All return types

XML03 error usually means

You’ve not completed a field that is required.

Entered something in a field that is not allowed in that field,

Exceeded the number of characters in the field.

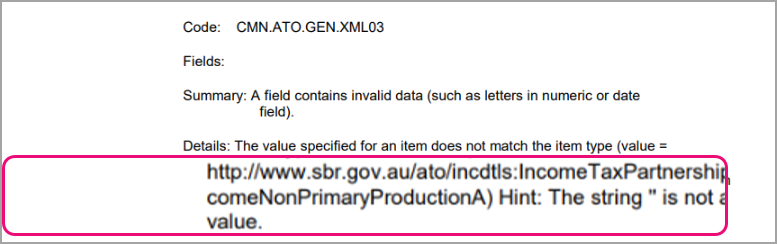

CMN.ATO.GEN.XML03

A field contains invalid data (such as letters in numeric or date field).

The value specified for an item does not match the item type (value = "", item type = Decimal, uniqueID =

Identifying the field name from the ATO rejection report To fix the error, it's important to identify the specific field where it occurred.

Follow the steps below on how to find the field.

Open the rejection report .

In the Details section, get the field name after /ato .http://www.sbr.gov.au/ato/ incdtls:IncomeTaxPartnershipExcludingForeignIncomeNonPrimaryProductionA )

Check the Hint to see if it is an invalid value, mandatory field, or exceeding character limit.Hint: The string '' is not a valid Decimal value.

Fixing the error This is the list of common fields in which this error can happen.

Individual return incdtls:IncomeTaxPartnershipExcludingForeignIncomeNonPrimaryProductionA

http://www.sbr.gov.au/ato/ incdtls:IncomeTaxPartnershipExcludingForeignIncomeNonPrimaryProductionA )

Check the fields

incdtls:IncomeTaxPartnershipRentalNonPrimaryProductionA

http://www.sbr.gov.au/ato/ incdtls:IncomeTaxPartnershipRentalNonPrimaryProductionA )

Check the fields

incdtls:OrganisationNameDetailsOrganisationalNameT

http://www.sbr.gov.a/ato/ incdtls:OrganisationNameDetailsOrganisationalNameT

Check the fields

ESS payer's name in Employee share scheme schedule

Dividends company or trust name in Dividends received schedule

Managed fund name in Distribution received from managed fund schedule.

Foreign income employer name in Foreign employment income non-payment summary schedule

Partnership Name in Distributions from Partnerships schedule

Name of distributing trust in Distributions from Trusts schedule.

Business income statement payer's name in Business income statements and payment summaries

incdtls:DepreciatingAssetsIntangibleBalancingAdjustmentA

http://www.sbr.gov.au/ato/ incdtls:DepreciatingAssetsIntangibleBalancingAdjustmentA)

Hint: The string '' is not a valid Decimal value.

Check the fields

incdtls:InternationalDealingsA

http://www.sbr.gov.au/ato/ incdtls:InternationalDealingsA )

Check the label

Foreign rental income gross amount in Foreign income worksheet "

If you have a foreign tax paid amount, make sure you’ve completed gross foreign income.

incdtls:InternationalDealingsForeignSourceInco meOtherA

http://www.sbr.gov.au/ato/ incdtls:InternationalDealingsForeignSourceIncomeOtherA

Check the label

trt.RegulatoryDisclosuresGeneralInformationAboutFinancialStatementsT

http://www.sbr.gov.au/ato/ trt:RegulatoryDisclosuresGeneralInformationAboutFinancialStatementsT )

Check the following

Trust return trt:PropertyPlantAndEquipmentEffectiveLifeRecalculationI

http://www.sbr.gov.au/ato/ trt:PropertyPlantAndEquipmentEffectiveLifeRecalculationI )

Check and complete the label

trt.IncomeRangeC

http://www.sbr.gov.au/ato/ trt:IncomeRangeC )

Check and enter the code at the label

distbentrt:AustralianCompanyNumberId

http://www.sbr.gov.au/ato/ distbentrt:AustralianCompanyNumberId )

Check and complete

trt.A

http://www.sbr.gov.au/ato/ trt.A )

Check the following labels

Item 11 Label J Gross interest including Australian Government loan interest

Label 14 Label O Amount of Other Australian income

Item 23 Label B Gross amount of Other assessable foreign source income, excluding income shown at Attributed foreign income