MYOB AE/AO release notes—5.4.48/2023.1 (Australia)

Release date—11 September 2023

Client Accounting

Statutory Reporter

- We've increased the number of member statements from 4 to 12 for the Superfund entity type.

- Specified text feature:

You now have the ability to use the Specified text feature to edit heading descriptions, sub-total and total descriptions, and descriptions that are currently blank for sub-totals and totals, and on the summarised line items.- This feature is available for the following reports and will be available for more reports in the future:

Statement of profit or loss and other comprehensive income

Income statements

Appropriation statement

Operating statement

Balance sheet

Statement of financial position

Statement in changes in equity

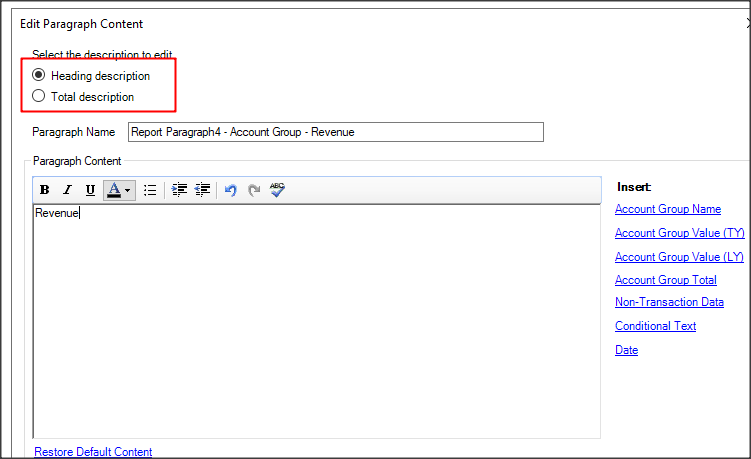

When editing a heading or total description, you may see the following window. You have the option to change the heading and/or a total within the same property. If you're changing the description of a total, make sure to select the Total description as it always defaults to the Heading description.

You can't change the descriptions for the following scenarios. When printing

the details of an account range (e.g., printing all items in the Expenses folder).

- the details by header account. This setting is managed by the Account Type Group through Manage Accounts.

- This feature is available for the following reports and will be available for more reports in the future:

Account Policy Notes

For the entity type Superfund, the Critical accounting estimates and judgments accounting policy will now always print

Notes to the financial statements

We've moved the heading Movements in the Investment Property Note and it will now print under Balance at beginning year.

We've made the spacing wider for columns in the Movements in carrying amounts in the Investment Property Note.

- We've corrected

the note number alignment for the Liability for accrued benefits note for the Superfund entity type.

the incorrect referencing to the trustee(s) in the notes and the Independent Audit Report - SDS when running the financial statements for Simplified Disclosures for the Association entity type.

Trustee's declaration

The signatures at the bottom of the declaration are now aligned.

Committee's report

No significant change in the nature of these activities occurred during the year will now only print if the NTD has been completed for Principal activities.

The committee report will now be printed before the Auditor's Independence report.

Compilation Report

The condition on the compilation report has been updated so it will now only print if the Auditor’s name has not been filled out in Non-transaction data > Auditor's details > Auditor's name

Auditor’s Independence Declaration

The condition has been updated so the Declaration will now only print if you have entered the Auditor name under - Non-transaction data > Auditor's details > Auditor's name.

Tax

- CPI rates: CPI rates are updated for the period ending 30 June 2023.

- Interest schedule: When the interest income is prefilled subsequently, any Interest Certainty indicator reason and description from the first prefill were not cleared. This is now fixed.

- (2021, 2022, 2023) Tax estimate: The HELP debt repayment estimate was incorrect when there is a Medicare family low-income reduction.

- FBT 2024 was accessible incorrectly from the 2023 tax return. This is now blocked so you can no longer create a 2024 FBT return.

- Digital games tax offset: In the Refundable tax offset (rto) worksheet, we've created a new Other refundable tax offset field to claim the tax offset. See the ATO website for more info on Digital games tax offset.

- Printing: Item 7J and Item 7L were not included when printing the Electronic Lodgment Declaration (ELD). This is now fixed.

- (2022 and 2023) CMN.ATO.IITR.730359 Foreign income tax offset amount is incorrect: We've added an F3 validation if the FITO amount at Item 20 O exceeds the sum of all of the foreign tax paid amounts provided in the attached Income Details schedule.

- IITR.730234/ IITR.730240: We've added an F3 validation error if there is a Business Income Statements & Payment Summaries (bip) schedule with zero amounts and incorrectly rolled over.

- (2022) CMN.ATO.IITR.730088: We've fixed the integration of the foreign income worksheets (for), and Foreign Employment Income Non-Payment (fem) worksheet into the main return.

- CMN.ATO.IITR.211016: We've fixed the Go to link and it will now go to the spouse details so the required details can be completed.

- (2022 and 2023) CMN.ATO.SMSFAR.437136: We've added an F3 validation error if Credit for tax withheld - foreign resident withholding is greater than zero

- INCDTLS.000416: This error happens when there is no code present in the interest worksheet. This is now fixed.

- INCDTLS.000120: This error happens when Lump Sum in Arrears codes are incorrectly rolled over. This is now fixed.

- (2021 and 2022) V23: This error happened in an activity statement due to a rounding issue at the PAYG instalment calculation. This is now fixed.

- (2022 and 2023) XML04 - DividendTotal not found: We've implemented F3 validation where the Dividend record is present and zero in the amounts field.

- CMN.ATO.IITR.800002/CMN.ATO.IITR.800004: We've fixed the Go to link and it will now go to the correct business item.

We've fixed a page scaling/sizing issue in the Activity statement Obligations homepage.