Release date—April 2021

Release notes

This release will install new and updated report formats.

To update your practice and client masters, you can either copy from these new master versions, or manually update your own practice and client versions using the information provided about each report format change included below.

Masters version is 3.5.400

Accounting policies

This update applies to all entities.

Special purpose reporting:

- In the Accounting Policy introduction, we've replaced the special purpose paragraph with These financial statements have been prepared in accordance with A Special Purpose Financial Reporting Framework for use by For-Profit Entities (SPFR for FPEs) published by Chartered Accountants Australia and New Zealand. This includes the printing of These financial statements have been prepared for the entity's owners and Inland Revenue.

- We've added a new Non-transaction data field called FinanicalsPreparedFor. You can find it under Policies > Contents > TextOfPolicies.

This is a memo field with the default wording These financial statements have been prepared for the entity's owners and Inland Revenue. You can change the default wording as required.

Partnerships

In the Accounting Policy introduction paragraph, we've removed the reference Partnership Act 1908 as this is no longer valid.

Company minutes

Directors resolution

We've updated the Special Purpose Framework paragraph to These financial statements have been prepared in accordance with A Special Purpose Financial Reporting Framework for use by For-Profit Entities (SPFR for FPEs) published by Chartered Accountants Australia and New Zealand.

Resolutions of Shareholders

- We've updated the Special Purpose Framework paragraph to These financial statements have been prepared in accordance with A Special Purpose Financial Reporting Framework for use by For-Profit Entities (SPFR for FPEs) published by Chartered Accountants Australia and New Zealand.

- We've removed the following:

- The Financial Statements of the company for the {PeriodLowercase} ended {ThisYear} dated {Today}, a copy of which is attached, be, and is hereby, adopted, and that any failure of the Financial Statements to comply with the provisions of The Companies Act 1993, as permitted by Section 211 of that act or any other statute is hereby approved.

- The associated Non-transaction data field Minutes > Shareholder Resolution > AnnualReport.

- The minute referring to the 9-month extension for financial reporting. 196(2) of the Companies Act has been repealed.

- As you can't have a blanket resolution approving major transactions, we've deleted the paragraph. To enter details for major transactions, go to Non-transaction data > Minutes > ShareholdersResolution > MajorTransactions.

Compilation report changes

- The Disclaimer will no longer print if you have filled in the paragraph box under Non-transaction data > CompilationReport > Independence.

- We've removed the paragraph Departure from reporting framework.

- In the IR10c report, the Net profit/loss before tax (KP27) has been changed to pick up the total of the profit and loss range from the account code range under Chart Map > Shortcuts > NetOperatingSurplus rather than adding key points 2 - 26.

- In the IR10c - Detailed report, the Net profit/loss before tax (KP27) has been changed to pick up the total of the profit and loss range from the account code range under Chart Map > Shortcuts > NetOperatingSurplus rather than adding key points 2 - 26.

If the total of KP 2 - 26 doesn't equal KP27, then you'll get an 'Out of Balance' error on the report.

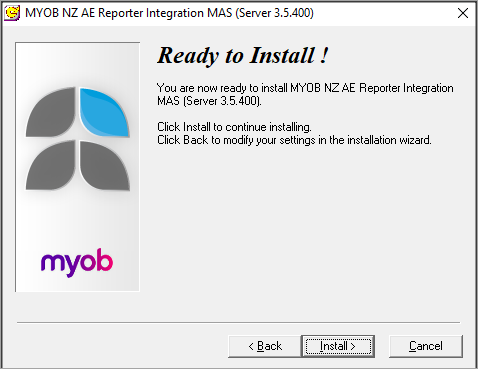

Install guide

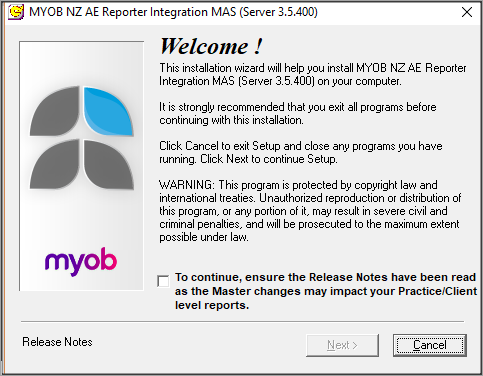

Read through this installation guide before you begin installing this update. It will help you plan the tasks required.

Prerequisites

- Make sure everyone's logged out of all MYOB programs.

- Check that your computer meets the system requirements.

- Disable your virus checker.

- Check that you meet the prerequisite version numbers for installing this release:

If you've got an earlier Version than 3.5, upgrade to 3.5.

If you've got an earlier Masters version than 3.5.100, you can still install this release. Read the release notes that came after your version, so that you're aware of any changes.

You can download previous versions and their release notes from my.MYOB.

To check your version numbers

- Open MYOB AE Reporter.

On the menu bar, click Help and select About MYOB AE Reporter.

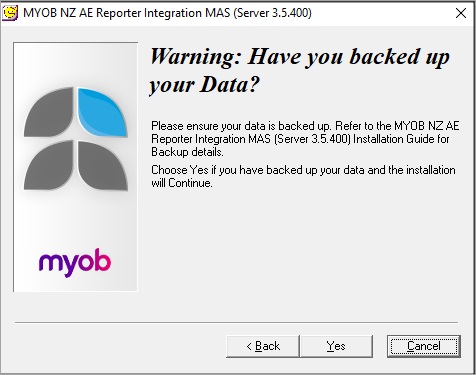

- Copy the .nrw files from your SOL64 folder to a temporary location as a backup.

| File name | Location |

|---|

| mm.nrw | \Sol64\Reporter\Modified |

| m.nrw | \Sol64\Reporter\Master |

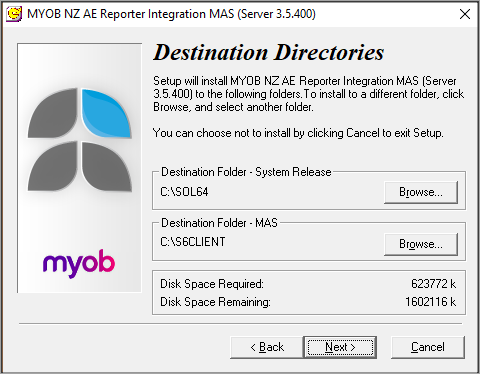

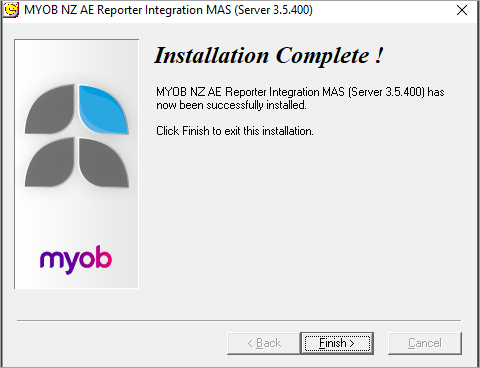

Post installation

Check your version numbers

To confirm if your upgrade is successful, check your Reporter version number.

- Open MYOB AE Reporter.

- Click Help and select About MYOB AE Reporter.

- Confirm that your Version is 3.5 and Masters is 3.5.400 (only the Masters version will be changed after the upgrade).

Rollover the practice Masters

Rollover the practice Masters to 2021:

- Open a MAS ledger with a year ending 2020.

- From the Client Ledger window, go to Reports > Reporter and select Design Practice Reports.

- Go to Tools > Roll Forward.

- Select Yes at the message Do you wish to roll forward to 2021?

- If the rollover is successful, the Reporter Year is 2021. This is displayed at the bottom right-hand side of your window.

Rollover the practice Masters to 2022: (These steps are optional)

- Open a MAS ledger with a year ending 2021.

- From the Client Ledger window, go to Reports > Reporter and select Design Practice Reports.

- Go to Tools > Roll Forward.

- Select Yes at the message Do you wish to roll forward to 2022?

- If the rollover is successful, the Reporter Year is 2022. This is displayed at the bottom right-hand side of your window.