MYOB AE/AO Tax Manager release notes & install guide—2019.0 Service Pack (NZ)

Release date—6 May 2019

Release notes

From the end of April 2019, Inland Revenue (IR) will start using Transaction data services (TDS) instead of the Tax agent web service (TAWS) to provide downloadable data.

You'll get income tax, tax credits, and working for families data from TDS.

Tax Manager uses IR gateway services for Transaction data services (TDS) and related interactions.

If your my.MYOB login isn't linked to a myIR account when you attempt to use an IR gateway service, you'll need to set it up. Your browser will display the myIR login page where you can link them.

A user can only perform the gateway service functions that they could perform in myIR.

However, once the data is in MYOB AE/AO, you must control:

- access to the data using task permissions

- access to specific clients by adding Team security.

Review permissions in Maintenance > Maintenance Map > Security > Task permissions.

- Enter your myIR login credentials.

- If an IR Consent Management message appears, read the message and click Authorise.

A confirmation message displays when IR has verified the login. - Close the browser window and return to Tax Manager.

You do need to store the existing online services login and password for tax agents so that you can still receive student loan data via TAWS.

Tax Manager references client lists for various reasons, such as:

- receiving download data

- when you do a Client IRD data refresh.

By requesting the client list, the data is available whenever the system needs it.

We've added a couple of ways to initiate a client list request:

- A request is automatically sent when you link your agency.

- To manually initiate a request, go to Maintenance > Maintenance Map > Tax > Maintain Agencies and click Request client lists form IRD.

You can compare the clients in your Tax Manager agency list to the those in myIR. Use the field chooser to add the Agency field to your Find Tax Clients page, and compare the Agency to the clients linked to the myIR agency list.

You'll receive daily download data via a connection to a secure MYOB server, rather than directly from IR. The link with MYOB is based on the tax agent client list. You need to let IR know that you want to receive the IR data downloads through your MYOB software.

- Go to Maintenance > Maintenance Map > Tax > Maintain Agents.

- For each tax agent you want to receive TDS data for:

- Select the required tax agent.

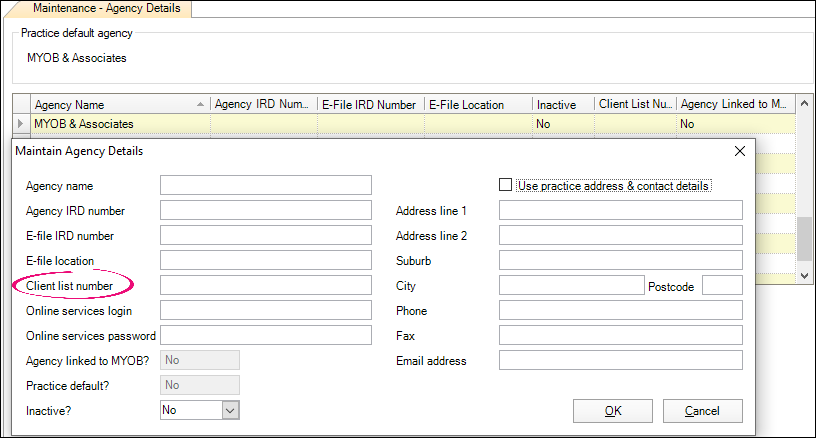

- On the Tasks bar, select Edit agency details.

Add the Client list number to the new field with this name.

The client list number is the number you use when you talk to IR or when you use myIR. You can find your client list number in MyIR under Manage my agency. The number might not be the same as your Agency and E-file IRD number.

Click OK.

- If you see the myIR login, enter your details.

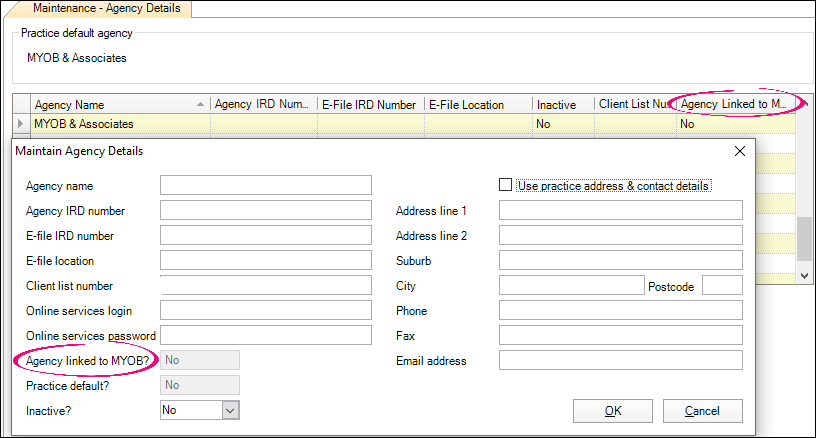

- On the Tasks bar, select Link agency to MYOB at IRD. When successful, the Agency Linked to MYOB column and field display Yes.

- Go to Maintenance > Maintenance Map > Tax > Maintain Agents.

- For each tax agent you don't want to receive TDS data for:

- Select the required tax agent.

- On the Tasks bar, select the tax agency with the client list, then select Delink agency from MYOB at IRD.

- Click OK. When successful, the column Agency Linked to MYOB changes to No.

You can update your agency's stored myIR credentials. This can be useful if someone changes the password, or if the user who set up the agency in myIR is deleted from myIR.

There are a couple of ways you can update your stored myIR credentials:

- Update manually:

- Go to Maintenance > Maintenance Map > Tax > Maintain Agencies.

- Select the agency and click Delete myIR credentials for agency.

- Select Request client list. New credentials are added.

- You may get prompted to update: If you're performing a task and your credentials are invalid, you'll be prompted to update your credentials. This is in addition to the previous functionality where you may get prompted to enter new credentials when performing a task.

We've added to the data that gets downloaded when you link your agency to MYOB.

The existing options will:

- continue to download TAWS data for the student loan

- download TDS data for:

- income tax

- tax credits

- Working for Families.

The following options download TAWS and TDS data:

- IRD download schedule

- Bulk refresh

- Client IRD data refresh.

TDS data is processed overnight, similar to TAWS. The bulk files are available for you to download the next day.

To stagger the download requests, we've updated the download schedule to randomise the minutes of the scheduled time. The update affects existing scheduled tasks and newly-scheduled downloads. There are no changes to the hour of the download schedule.

To verify the scheduled time, go to Maintenance > Maintenance Map > Tax > IRD download schedule.

We've updated the IR download history window:

- We've added a date range option. The default is one month of history, but you can select your preferred date range.

- The history window tells you which downloads are TAWS by displaying TAWS in the Type column. For example, a TDS download will display Manual Client, and a TAWS download will display Manual Client - TAWS.

With the introduction of TDS, we've reactivated the GST alert GST settings differ to IRD. We had previously deactivated the alert when GST was no longer available via TAWS. You'll see this alert when the GST setting received from the IR isn't the same as the setting in the client's Tax tab.

IR has changed how some transactions are displayed:

- In the IR statement view, each provisional instalment is displayed separately instead of as a combined total. The instalments will still be reversed and will then display as an assessment. This means provisional taxpayers see multiple assessments in one year. Once the assessment has been received, the provisional entries will no longer display. For provisional tax, the transactions view will still display a combined total.

- Penalties are displayed as one entry per tax payment period. Each period displays one transaction.

- You'll receive up to seven years of data via TDS for each tax type and client. If you haven't received this data before, you may notice more unreconciled entries.

- The TDS transaction description will display for any TDS-supplied transactions in any year.

- Any transactions related to an Imputation credit account or Maori Authority Credit Account will display in the Income tax account.

The Client IRD data refresh menu option isn't available until the history has been processed. This is because it's important that the history data is processed before any new TDS data is received. History data is first provided via the bulk refresh that matches existing TAWS transactions to new TDS transactions.

- You can't refresh client IR data if the client's not in the myIR workspace of the user whose myIR credentials are being used.

We're working with IR to resolve this issue.

Workaround: The overnight bulk refresh will update the client data. - IR data won't be displayed correctly for clients that have been issued a new IRD number as a result of, for example, being part of a consolidated group or having declared bankruptcy.

This issue will be resolved in a future Tax Manager update.

Workaround: Log in to myIR to check the account and see the correct data. - You may get the error "Other party clientid cannot be empty" when you add a transfer, if the reciprocal IR number isn't in Tax Manager.

This issue will be resolved in a future Tax Manager update.

Workaround: Add a transfer transaction with the same details. The two transactions will automatically reconcile. - IR now treat each weekly or fortnightly payment of Working for families tax credits as an assessment. When the first payment is made to clients, Working for families will display as having an unreconciled assessment in IRD > Data unreconciled for the 2019 and the 2020 tax years.

Workaround: None. This issue will be resolved in a future Tax Manager update. - If 2011 or 2012 tax years have a balance, the IRD Statement transactions are duplicated for these years, including for assessments and interest.

Workaround: None. This issue will be resolved in a future Tax Manager update.

Install guide

Read through this installation guide before you begin installing this update. It will help you plan the tasks required.

- Make sure you have MYOB AE version 5.4.31.132 and MYOB Tax Manager 5.4.31.132 installed on your network or standalone computer.

- Make sure everyone's logged out of all MYOB programs.

- Check that your computer meets the system requirements.

- Disable your virus checker.

- Ensure your data is backed up.

- Download MYOB Tax Manager 2019.0 (5.4.31) - service pack from my.MYOB and save it to the location on your server where MYOB AE/AO is installed.

- Double-click the .exe to start the install.

- Click Next in the Welcome to the InstallShield wizard.

- Select I accept the terms in the licence agreement.

- Click Next to install the utility.

Click Finish on the InstallShield Wizard Completed window.

Workstations update automatically when you open MYOB AE/AO. If you're on a terminal server workstation, your administrator must run setup.exe. A message displays telling you which folder setup.exe is in.

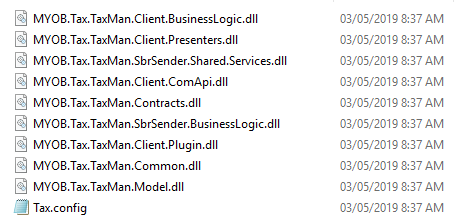

Check that the .dll files have been installed in the TaxManagerService folder with the modified dates as shown in the screenshot below.

The default location is C:\Program Files (x86)\MYOB\TaxManagerService.

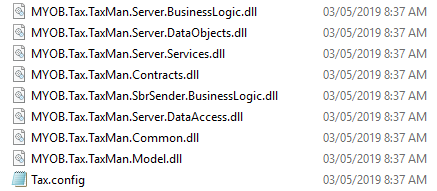

Check that the .dll files have been installed in your deploy folder(s) with the modified dates as shown in the screenshot below.

The default locations of the server deploy folder are:- (AE non SQL) C:\Program Files (x86)\MYOB\Central\Deploy

- (AE) C:\MYOBAE\AESQL\Central\Deploy

- (AO) C:\MYOBAO\AOSQL\Central\Deploy

The default location of the workstation deploy folder is:

- C:\Program Files (x86)\MYOB\Central\Deploy