MYOB AE/AO release notes—2019.1 (New Zealand)

Release date—9 July 2019

This is the latest version of MYOB Practice Solutions for:

- Accountants Enterprise (AE)—MYOB AE 2019.1

- Accountants Office (AO)—MYOB AO 2019.1

Product | Version number |

|---|---|

MYOB AE/AO | 2019.1 |

| Client Accounting | 5.4.32.108 |

| Document Manager | 5.4.32.108 |

| Practice Manager | 5.4.32.108 |

| Tax Manager | 5.4.32.108 |

| Statutory Reporter Formats | 18 |

Open MYOB AE/AO.

On the main menu, go to Maintenance > Maintenance Menu > Client Accounting > Practice Report Settings.

On the Tasks bar, click About.

Open MYOB AE/AO.

Click Help and select About.

Click Plugins.

- Check the version number of individual products.

We've added a few new workpapers:

- Imputation credit account to retained earnings reconciliation—Identify tax in retained earnings. Reconcile this amount with the Producing a detailed Imputation Credit Note in Statutory Reporter (NZ) closing balance.

- Shareholder continuity—Record the minimum holding of each shareholder throughout the year. Check that the company hasn't breached allowances that rely on the holding.

- GST analysis by period—Include a detailed account of all returns for the year. You can compare this to the general ledger data. The following amounts will be carried through to the GST reconciliation workpaper:

- The GST outstanding at the balance date.

- The net difference between GST returns and the general ledger.

We've made enhancements and corrections to the following workpapers:

Wages Reconciliation—We've added shading to the General Ledger Reconciliation fields to help you see them.

- Provision for Income Tax—The dividend withholding tax paid is available as a link from the Dividends Received - Net workpaper.

- Accounting for Investments, the Mark to Market Profit/(Loss) accounts section—Credit balances are negative balances for reconciliation purposes.

- Current Account - interest on overdrawn—If the shareholder's current account is overdrawn, interest is calculated on the average balance for the month. This is calculated by subtracting the starting balance from the ending balance, and dividing by two. The interest was previously being calculated on the end-of-month balance.

- Home Office Expenses—We've added a section to calculate using the square-metre rate option.

- Entertainment - Adjustment required—In box 9, the calculation for GST adjustment is 15% of the non-deductible, rather than the non-deductible being GST inclusive.

- Entertainment - Adjustment required, and Entertainment - 50% GST claimed—We've fixed a rounding issue.

- GST Reconciliation:

- We've corrected calculation errors. The amount of GST payable was being reduced instead of increased.

- We've added an explanation to the top of the template to help with adding the GST analysis by return template.

- Prepayments:

- We've moved the descriptions closer to the date buttons and fields. This makes it easier to see which date a description refers to.

- We've removed some unnecessary space in the date fields.

- Income Tax Expense:

- You can include dividends received net of imputation credits.

- We've added a field for assessable income that's not included in accounts. For example, taxable foreign investment fund (FIF) income.

The online ledger stores quantity values from workpaper journal. The values were previously stored in the local database.

The online ledger stores the values when you post the journal. For example, when you want to capture sales.

You can see if there are any quantities when you view transactions in Workpapers. The View Transactions window will display a Quantity column.

Running reports for 2018 and 2019

When you run a report for:

- 2019, quantity values come from the online ledger

- 2018, quantity values come from the offline data table, as they did previously.

Requirements for quantity values to be stored online

Your system will use this functionality when you create a new period, if:

- your configured ledger is an Essentials Accounting or Connected ledger.

- all existing full-year periods are completed, or you're not using yearly workpaper periods.

We've added an exciting new feature—Statutory Report Designer! It lets you create new reports for your practice.

To use the designer, your client manager will need to help you get set up and organise training for you. These consulting sessions are paid services.

Contact your client manager to find out more.

We’ve updated the following in financial statements:

Partnerships

We've updated the detail in the Sale of goods note:

"Revenue is recognised when the amount of the revenue can be measured reliably, it is probable that economic benefits associated with the transaction will flow to the Partnership and specific criteria relating to the type of revenue as noted below, has been satisfied.

Revenue is measured at the fair value of the consideration received or receivable and is presented net of returns, discounts and rebates.

Revenue is recognised when the business is entitled to it."

All entities

We've updated the detail of the Accounting policy > Revenue and other income > Sale of goods note:

"Revenue is recognised on transfer of goods to the customer as this is deemed to be the point in time when risks and rewards are transferred and there is no longer any ownership or effective control over the goods.

The above paragraph applies to all entities that have a balance in the account group SALES."

Paragraphs are colour-coded to make it easy to tell if and how someone's edited them.

- Orange indicates a practice-level change.

- Blue indicates a client-level change.

- Black indicates no change.

- Farming reports—If you add a page break, it appears in the section that you selected. Previously it appeared at the top of the report.

- Practice reports—We've removed the word Accountants from footer paragraphs. We've found it's not usually needed.

- Livestock trading accounts—We've updated the label Average to Average price.

We've made more changes to Transactions data services (TDS) replacing the Tax agent web service (TAWS) for receiving Inland Revenue (IR) data.

IR generates the TDS daily files for each agency (see tip*) after every business day (Monday–Friday). These files are usually received by MYOB early the next day, and are available for you to collect via scheduled or manual download after that. We recommend setting your scheduled download time to no earlier than 3.00am.

The bulk daily files are only generated by IR once a day. If there has been no activity in any of your clients, there will be no file. TDS files also aren't generated by IR on public holidays.

IR generates a weekly file overnight on Saturdays, which should be available for downloading on Sundays. The weekly file is a summary of all the information sent through the past week. It won't contain new data.

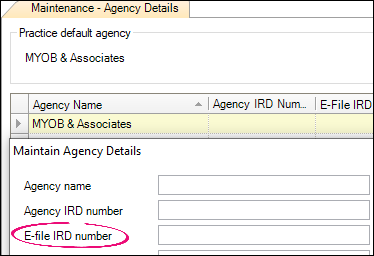

* In AE/AO, the myIR agency number is referred to as E-File IRD number, seen here when you open an agency (click to enlarge).

- The bulk refresh has an auto reconciliation process that reconciles MYOB and IR data. Previously, the auto reconciliation wasn't always run when there was an issue during the refresh. We've updated auto reconciliation to always run at the end of manual and scheduled bulk refreshes.

We've ensured that IR data from a bulk or client refresh is allocated to the appropriate entity. Consolidated companies are linked in myIR under a nominated company number, which may be different to the IR number.

Existing data may still be mismatched. If you have discrepancies, contact MYOB Support to have the data corrected.

Agencies

After linking a client list in Maintain Agencies, the E-File IRD number and Client list number fields are now unavailable. This helps ensure that no changes can be made that will stop IR data from being received. IR data will only be received if these fields contain the information used when the agency was successfully linked.

Transactions

Reversal transactions for payments and transfers are included in the Paid amounts:

- displayed on tax notices, and

- on the summary view for provisional and terminal tax payments.

Client not linked message

We've fixed an issue that was causing a message to be displayed about the client not being linked. This was happening because a TAWS student loan function for individual entities was being applied to all clients.

You might still see this message for Individual entities without a Student loan account.

Assessments

Working for families tax credit payments that you receive are now treated as an assessment. These were previously displayed in the assessments view and the IRD Data > Unreconciled view immediately. They now display in the assessments view after the income tax return has been assessed for the year.

Alerts

The balance month alert only displays when the balance month that you select is different to the month that you receive from IR. The alert was sometimes displaying when you selected the correct month.

IRD balance

We've ensured the amount displayed in the Find Tax Clients > IRD Balance column is correct.

Estimates form

We've removed the link to the IR provisional estimates form from the Tasks bar. The form's no longer available from IR. To submit an estimate for your clients, you now need to log in to myIR.

No Practice Manager changes in this release.

No Document Manager changes in this release.