MYOB AE Assets release notes and install guide—2.4.7 (Australia)

- Temporary Full Expensing (TFE) is available for new assets and the Small Business Pool. TFE will be applied for the SBE pool, as mandatory, when the upcoming year-end is between 7:30pm AEDT 6 October 2020 and 30 June 2022.

- For the 2019–20 and 2020–21 income years, eligible businesses can deduct 57.5% (rather than 15%) of the business portion of a new depreciating asset in the year it's added to the pool.

- The instant asset write-off of $150,000 has been extended by another 6 months from 31st Dec 2020 to 30th June 2021.

- We've fixed a problem where the instant asset write-off threshold was applied:

- in the General Small Business Pool report when the balance was over $150,000

- in the LVP Schedule report when the balance was under $20,000.

- We've made changes to reflect the ATO changes to instant asset write-off thresholds.

Calculating pool balance and write-off threshold

If the pool balance for the year (calculated prior to depreciation) falls below the pool write off threshold, the entire small business pool is written off:

| Date range | Threshold for each asset |

|---|---|

12 March 2020 to 30 June 2021 For eligible businesses with an aggregated turnover from $10 million to less than $500 million, the $150,000 threshold applies for assets purchased from 7.30pm (AEDT) on 2 April 2019 but not first used or installed ready for use until 12 March 2020 to 31 December 2020. | $150,000 |

| 2 April 2019 (7.30pm AEDT) to 11 March 2020 | $30,000 |

| 29 January 2019 to 2 April 2019 (prior to 7.30pm AEDT) | $25,000 |

| 12 May 2015 (7.30 pm AEDT) to 28 January 2019 | $20,000 |

| 1 January 2014 to 12 May 2015 (prior to 7.30pm AEDT) | $1,000 |

| 1 July 2012 to 31 December 2013 | $6,500 |

| 1 July 2011 to 30 June 2012 | $1000 |

See instant asset write-off thresholds on the ATO website for more information.

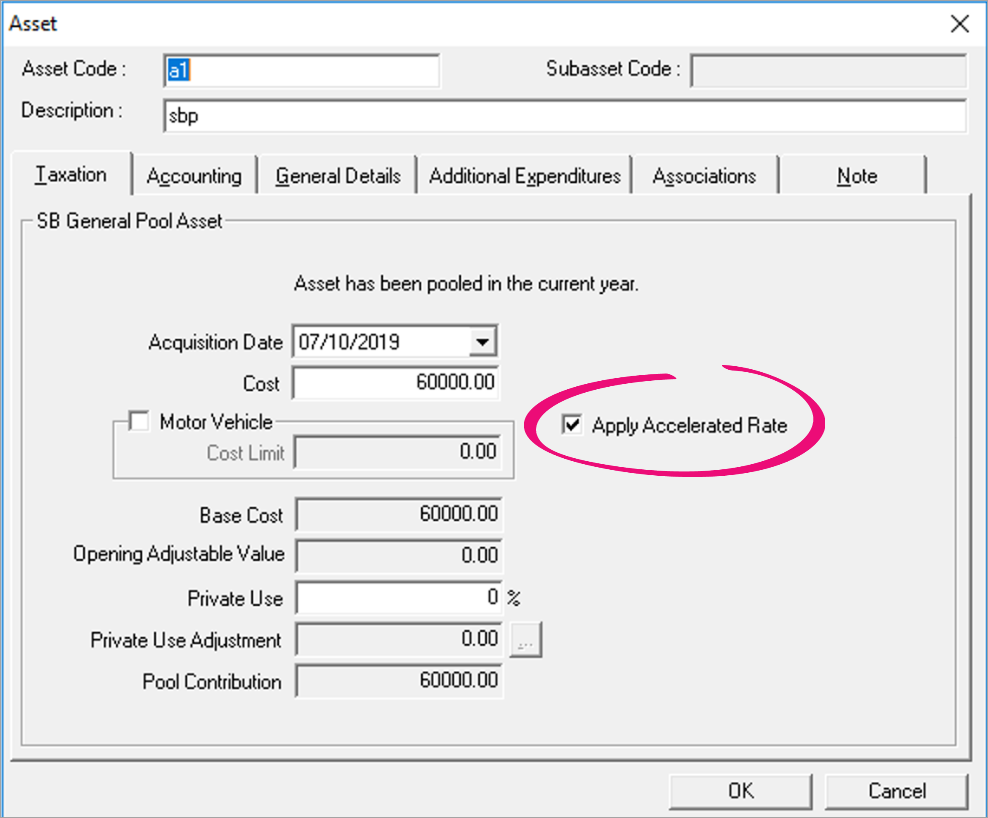

For the 2020 and 2021 financial years, if there are new assets in the Small Business Pool, you'll see an Apply Accelerated Rate checkbox when you create or edit the asset.

To apply accelerated depreciation, select Small Business Pool. For accelerated depreciation to be applied, the assets must not be eligible for Temporary Full Expensing or Instant write-off.

Install guide

Read through this install guide before you start installing the update. It will help you plan the tasks required.

Back up your data.

- Ensure everyone's logged out of all MYOB programs.

- Check that your computer meets the system requirements.

- Disable your virus checker.

Each workstation that is currently running MYOB AE Assets must be upgraded to MYOB AE Assets Version 2.4.7. If you have MYOB AE Assets on a terminal server use, Add/Remove Programs to upgrade to MYOB AE Assets Version 2.4.7.

The MYOB AE Assets 2.4.7 installer will recognise if you have an existing version of MYOB AE Assets installed on your system. The installer will uninstall the previous version and install MYOB AE Assets 2.4.7.

If you are installing MYOB AE Assets for the very first time, MYOB AE Assets 2.4.7 is all you need to install.

To upgrade to MYOB AE Assets Version 2.4.7 from an existing version

- Download the .exe file from my.MYOB.

- Double-click the download file. The Licence Agreement window opens.

- Read the licence agreement.

- Click Yes to agree with all the terms of the licence agreement.

- Click OK. The previous version of MYOB AE Assets is uninstalled and the Warning: Have you backed up your Data? window opens.

- If you have backed up your data, click Yes. The System Release Directory window opens.

- If you haven't backed up your data:

- Click Cancel to exit the installation.

- Back up your data.

- Restart this procedure.

Specify where System Release is installed.

You must specify all locations of System Release. System Release is usually installed in C:/Sol64.- Click Add. The Browse For Folder window opens.

- Browse your computer for the location of System Release.

- Click OK.

- Click Next. The Destination Directory window opens.

- Accept the default directory.

- Click Next. The Installation Summary window opens.

- Review the selected current settings for the installation and, if you need to make any changes, click Back to go to the appropriate window and make your changes before proceeding.

- To begin the installation, click Next. MYOB AE Assets version 2.4.6 is installed on your computer. The Installation Complete! window opens.

- Click Finish.

Check your version number

- Open MYOB AE Assets.

- Click Help and select About MYOB AE Assets.

- Check that the version is 2.4.7.