MYOB AE/AO release notes – 2025.0 (Australia)

To read about the latest release of AE/AO (November 2025), go to MYOB AE/AO release notes—5.4.56/2025.1 SP1 (Australia)

Release date – June 2025

2025 Tax webinar

Register for a free MYOB tax webinar. Learn about the ATO's 2025 tax compliance changes in MYOB AE/AO, access the 2025 tax tables and new workflows in MYOB Practice tax.

What’s new in AE/AO

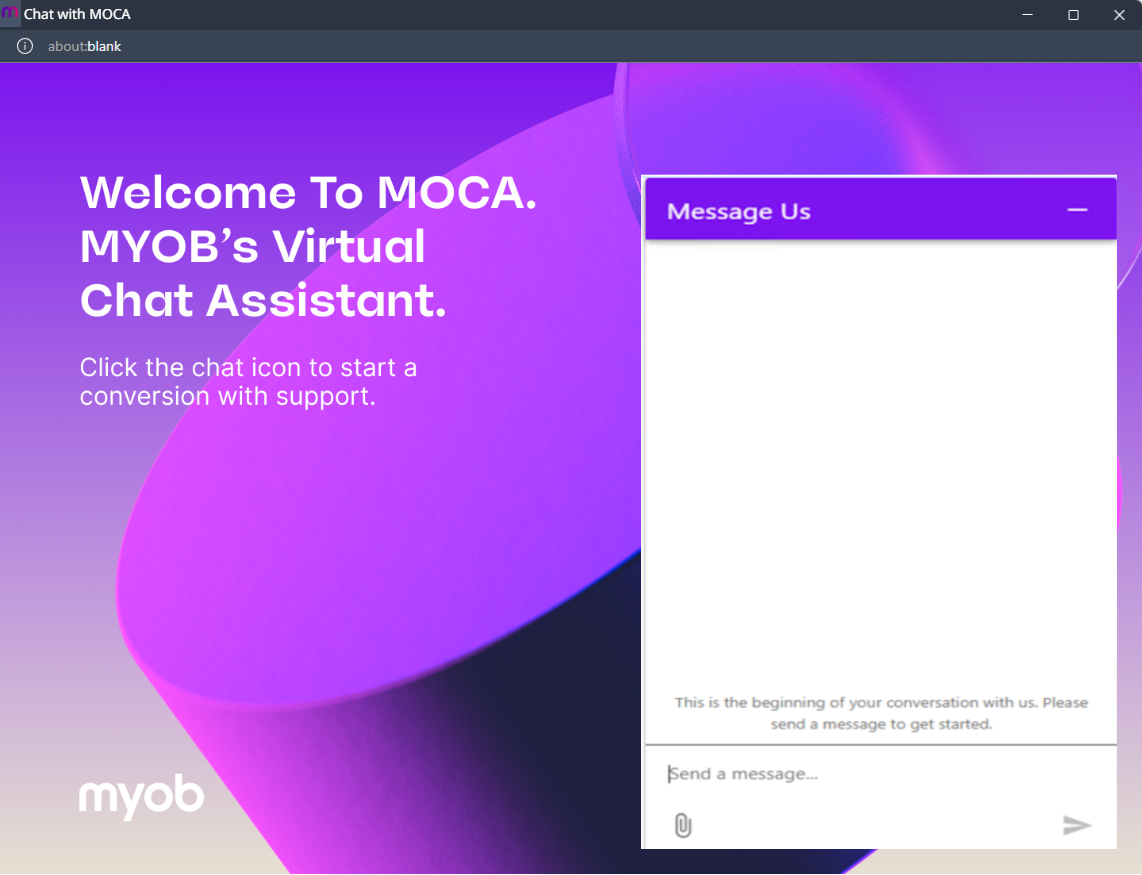

MOCA is here!

MOCA is MYOB’s virtual chat assistant.

You can access MOCA from various windows in AE/AO. This integration offers a customised experience by providing the context of the issue, including the details.

See how you can use MOCA in AE/AO and get help instantly without delay during the busy EOFY period. And if you need help with complex issues, MOCA can forward your query to our live chat team.

2025 Tax changes

Client Accounting

Assets

M-powered Services

Need help?

We're here to support you through this busy tax season.

Extended support hours

30 June 2025 to 20 July 2025

Phone support

9am to 5pm AEST (including Saturday and Sunday)

Live chat support

9am to 7 pm AEST - Monday to Friday

9am to 5pm AEST - Saturday and Sunday

Check out our community forum.