MYOB AE/AO release notes—2020.0 (New Zealand)

Release date—14 April 2020

A new Solvency note is now available for companies. It will print if your liabilities exceed your assets.

To turn on the note:

- Click the Reports tab.

Select Display all reports at the bottom of the screen.

- Select Solvency note

Manually type the details of the note by either:

- going via the paragraphs option or

- running the report to screen and clicking on the note.

The paragraph for the Departure from Framework is no longer required.

By default we've unticked this in Non-Transaction data > Compilation Report > Departure from Framework. You can still change this if you want to.

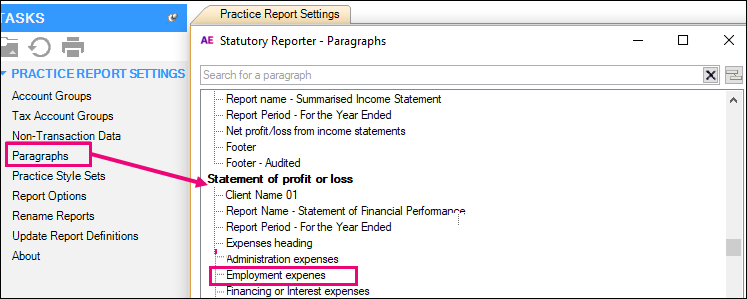

We know how annoying it is to see a spelling mistake so we've fixed this one! It now correctly refers to Employment expenses.

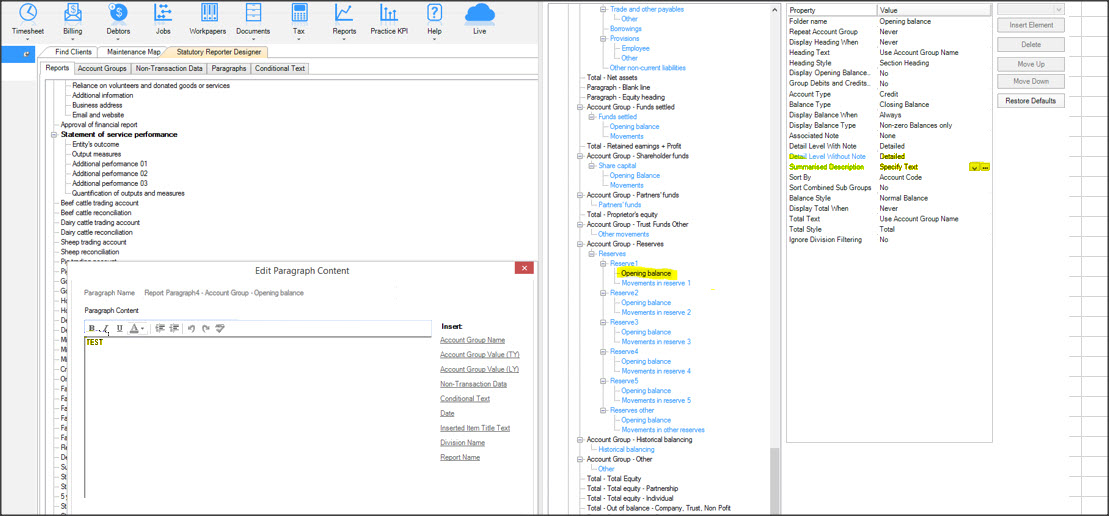

In Balance Sheet > Equity, the Specify Text content for the Opening balance for reserve 1 will now use Account Group Name instead of "TEST".

Copy your customised tax notice templates before installing this release if you want to keep them for reference purposes.

DO NOT copy them back after installing the release. This release overwrites the tax notice templates so they won't print correctly if you use your old templates.

We previously released hotfix 49545239 to update these tax notice templates.

From 1 March 2020, IR stopped accepting payment by cheque and have withdrawn the IR901DL pre-printed stationery. See we're moving on from cheques on the IR website to see other payment options.

We've updated the tax notice templates to remove the IR901DL watermark and print in plain paper format. We've also updated the payment options and included a salutation.

The provisional tax threshold has changed from $2,500 to $5,000 for the 2021 tax year onwards.

See provisional tax on the IR website for more information.

- If you accessed the 2020 tax year prior to installing this update, you may find that the top right-hand side of the Summary view still shows 2021 provisional tax due, when the RIT is now below the threshold.

- This is a display issue on the Summary view only. This will be correct when you make future changes to the provisional tax basis or amount such as when you file the 2020 return.

- To correct this issue for a client now:

- access the 2020 provisional tax calculator

- change the radio button to a different method

- click save

- then change back to the standard method.

You won't receive any IRD data via a client or bulk refresh until you install this release. After installing, you will receive any uncollected IRD data including the new student loan data.

- From April 2020, student loan transaction data will come via the transaction data service (TDS) instead of the tax agent web service (TAWS).

When this happens, Tax Manager will no longer use TAWS for a:- scheduled bulk refresh

- manual bulk refresh

- client refresh.

- If a client didn't have a student loan, there was no TAWS data so you would see the message 'Client not linked'. Now that data isn't coming from TAWS, we've removed any status received from TAWS.

- Now that data for student loan transactions is coming via the TDS, you may notice the following:

- long term loan transactions won't display. You'll no longer see transactions such as a repayment deduction and the related credited to loan transaction.

- transfers in or out of the student loan account will now be automatically inserted during the reconciliation process if they don't already exist

- a few transactions already reconciled for a student loan may need reconciling again, such as the small balance offset

- some entries are reclassified so this may result in extra entries to reconcile. An example is the capitalisation credit, which was previously a cancelled repayment obligation

- you may receive some prior year student loan data for years that you previously didn't have.

- Use of money interest (UOMI) rates that came into effective on 29 August 2019:

- UOMI payable 8.35%

UOMI receivable 0.81%.

These rates were previously made available via KB #37275.

- The 2022 tax year is available from 1 October 2020. This will give you access to the 2023 provisional tax calculator. We've added rates for the 2022 tax year so you can calculate the correct rates and uplifts.

- New fields added to the Summary view to:

- record losses carried forward for rental and R&D tax credits

identify these credits as confirmed.

As with other loss options, the amount fields are automatically updated from the tax return but you can manually update them if required.

Improvements made to the handling of assessments for clients on the accounting income method (AIM).

- Some sites use a proxy, so we've included a proxy.config file as part of the install. This file is only installed if it doesn't already exist. We're not changing any existing config files.

- We've fixed:

- where provisional tax assessments received via TDS were not showing in the provisional tax grid on the summary view

- an issue with weekly or fortnightly working for families payments. This is where you received an alert and the account status showed a variance before receiving a final assessment

- where the UOMI calculation was incorrect for the next date range after the UOMI rate change

- where you receive a nil value evaluation late penalty transaction, it will no longer show for reconciliation.

There aren't any Document Manager changes in this release.

Product | Version number |

|---|---|

MYOB AE/AO | 2020.0 |

| Client Accounting | 5.4.34.73 |

| Document Manager | 5.4.34.73 |

| Practice Manager | 5.4.34.73 |

| Tax Manager | 5.4.34.73 |

| Statutory Reporter Formats | 21 |

Open MYOB AE/AO.

On the main menu, go to Maintenance > Maintenance Menu > Client Accounting > Practice Report Settings.

On the Tasks bar, click About.

- Report Definition Version should be 21.

Open MYOB AE/AO.

Click Help and select About.

Click Plugins to access the version number of individual products.