MYOB AE/AO release notes—5.4.42 (New Zealand)

Release date—28 March 2022

Reports and templates have been updated to be in line with current practice. We've also made changes based on customer feedback.

Directors Interests and Remuneration workpaper

We've added a new workpaper to record items that need to be included in the Register of Directors’ Interests and Remuneration register.

New Report - Certificate of Fair Value

The Certificate of fair value will print as part of the Report Set = Minutes.

This will display when Non-transaction Data > Directors > Remuneration - has non-zero balance.

You can access 2 blank paragraphs from Paragraphs > Certificate of fair value:

- Additional fair value paragraph 01

- Additional fair value paragraph 02.

Minutes

Resolution of directors

- Given that the directors must approve shareholders remuneration and directors' remuneration, we've added the following minute paragraphs (as copied from the Minutes of the annual general meeting), to the Resolution of Directors.

1. Shareholder remuneration: This will print when there is a balance in account group Profit or loss statement > Expenses > Trust distributions or shareholders salary

2. Director remuneration: This will print when there is a balance in Non-transaction data > Directors > Remuneration.

The above paragraph minutes will now print in both AGM Minutes and Resolution of Directors.

If you don't want any of the paragraphs to print, including the AGM Minutes and Resolution of Directors paragraphs, de-select the paragraphs before previewing the reports.

- The heading for the 2 paragraphs - Loans to directors and shareholders and 'Advances from directors to shareholders' was incorrect. This is now fixed

New minute for Lack of Independence

Trust entities only

- There is a new minute paragraph for Lack of Independence.

This paragraph will display when Non-transaction > Compilation report > Independence = Yes

You can change the default wording in this paragraph. You'll need to click into the paragraph and type in the Trustee's name in [Click here to type the trustees name].

- There is a new minute paragraph for Lack of Independence.

Minutes of Annual General Meeting

- We've changed the Disclosures in the financial reports heading to Special purpose financial statements.

Changes to Accounting Policy intro paragraph

- New Non Transaction Data option for Special Purpose Financial Reporting Framework for use by For-Profit Entities (SPFR for FPEs)

- In the Non-transaction Data field > Accounting policy - special purpose framework > Use SPFR for FPEs = Yes/No (default = Yes)

If Use SPFR for FPEs = Yes:

The wording in the introduction to the accounting policies will show:

These financial statements have been prepared in accordance with A Special Purpose Financial Reporting Framework for use by For-Profit Entities (SPFR for FPEs) published by Chartered Accountants Australia and New Zealand.When Use SPFR for FPEs = No

The wording in the introduction to the accounting policies will show:

These are special purpose financial statements and have been specifically prepared for the purposes of meeting the company's income tax requirements and for internal management purposes.

Changes to Statement of Profit or loss

- Farming - Display cash profit from livestock

The Cash profit - (livestock name) will display on the Farm Trading Account.

In the Statement of Profit or Loss, you'll see the:

- Net profit from farm trading

- Increase (decrease) in livestock values after the Net profit before depreciation.

- Gross profit %

Currently, the Gross Profit % prints when the cost of sales is active in the Profit or Loss Statement and the Departmental Income Statements. You can turn off the option to show the Gross Profit %.

Go to Non-transaction data > Profit or loss statement/Show gross profit %. > Select No in the value field.

- Tax codes and Tax amounts: Allow journals with GST to be posted correctly to New Essentials/MYOB Business/AccountRight Live. Learn more.

- Balance Forward Accounts: When you configure a New Essentials/MYOB Business ledger, make sure you import the MAS, AOGL, or Accounts chart of accounts into the New Essentials/MYOB Business ledger. We'll then configure the default balance forward accounts automatically.

- Set Lock date: When using an online ledger such as, MYOB Essentials, or MYOB Business, you'll be able to set the lock date in Client accounting by selecting Set Lock Date from the Tasks > Ledger on the right side.

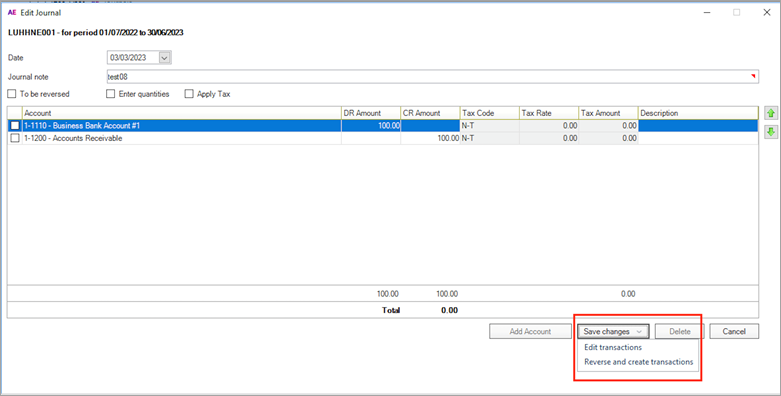

- Editing a posted journal: In the Edit Journal window, you'll be able to edit the original journal without having to reverse it. These changes will write back to the underlying ledger.

There will now be 2 options if you need to make a change:

- Edit transactions

Reverse the original journal and create a new transaction.

If you're on version 5.4.40, you might see New Relic installed that is used for tracking system performance. This is to monitor the time and performance of the client accounting module when performing certain tasks.

If you prefer not to have New Relic on your workstations, you can uninstall it. Follow the steps below:

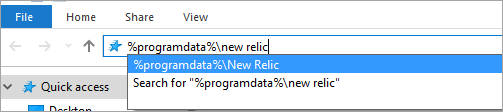

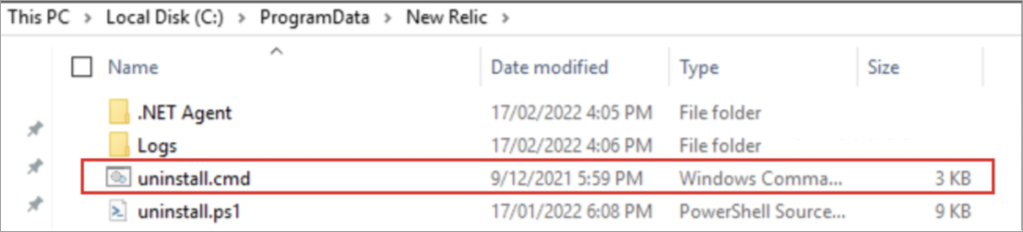

- Open Windows Explorer on the machine you want to uninstall New Relic from.

- On the Address bar, type %programdata%\new relic.

- Right-click uninstall.cmd and run it as administrator.

If you've contacted support to disable New Relic, it will stay disabled even after installing a new version of AE/AO

- Quantities posted from Client Accounting Workpaper not appearing on reports: When entering quantities (entered manually or from Livestock journal) from client accounting disappears after posting, and they do not appear on the trial balance or reports. This happens for both AccountRight and Essentials files. This is now fixed.

- For a Trust client, when opening a To do task that has a workpaper attached, nothing happens. This is now fixed.

- We've fixed the error sorry we failed to post the journal, platform responded with an unexpected result when posting journals with tax GST code.

- For a Trust client, when opening a To do task that has a workpaper attached, nothing happens. This is now fixed.

In AE MAS chart of accounts, in Master Level Designer, for Essentials (pre March 2020), MYOB Business/AccountRight/Essentials (new) and Industry type' = All - Accountants Chart (AE MAS), the following code ranges were incorrect:

Profit or loss statement > Farming > Livestock > Goats.

The codes were incorrectly using the code ranges 140 - 14699. The account codes are now changed to the correct code ranges 150 - 15699.Profit or loss statement > Farming > Livestock > Deer.

The codes were incorrectly using the code ranges 150 - 15699. The account codes are now changed to the correct code ranges 140 - 14699.

Statutory reporter and workpaper fixes

- The expenses are shown twice in the Farm Trading Report when expense categories are used. This is now fixed.

- In the Accounting Policies, the Note 1 - Company - Special purpose - Authorisation date paragraph will not print if, Non-transaction Data > Accounting policy - special purpose intro - authorisation date = BLANK.

Under the Reports tab, the format Farm produce other 4, the Total - Net profit (loss) was not including the Direct costs in the total. This is now fixed.

Income Tax Expense: The line Imputation credits utilised this year (if dividend income shown net of ICs) will now always show as zero if the value of Imputation credits on dividend income (if dividend income shown net of ICs) located at top of workpaper is zero.

Mixed-Use Asset Calculation – Days: The Income earning days / (Income earning days + counted days) calculation will now show as a percentage with 2 decimal places. This will give a more accurate calculation for percentage of expenses that can be claimed

- In the previous release version 5.4.41, there was a display issue when migrating custom account groups. The progress bar was always showing a total of 25 accounts updated even when more account groups were migrated. This is now fixed.

Need help?

- Call our support team on 0800 94 96 98

- Submit a support request via my.myob.