withheld from gross interest must be provided.

This error occurs in the interest income worksheet where there are 2 or more ATO pre-fill data and an incorrect total is integrated into Item 10 in the tax return.

Solution

This is a refreshing issue,

Go to the interest worksheet.

Click the TFN withholding field and press tab.

Press F6 to close out of the worksheet.

Distribution from partnerships must be provided.

Where Primary production distribution from partnership amounts are present, make sure you’ve entered the Distribution from partnerships amount.

CMN.ATO.IITR.EM errors

Surname does not match ATO records. Please check and match the records with ATO

Date of birth does not match ATO records

Details: To update your ATO records for the name, gender or date of birth, search for Updating your details with us on ato.gov.au.

Solution

This message indicates that the client's date of birth does not match the ATO records.

Check and change the client's date of birth in your database. This will ensure the correct date is used in the return

Number of months eligible for the tax-free threshold must be within the income year.

Solution

Check the dates at A2 and relodge.

A tax return for this period has already been lodged

If you receive this message, check the ATO Tax Agent Portal to see if the return is lodged. If it shows as Lodged, update the status to Lodged/

Solution

To change the status of the return to lodge, follow the steps below.

Follow the menu path Lodgment > Update > I P T C F Forms.

Make sure the Single Return option is selected.

Click OK. The Lodgment Update window displays showing the current status of the return.

At the Status field, click the drop-down arrow and select Lodged.

Part year tax-free threshold date must be within Income Tax year

Details: Where Part year tax-free threshold date has been entered, the date must be between the period start and period end dates of the Individual tax return (IITR) lodged.

Solution

Check what you've entered at label A2 and relodge.

Details: Interest adjustment reason code must be provided.

Solution

Check the prefill report on the ATO portal and check the adjustment reason.

Details: The amount of Government allowance income stated is less than the information the ATO has confidence in for your client. Please provide a reason for the Government allowance income not matching the ATO's prefill information.

Solution

You have either not declared any Australian Government payments or declared amounts is less than what the ATO has.

You can find these amounts in the Australian Government Payments schedule (aga)

To fix the issue:

Complete the amounts in the aga schedule

If the amount is less than ATO records, provide an adjustment reason in the aga schedule

Details: The amount of Government allowance tax withheld amount stated is more than the information the ATO has confidence in for your client. Please provide a reason for the Government allowance tax withheld amount not matching the ATO's prefill information.

Solution

You have either not declared any Australian Government payments or declared amounts is less than what the ATO has.

You can find these amounts in the Australian Government Payments schedule (aga).

To fix the issue:

Complete the amounts in the aga schedule

If the amount is less than ATO records, provide an adjustment reason in the aga schedule

Details: The amount of Government pension tax withheld amount stated is more than the information the ATO has confidence in for your client. Please provide a reason for the Government pension tax withheld amount not matching the ATO's prefill information.

Solution

You have either not declared any Australian Government payments or declared amounts is less than what the ATO has.

You can find these amounts in the Australian Government Payments schedule (agp).

To fix the issue:

Complete the amounts in the agp schedule

If the amount is less than ATO records, provide an adjustment reason in the agp schedule

Details: The amount of Government pension income stated is less than the information the ATO has confidence in for your client. Please provide a reason for Government pension income not matching the ATO's prefill information

Solution

You have either not declared any Australian Government payments or declared amounts is less than what the ATO has.

You can find these amounts in the Australian Government Payments schedule (agp).

To fix the issue:

Complete the amounts in the agp schedule

If the amount is less than ATO records, provide an adjustment reason in the agp schedule

Make sure the organisation name matches the registered name of the company.

- Check the client details on the ATO Portal, or use the ABR ABN Lookup.

Note that if the organisation name contains a hyphen, you must not add a space before and the hyphen. If you do, the ATO will reject the return.