MYOB AE/AO release notes—2023.0 (Australia)

Release date—27 June 2023

This is the latest version of MYOB Practice Solutions for:

Accountants Enterprise (AE)—MYOB AE 2023.0 (including Tax 6.51 and Tax 8.35)

Accountants Office (AO)—MYOB AO 2023.0.

Free tax seminar

Learn all about the ATO's 2023 tax compliance changes, access the 2023 tax tables, and new workflows in MYOB Practice tax. Register for a free MYOB tax seminar.

What’s new in 2023

Tax

CPI rates: Updated to 132.6 for the quarter ending March 2023.

Government super co-contributions: The income thresholds are updated to the 2023 rates.

Super co-contributions: The co-contribution income threshold is updated to 2023-24 rates.

Foreign currency exchange rates: Updated for the calendar year ending December 2022.

Medicare levy reduction for low-income earners: Updated to 2023 rates.

Study and training loan repayment thresholds and rates: Updated to 2022-2023.

Dependant offset: The ATI threshold is updated to 2022-23 income.

The Motor Vehicles and Fuel efficient Motor Vehicles Depreciable Car Limit (DCL) is updated to $64,741.

We've removed the low and middle income tax offset.

The Non-resident foreign income occupation codes, descriptions,median rates, and calculations are updated to match the ATO's lists.

The occupation codes are updated for individual tax returns.

The ATO has notified us about the following rejection codes that may occur when selecting some occupation codes. While they're working on a fix if you see a rejection based on a occupation code, contact the ATO.

- CMN.ATO.GEN.XBRL03

- CMN.ATO.GEN.XBRL04

Work related self education expenses worksheet (sed): The ATO has removed the exclusion of the first $250 of deductions for prescribed courses of education. See Removing the self-education expenses threshold for more information.

In the sed worksheet, we've removed the Ancillary expenses not deductible section.Item C1 Credit for interest on early payments - amount of interest has been removed from the Adj/Credits tab.

We've removed the following private health insurer codes

ESH - Emergency Services Health

HEA - health.com.au Pty Ltd

NMW - Nurses & Midwives Health Pty Ltd

The Early Payment of Interest (EPI) worksheet is removed.

Interest worksheet: We've added a new Interest Adjustment Reason field - Foreign resident

Label M R&D Recoupment tax is removed from the Calculation statement.

Item H1 Credit for interest on early payments - amount of interest has been removed from the Calculation tab.

The Loss Carry Back tax offset worksheets (lcb and lcc) have been expanded by one year to allow eligible corporate tax entities to claim a loss carry back tax offset in the 2022-23 income year to an earlier profitable year as far back as 2018-19.

The 2022-23 tax year has been included in Loss Carry Back Change in Choice (cic) schedule to allow eligible corporate tax entities to amend loss carry back tax offset claims.

New label on the Front cover - CCIV sub-fund trusts : Do you own shares that are referable to a sub-fund within the same CCIV as you? Yes or No.

Item 7 Credit for interest on tax paid has been removed.

(Fund) Item 12 label H1 Credit for interest on early payments - amount of interest has been removed.

(SMSF) Item 13 Label H1 Credit for interest on early payments – amount of interest has been removed

(SMSF) The country name is removed from the current postal address and SMSF Auditor postal address.

You'll see an error Tax rate must be 25% (for a base rate entity) or 30% if Label R in PART E - R&D tax offset calculation field is blank or if the rate is not 25% or 30%.

The fields Item 8 - R&D assets - Balancing adjustment losses (Australian owned R&D and Foreign owned (R&D) at Part A Calculation of notification R&D deductions are removed.

Item Do you have an aggregated turnover of $20 million or greater is changed to be a mandatory field.

Activity statements: V1513A and V1513B were appearing incorrectly on activity statements due to a rounding issue. This is now fixed.

Scheduled backups were failing after the default SQL password for sa username is changed using the utility. This is now fixed.

You may notice the Tax homepages might be slower to load when there are a number of POI record entries for your clients. This is now fixed.

Validation errors

CTR.500354 Field incorrect format: This issue was happening when the value from Item 13Z from the LCB component worksheet was in the incorrect format.

IITR.730308 : The Work related uniform, occupation-specific or protective clothing, laundry, and dry cleaning expenses amount must equal the sum of all work-related clothing expenses amounts in the attached Deductions schedule.

Printing

When printing the Loss carry back worksheet, the company tax rate was incorrectly printed as rounded 28% instead of 27.5. This is now fixed.

2023 lodgment

You can start lodging 2023 tax returns from 21 June 2023.

If you haven't changed the default password set by MYOB for sa username in SQL, you'll be prompted to change the password. Previously, this prompt was shown when installing the 5.4.46 release

Changing the password can be done during the installation of this release or you can run the utility manually later.

For more information, see Changing the default password for 'sa' username in SQL

Client Accounting

We've updated the following workpapers to include the 2023 interest rates:

Division 7A loan summary

Division 7A loan summary - 10 years

Division 7A loan summary - 25 years

We’ve deleted a number of master level paragraphs. If you made any changes to the paragraphs at the practice or client level, you'll see the upgrade wizard. Make sure to run through the wizard.

Practice level upgrade wizard

We’ve deleted a number of master level paragraphs. If you made any changes to the paragraphs at practice level, then you'll see the upgrade wizard. This identifies any previously made changes to the deleted paragraphs.

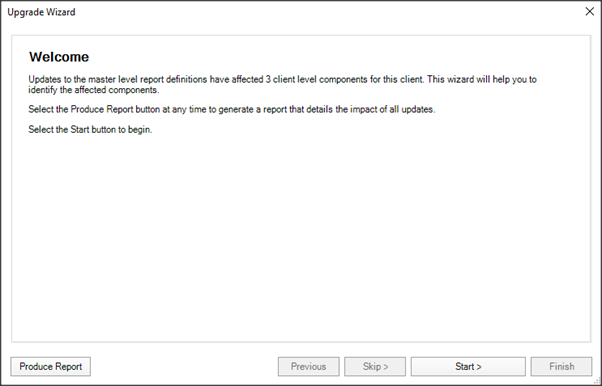

Upgrade wizard

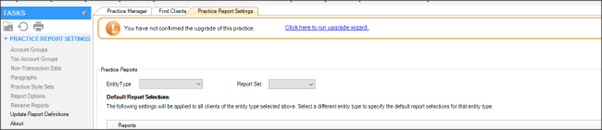

Go to Maintenance > Client Accounting > Practice Report Setting.

In the Practice Report settings tab, if you have paragraphs at Practice level that have been amended, the changes will need to be re-applied.

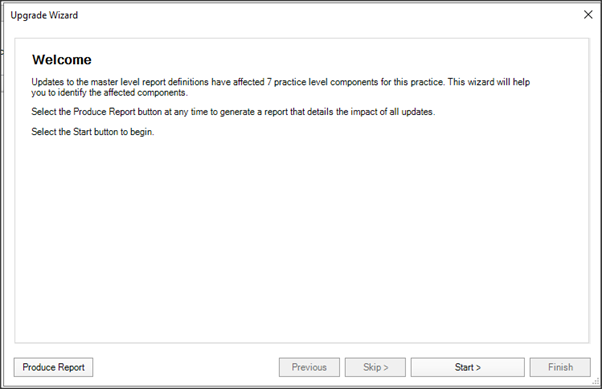

Select Click here to run upgrade wizard. The upgrade will identify the number of practice level components that will be affected by this upgrade.

You will be able to get details of the paragraphs that have been impacted as you go through this upgrade process.

Select Start to upgrade.

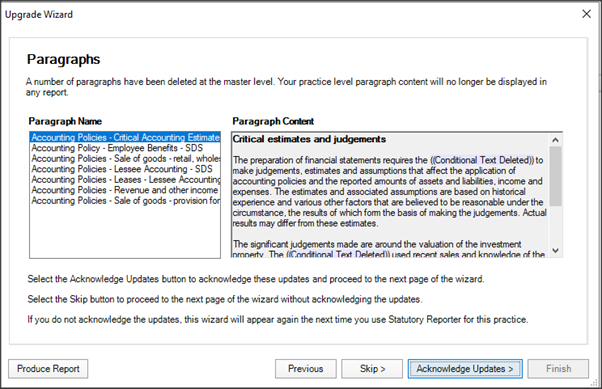

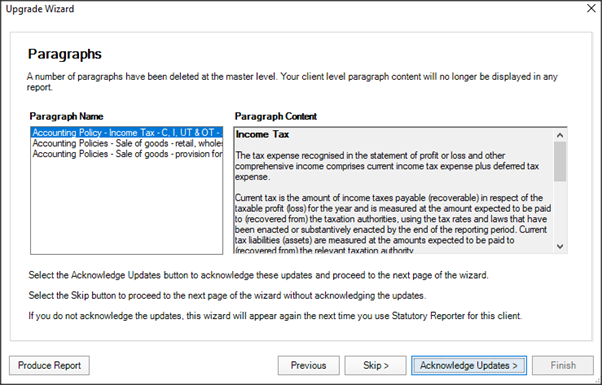

You will see a screen that will display any paragraphs that have been changed at practice level that will be affected by this upgrade.

Click Produce Report to print or save the report so you can refer to it if required.

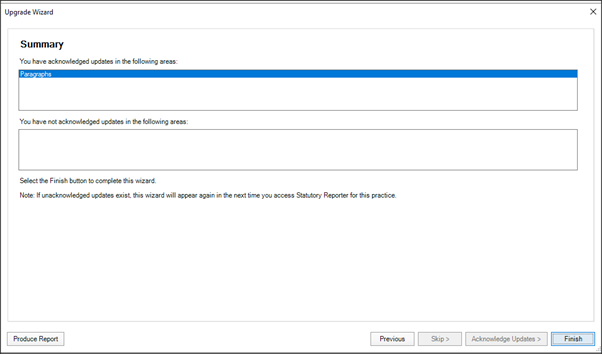

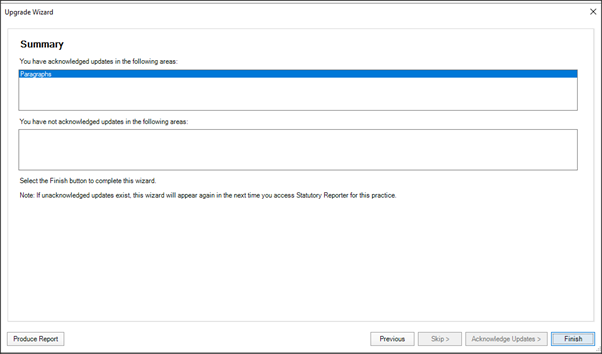

Select Acknowledge Updates to continue. You'll see a summary of the changes.

Select Finish to complete the update.

Client level upgrade wizard

We’ve deleted a number of master level paragraphs. If you made any changes to the paragraphs at client level, then you'll see the upgrade wizard. This identifies any previously made changes to the deleted paragraphs.

Upgrade wizard

When you access each client’s reports in Client Accounting > Reports (statutory reporter), the upgrade will identify any paragraphs that have been amended at the client level which will require your attention.

You can get details of the paragraphs that have been impacted as you go through this upgrade process

When you access each client’s reports in Client Accounting > Reports (statutory reporter), if you have paragraphs at client level that have been amended, the changes will need to be re-applied.

Select Click here to run upgrade wizard.

Select Start to upgrade

You will see a screen that will display any paragraphs that have been changed at client level that will be affected by this upgrade.

Click Produce Report to print or save the report so you can refer to it if required.

Select Acknowledge Updates to continue. You'll see a summary of the changes.

Select Finish to complete the update.

Account Group Folder Structure

We've changed the name from Fair Value Adjustments to Movements under the account Group folder Balance sheet > Assets and liabilities > Assets > Non-current assets > Investment properties.

Accounting Policy Notes

For the entity type individual, We've removed the wording ‘meet the needs of the stakeholders and to’ from the Introduction text - Individual paragraph.

Corrected spelling in Accounting policy - property, plant and equipment - Depreciation paragraph.

Accounting policy Revenue and other income - retail, wholesale and training - SDS. Although this policy is for Simplified Disclosures only, it was also printed for Special Purposes. This is now fixed.

Notes to the financial statements

For a Partnership entity type, we've added a new note for Statutory Information - Registered office and will print as the last note in the Notes to the Financial Statements. The statutory information is picked up from the Business Address information in the Client Details tab of Non-transactional data.

We've widened the column for depreciation in the Property, plant and equipment movements in carrying amounts note.

A new paragraph is created for individuals and partnerships

Introduction text - comparative paragraph and removed from Introduction text - individual paragraph - Individual/Partnership.

Principal Activities. This pulls information from the Principal activities tab in Non-transactional data.

Detailed Profit and Loss

For an Individual entity, we've created a Detailed Profit and Loss to print in addition to the Income Statement.

Balance Sheet

The account group folders for property, plant and equipment were not displaying correctly. This has now been corrected.

Compilation Report

For an Individual entity, we've included the wording and the additional information contained in the detailed profit and loss in the opening paragraph of the Compilation Report.

If you choose to deselect the Profit and Loss statement, then you will need to remove the above wording from the Compilation Report.We've updated the wording in the Compilation Report - Body - OT & UT paragraph for the entity types Unit Trust and Other Trust.

Directors' Report

If there is no audit, the Independence paragraph will no longer print.

Committee Report

We've removed the heading Significant changes.

We've added the following paragraphs:

Significant changes in state of affairs

Events after the reporting date

Environmental issues

Indemnification and insurance of officers and auditors

Auditor's independence declaration

If there is no audit, the Independence paragraph will no longer print, along with the audit report.

Declaration

We've updated the word determine to declare in the opening paragraph of the Declaration report.

Simplified Disclosures

We've created a new paragraph for Accounting policies - employee benefits - paragraph 3 - SDS for Defined contribution schemes.

Trust Minutes

We've added a new minute for No income distribution. This will print if all of the following conditions are true:

Profit and loss statement > Appropriation > Distributions - is zero balance - this year

Non-transaction data > Beneficiaries > Net Income Distributed = zero - this year

Non-transaction data > Beneficiaries > Income Distribution Percentage = zero - this year

Non-transaction data > Beneficiaries > Capital gains = zero - this year

Non-transaction data > Beneficiaries > Interest = zero - this year

Non-transaction data > Beneficiaries > Investments = zero - this year

Accounting policies paragraphs splitting

We've split the existing paragraphs into smaller paragraphs since the text was not included when exporting to Word.

If you made any changes to any deleted paragraph, you need to reapply the changes to the new paragraphs. You will now be able to deselect any of the new reports, if not applicable.

Original report | New report | New split paragraphs |

|---|

Original report | New report | New split paragraphs |

|---|---|---|

Accounting policy = Accounting policy - revenue and other income - retail, wholesale, training – SDS For entities (SDS) - Company, Trust, Partnership, Individual, Association. | Accounting policy - revenue and other income - retail - SDS. |

|

| Accounting policy - revenue and other income - wholesale - SDS |

|

| Accounting policies - sale of goods - provision for training services - SDS |

We've deleted the original paragraph = Accounting Policies - Sale of goods - retail, wholesale - SDS |

Accounting policy = Revenue and other income – training services For entity – Associations |

We've deleted the original paragraph = Accounting policy - revenue and other income - training services | |

Accounting Policies - Revenue and other income - contract cost assets For entities (simplified disclosures) - Company, Trust, Partnership, Individual, Association |

| |

Accounting Policies - Revenue and other income - contract cost assets For entity (special purpose) - Association |

| |

Accounting policy = Employee benefits For entities (special purpose) - Company, Partnership, Individual, Trust |

| |

Accounting policy = Employee benefits For entities (simplified disclosures) - Company, Partnership, Individual, Trust, Association |

We've deleted the original paragraph = Accounting policy - Employee Benefits - SDS | |

Accounting policy = Employee benefits For entity - Association |

We've deleted the original paragraph = Accounting Policies - Employee benefits - A | |

Accounting policy = Critical estimates and judgements For entity – Superfund |

We've deleted the original paragraph = Accounting Policies - Critical Accounting Estimates and Judgments | |

Accounting policy - Lessee accounting For entities (simplified disclosures) - Company, Trust, Partnership, Individual, Association | Accounting Policies - Lessee Accounting – SDS |

We've deleted the original paragraph = Accounting Policies - Lessee Accounting - SDS |

Accounting policy - Lessor Accounting - SDS For entities (simplified disclosures) - Company, Trust, Partnership, Individual, Association | Accounting Policies - Lessor Accounting - SDS |

We've deleted the original paragraph = Accounting Policies - Lessor Accounting - SDS |

Accounting policy - Lessee accounting - Associations | Accounting Policies - Leases - Lessee Accounting – Associations |

We've deleted the original paragraph = Accounting Policies - Leases - Lessee Accounting - Associations |

Accounting policy - Income tax - C, I, UT & OT SDS For entities (simplified disclosures) - Company, Trust, Individual | Accounting Policy - Income Tax - C, I, UT & OT – SDS |

We've deleted the original paragraph = Accounting Policy - Income Tax - C, I, UT & OT - SDS |

Accounting policies - Income tax - SMSF For entity – SMSF | Accounting Policies - Income Tax – SMSF |

W've deleted the original paragraph = Accounting Policies - Income Tax - SMSF |

Accounting Policies - Measurement of Investments For entity – SMSF | Accounting Policies - Measure of Investments |

We've deleted the original paragraph = Accounting Policies - Measure of Investments |

Accounting policy = Financial Instruments For entities – Company, Partnership, Individual, Trust, Association |

|

We've deleted the original paragraphs

|

Error: Object reference not set to an instance of an object when rolling over a workpaper from 2022 to 2023.

Need help?

We're here to support you through this busy tax season. If you need help:

Call our support team on 1300 555 117, option 3.

We've extended support hours from 26 June - 14 July 2023.

Monday to Friday: 8.00 am – 7.00 pm AEST

Weekend support (1 July and 2 July): 9:00 am - 5:00 pm AEST.

Submit a support request via my.myob.

Check out our community forum.