MYOB AE/AO release notes—2019.0 (Australia)

Release date—4 July 2019

This is the latest version of MYOB Practice Solutions for:

- Accountants Enterprise (AE)—MYOB AE 2019.0 (including Tax 6.47 and Tax 8.31)

- Accountants Office (AO)—MYOB AO 2019.0

Product | Version number |

|---|---|

MYOB AE/AO | 2019.0 |

| AE/AO Tax | 2019.0 (for a 2019 tax return) 2018.3 (for a 2018 tax return) |

Client Accounting | 5.4.32.108 |

Document Manager | 5.4.32.108 |

Practice Manager | 5.4.32.108 |

Tax Homepages | 7.0.11.261 |

| Stat Reporter Formats | 35 |

- Open a tax return.

- Click Help and select About.

- Check the version number is 2018.3 for a 2018 return and 2019.0 for a 2019 return.

Open MYOB AE/AO.

On the main menu, go to Maintenance > Maintenance Menu > Client Accounting > Practice Report Settings.

On the Tasks bar, click About.

Open MYOB AE/AO.

Click Help and select About.

Click Plugins.

Check the version number of individual products.

- The ATO won't start processing 2019 returns until Friday 5 July.

- Taxpayers will start receiving refunds for 2019 tax returns from Tuesday 16 July.

Check the key dates for the ATO system availability and the start of return processing.

Click to view tax changes for...

We've updated the International dealings schedule (IDS):

Changes

- Section A—Question 2 has split into 2a and 2b, and 13f changed.

- Section B—Question 19a now shows if a taxpayer's financial arrangements didn't create a debt interest.

- Section C—Questions 21(f), 22(a) and (b) are new. Question 23b changed and 29b was deleted for the current year.

Additions

- Section E—40d. This is for amounts denied under section 160ZZZL of the ITAA 1936.

- Section G—This is a new section for the implementation of the OECD hybrid mismatch rules.

- Section H—The taxpayers declaration previously in section G is now in section H.

The instant asset write-off threshold increased to $30,000 and is extended to 30 June 2020.

Small business entities

Businesses with a turnover of up to $10 million can claim a deduction for each asset purchased and first used or installed ready for use, up to the following thresholds:

| Dates | Turnover | Write off |

|---|---|---|

| 1 July 2018 to 28 January 2019 | < $10 million | $20,000 |

| 29 January to 2 April | < $10 million | $25,000 |

| 3 April to 30 June 2019 | < $10 million | $30,000 |

For small business entities with aggregate turnover of less than $10 million, assets to be instantly written off should be entered into a general small business pool.

To renew your eligibility for the instant asset write-off, you need to complete the Small Business Entity Eligibility Test Worksheet (sbe) each year.

Medium business entities

The instant asset write-off now includes businesses with a turnover from $10 million to less than $50 million. These businesses can claim a deduction of up to $30,000 for the business portion of each asset (new or second-hand), purchased and first used or installed ready for use from 7.30pm (AEDT) on 2 April 2019 until 30 June 2020.

For assets you must select the immediate write-off method. Don't use general small business pools for these entities, as the deduction for general small business pools integrates to item 10 in the company return, P10 in the individual return, item 49 in the trust return and item 48 in the partnership return.

The Deductions schedule is a new mandatory schedule where a deduction is claimed on the main individual income tax return.

You'll need to know how to complete IITR deductions. Click here to learn how!

For tax agents who need to lodge Schedule W for work expenses greater than $300, in 2019 you need to lodge a Schedule W and the Deductions schedule. Integration from motor vehicle expenses (mve) and depreciation is to the deductions schedule, and you must reenter amounts in Schedule W. Amounts at D1 to D5 integrate from the Deductions schedule and, if different to schedule W, will generate an error on validation.

The following changes apply if you pre-fill using Pre-fill Manager.

Payment summaries

Employers who use Single Touch Payroll enabled payroll solutions need to submit a finalisation declaration instead of providing a payment summary and lodging a Payment summary annual report. For those who started STP reporting this year, the due date for finalisation is 31 July.

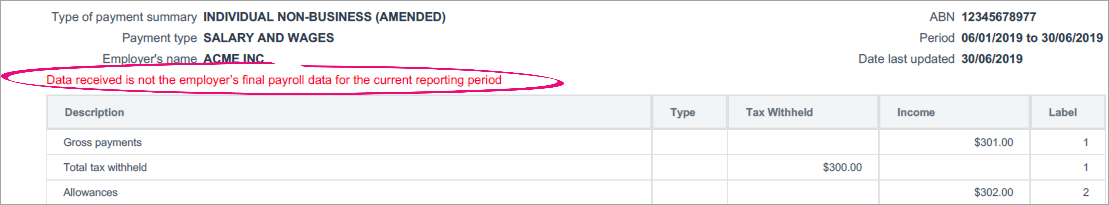

The pre-fill report may contain unfinalised income statements reported through STP. The ATO recommend you wait for this finalisation before lodging your client’s tax return. Unfinalised income statements are not pre-filled into the tax return but display on the PDF report with the warning “Data received is not the employer’s final payroll data for the current reporting period”.

If you chose to enter this information on the return, the ATO warn that your client’s employer may finalise the income statement with different amounts, and you may need to amend your client’s tax return.

Payment summaries may also display a Payment Summary Annual Report amendment code:

- XYZ PAYMENT SUMMARY (ORGINAL)

- XYZ PAYMENT SUMMARY (AMENDED)

If no status indicator is displayed, this indicates the payer has submitted their payment summaries for the payee using STP reporting.

First Home Super Saver Scheme

New fields supplied by the ATO in 2019:

- Assessable FHSS amount

- FHSS Tax Withheld amount

This data will be pre-filled into tax worksheet (oir) Other Income – Category 3 and integrates to Item 24R.

Personal superannuation contribution deductions

New fields supplied by ATO in 2019:

- Reporting party personal superannuation contribution sequence number

- Did you provide your fund (including a retirement savings account) with a notice of intent to claim a deduction for personal superannuation contributions and receive an acknowledgment from your fund? Y/N

- Full superannuation fund name

- Date of last eligible superannuation contribution

- Superannuation account number

- Superannuation fund ABN

- Superannuation TFN

- Superannuation deduction claimed

If the data finalised indicator is received, the data will be prefilled into tax return worksheet (psc) which integrates to item D12 and the Deductions schedule, and printed on the pdf report. If no data finalised indicator is received the data won't be prefilled into the tax return.

Business transactions through payment systems

This data is displayed for information only and is not prefilled into the tax return.

New fields supplied by the ATO in 2019:

- Providers name

- BTTPS Net annual payments (AUD)

- BTTPS Net annual payments (Foreign currency)

- Currency code

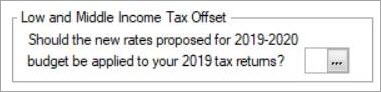

The Low and middle income tax offset (LMITO) is a new benefit of up to $530. In the 2019 federal Budget, the government proposed increasing the LMITO, providing tax relief of up to $1,080 for singles or up to $2,160 for dual-income families.

These proposed changes haven't received royal assent by the 2019 tax release.

We've added a LMITO question in the Defaults tab of the Control record properties window—Should the new rates proposed for the 2019–2020 budget be applied to your 2019 tax returns? This setting applies to an individual return when you print a tax estimate.

Here's how to use the setting if the proposed rates are passed.

To answer the LMITO question:

- In Tax, click Utilities and select Control Record. The Control record properties window opens.

- Click the Defaults tab.

- In the Low and Middle Income Tax Offset question, enter Y and click OK.

The tax estimate will indicate whether the new rate is used. If the rate isn't used, a warning is displayed on F3 validation.

- There's a new income category in item 24 of the First home super saver scheme (FHSS).

- Income tax thresholds for residents, non-residents and working holiday makers have changed. The threshold rate of 32.5% has increased from $87,000 to $90,000.

- The low income threshold for the Medicare levy has increased.

- The 2018–19 repayment thresholds have been updated and increased for HELP, TSL, SFSS, VSL, SSL and ABSTUDY SSL.

- We've removed the Interest and dividend deductions (BJ) schedule. The ATO no longer accepts this schedule in the 2019 Individual Income Tax Returns (IITR), now that the Deductions schedule is available.

D4 Self-education expenses calculating incorrectly

In MYOB Tax version 2019.0, you might notice that Item D4 Work-related Self-education expenses excludes motor vehicle repair expenses in 2019 Individual tax returns. See D4 - Self-education expenses calculating incorrectly in MYOB Tax 2019.0 for full details and the workaround.

Items D6 Low value pool deduction in the Deductions schedule

At item D6, your change won't be saved if:

you enter a value of 0 at either LVP deductions relating to rental properties or LVP deductions relating to financial investments, and

you entered 0 before entering the full amount at the corresponding field.

On F3 validation, you'll get the error "DDCTNS.000211 If any low value pool amount is provided, all must be provided".

Workaround: Enter the full amount of the low value pool deduction in the corresponding field before you enter 0 at D6.

(Auskey lodgers only) Error: "CMN.ATO.DDCTNS.00004 - Incorrect Car expenses calculation method details provided"

You'll get this error if:

you have an individual income tax return that has multiple motor-vehicle expense worksheets, and

a vehicle uses the cents-per-kilometre method and another vehicle uses the log book method.

- We've added a reportable tax position (RTP) schedule. It requires large businesses to disclose their most contestable and material tax positions, and has been extended to include companies with a turnover greater than $250 million.

- In 2018–19, base rate entities apply to companies with an aggregated turnover threshold of less than $50 million. The threshold was previously less than $25 million.

- We've increased the bank account name to allow 200 characters (SMSF only).

- We've added:

- the label Was Part A of the audit report qualified? in the SMSF auditor section

- the label Crypto-Currency in the assets and liabilities sections

- a drop-list for selecting the electronic service address at label 7C.

Member information

- Limited recourse borrowing arrangement (LRBA) balances form part of the total superannuation balance (TSB).

- An individual who sells their home to downsize can use up to $300,000 of the sale as a superannuation contribution.

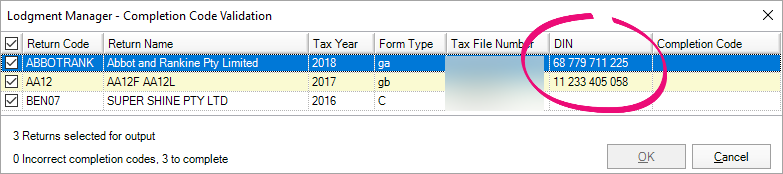

We've added a document identification number (DIN) column to the Completion Code Validation window.

The DIN helps you identify the correct activity statement to use when lodging, if your practice uses the Completion code validation required option. This is useful if you lodge multiple activity statements at the same time for one client, as each activity statement has its own completion code.

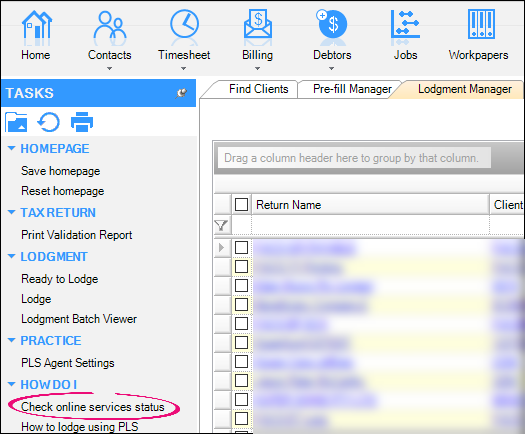

We've added links to the AE/AO Tasks bar, in the How Do I section. For example:

These links take you to some handy help and info pages. We've added:

- Check online services status to the Lodgment Manager homepage

- How to complete IITR deductions to the Tax homepage

- Agent Reports homepage to the Agent Reports homepage

Getting started with PLS activity statements on the Activity Statement Obligations homepage. This replaces the Getting started link.

We've made enhancements and corrections to the following workpapers:

- Accounting for Investments, the Mark to Market Profit/(Loss) accounts section—Credit balances are negative balances for reconciliation purposes.

- Carried Forward Losses—The Opening balance and Current year loss columns display the sum total.

- Income Tax Calculation (Detailed) - Trust—You can add the beneficiary name to the distribution table. This makes it easier to identify which beneficiary is being distributed to.

- Division 7A Loan - Unpaid Loan Balance:

- The calculation of days between payments includes the first day of the year. Previously, the final repayment was based on 364 days, which generated an incorrect value.

- The Income year in which loan was made and Current income year fields default to 0. This makes it easier to select the field using a mouse.

- Prepayments:

- We've moved the descriptions closer to the date buttons and fields. This makes it easier to see which date a description refers to.

- We've removed some unnecessary space in the date fields.

Essentials Accounting now supports quantity journals, letting you post quantity values back to the ledger.

The online ledger stores quantity values from workpaper journals when you post the journal. For example, when you want to capture sales. The values were previously stored in the local database.

You can see if there are any quantities when you view transactions in Workpapers. The View Transactions window will display a Quantity column.

Running reports for 2018 and 2019

When you run a report for:

- 2019, quantity values come from the online ledger

- 2018, quantity values come from the offline data table, as they did previously.

Requirements for quantity values to be stored online

Your system will use this functionality when you create a new period, if:

your configured ledger is an Essentials Accounting or Connected ledger.

all existing full-year periods are completed, or you're not using yearly workpaper periods.

We've added an exciting new feature—Statutory Report Designer! It lets you create new reports for your practice.

To use the designer, your client manager will need to help you get set up and organise training for you. These consulting sessions are paid services.

Contact your client manager to find out more.

We’ve updated the following in financial statements:

Partnerships

We've updated the detail in the Sale of goods note:

"Revenue is recognised when the amount of the revenue can be measured reliably, it is probable that economic benefits associated with the transaction will flow to the Partnership and specific criteria relating to the type of revenue as noted below, has been satisfied.

Revenue is measured at the fair value of the consideration received or receivable and is presented net of returns, discounts and rebates.

Revenue is recognised when the business is entitled to it."

All entities

We've updated the detail in the Accounting policy > Revenue and other income > Sale of goods note:

"Revenue is recognised on transfer of goods to the customer as this is deemed to be the point in time when risks and rewards are transferred and there is no longer any ownership or effective control over the goods.

The above paragraph applies to all entities that have a balance in the account group SALES."

Paragraphs are colour-coded to make it easy to tell if and how someone's edited them.

- Orange indicates a practice-level change.

- Blue indicates a client-level change.

- Black indicates no change.

Other changes

In practice reports, we've removed the word Accountants from footer paragraphs. We've found it's not usually needed.

No Practice Manager changes in this release.

No Document Manager changes in this release.