Accountants Enterprise/Accountants Office Tax 2025.0a (Australia)

Release date—August 2025

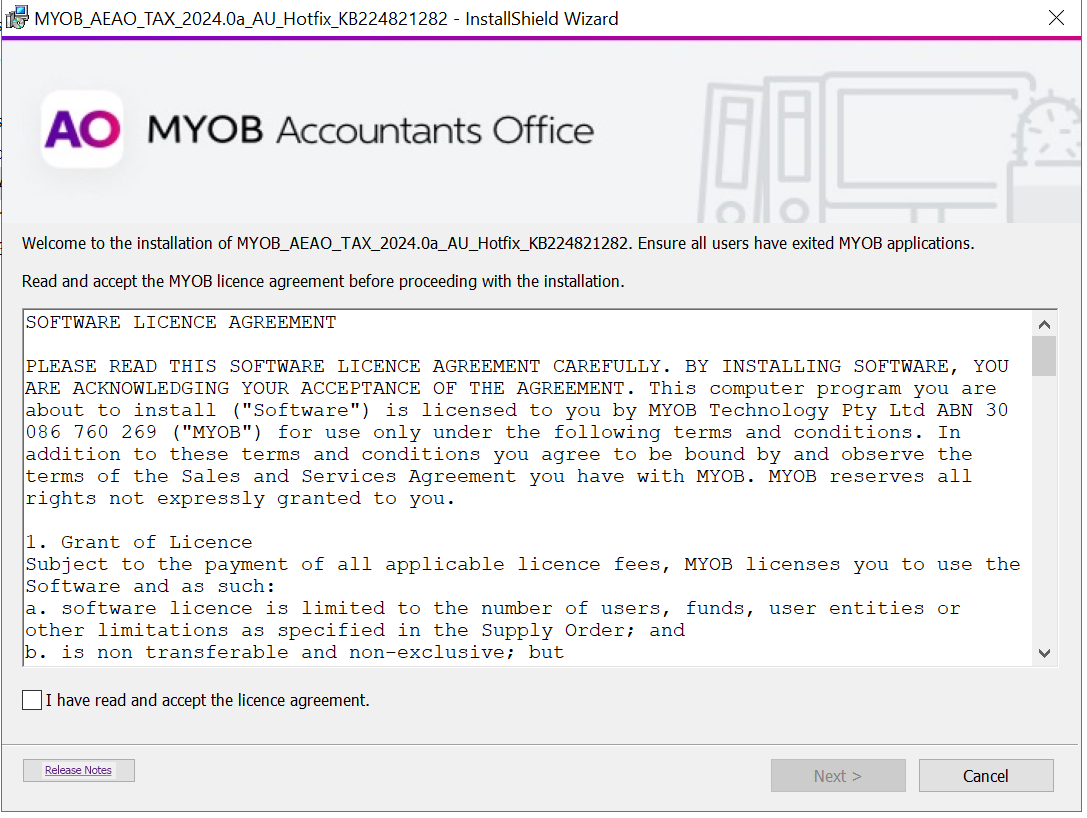

Make sure you've installed MYOB AE/AO release notes—2025.0 (Australia) before installing this hotfix. Otherwise, the installation will not continue.

Release notes

Amended returns: You’ll be able to delete schedules in an amended return, so it is now easier to make changes.

Printing

The estimate was incorrectly showing a Lump sum payment in arrears (lump sum E), even if there is no lump sum payment. This is now fixed.

The depreciation worksheet was not printing the Original cost, Private use %, and Opening values for assets with private use. This is now fixed.

Low-value fields: Missing Add. Opening Pool Balance/ Total/ @37.5%/ Decline in value/Closing Pool balance was not printing. This is now fixed

The capital gains worksheet was printing null values.

The first 3 pages in the PDF copy of the 2025 FBT return was showing 2024 instead of 2025. This is now fixed.

Estimate

Individual return estimate not calculating overseas levy HELP Debt Repayment. This is now fixed

Rates

We’ve updated the Study and training repayment threshold to 2026 rates.

Foreign exchange rates updated to 30 June 2025 quarter.

Validation error fixes

International Dealings Schedule:

We’ve updated validation errors as provided by the ATO.

Enabled Item 37 as it was incorrectly triggering VR.ATO.IDS.440825, VR.ATO.IDS.440826, and VR.ATO.IDS.440827.

Company returns

Fixed the Reportable Tax Position schedule rollover issue to avoid CMN.ATO.CTR.500005 error.