Set up balance forward accounts

MYOB AccountRight and MYOB Business/Essentials will clear your income and expense accounts and balance forward your earnings to your retained profits account on rollover. However, AccountRight and Essentials won't balance forward any other balance sheet accounts. This means that journal entry needs to be posted at the beginning of each year to transfer the balance of any asset, liability or equity accounts required (for example, beneficiary accounts).

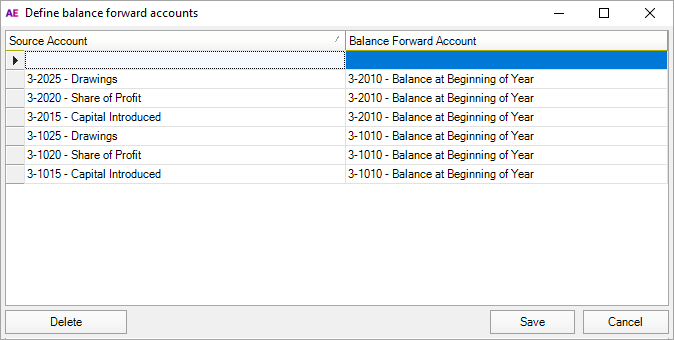

You can set up Client Accounting to automatically generate a journal at the beginning of the year to transfer the balance from one account to another.

When you define which accounts need to be balanced forward, an unposted journal entry dated for the first day of the financial year is created when you add a new workpaper period for the year, and the account has a closing balance in the prior year.

The Start date of the workpaper period must be the same as the first day of the financial year for a journal to be created automatically. Journal entries are only created for accounts that have prior-year closing balances.