Setting up Trusts and Partnerships in AccountRight/Essentials for reporting in Statutory Reporter

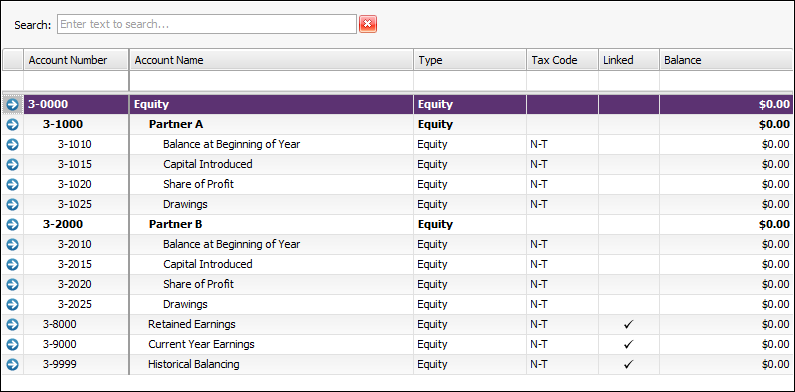

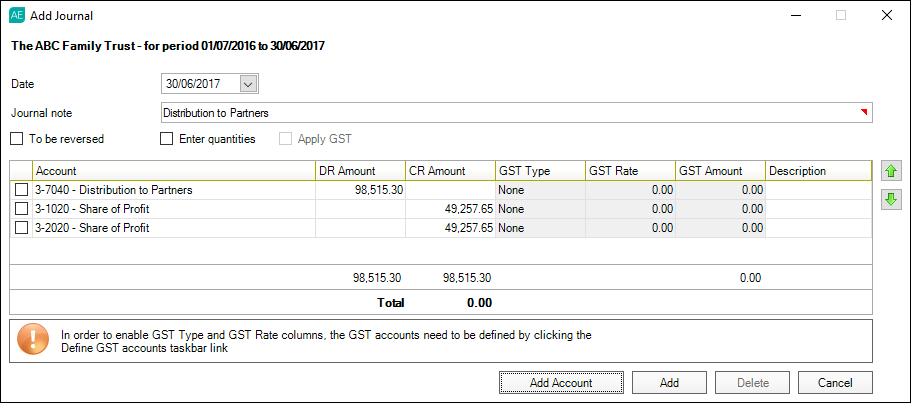

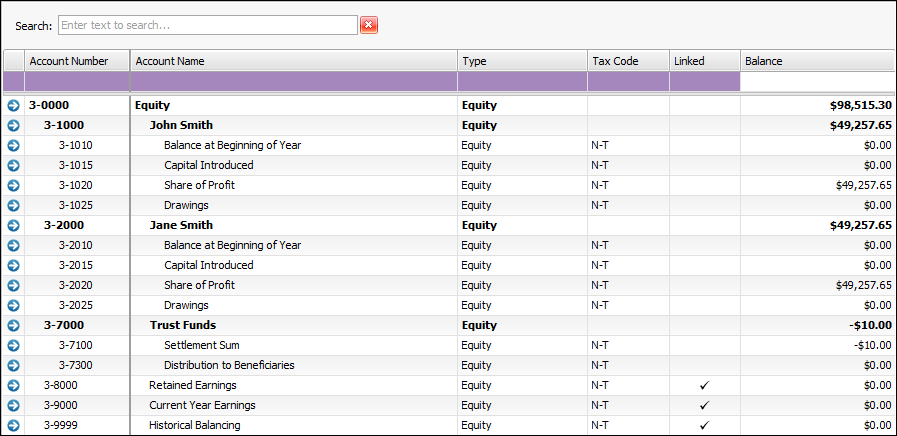

Once an account has transactions recorded against it, you may find that it's become more complicated than before to change the account code, account type or to make the account inactive. So, before you start creating and posting journals or modifying balances, we recommend reviewing your client's chart of accounts to ensure that the chart of accounts is set up correctly and is ready to produce financial reports in Statutory Reporter.

Preparing different types of data

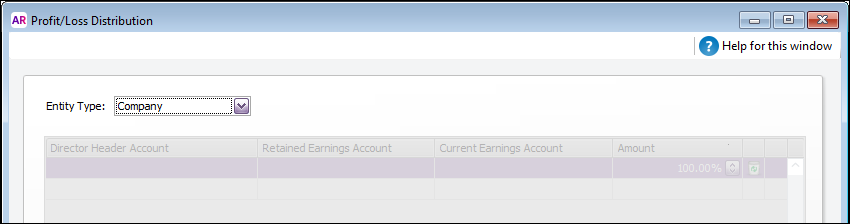

New AccountRight or Essentials files are generally set up as company entities with the Retained Earnings and Current Year Earnings accounts set up automatically. If the client is a company, you can skip to Check opening balances (AccountRight/Essentials common ledger).

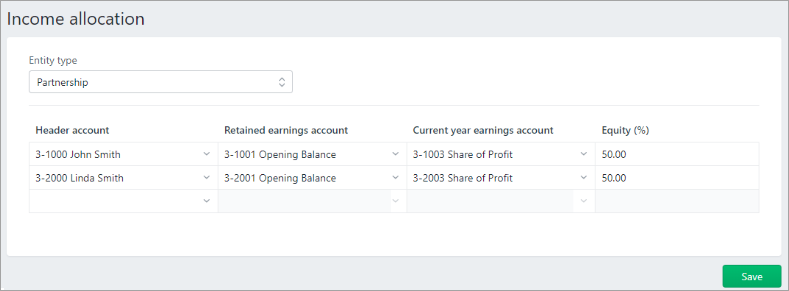

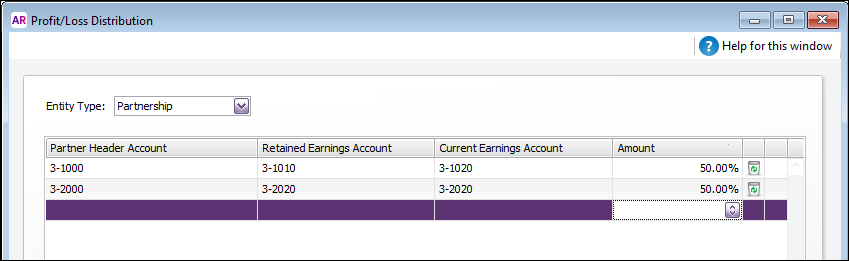

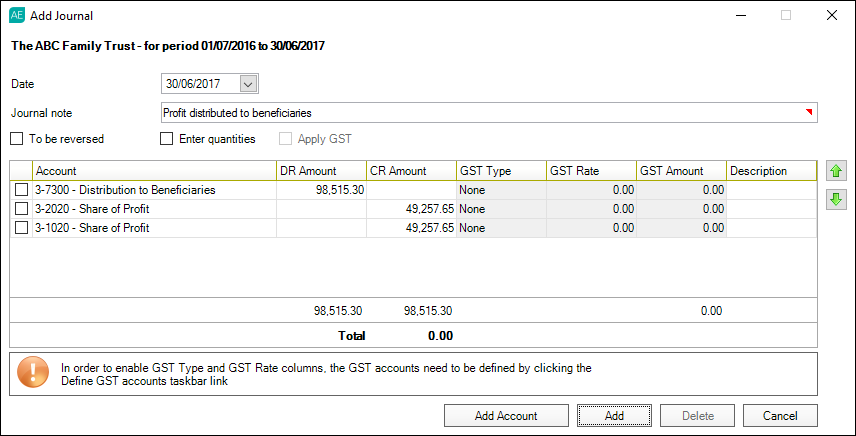

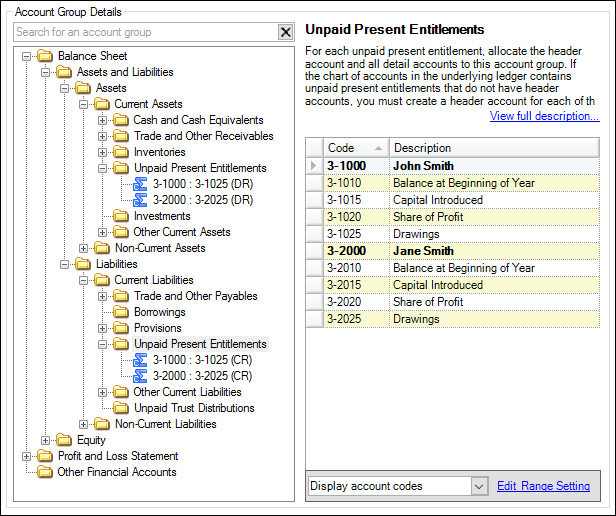

However, if you're configuring data for a Trust or Partnership that distributes earnings, there are a few things to check to make sure the Chart of Accounts can be reported correctly in Statutory Reporter. Use this guide to understand how to prepare your clients file if it is a trust or partnership.

The following examples are taken from AccountRight, but you can use the information for setting up a Partnership or Trust in MYOB Essentials.