MYOB AE Tax release notes—2019.0 (New Zealand)

Release date—2 April 2019

2019 Tax Online Help—IMPORTANT NOTE

Our AE tax online help has had a makeover, but it’s not available in-product just yet. This means you’re unable to access online help by pressing F1 in your software.

We’ll add in-product help in a later release. In the meantime, you can get 2019 tax help from our IRD Tax Guides 2019.

We recommend sharing this message to avoid confusion.

- Open Tax Returns System 2019.

- Click Help and select About.

- Check the version number of each application:

| Application | Version |

|---|---|

| Tax Return System 2019 | 2019.0 |

| Tax Return System 2018 | 2018.1 |

| Tax Tracking System | 2019.0 |

| E-File System | 2019.0 |

| System Release | 8.1a |

| Central Database | 6.3aNZ |

We've updated the tax modules to comply with the legislative changes for the 2019 tax year:

- ACC Earner Levy maximum liable earnings have increased from $124,053 to $126,286.

- The earning rate is unchanged at 1.39%, so $1,755.37 is the maximum payable amount.

- Student loan repayment rates remain at 12%, but the threshold rate has increased from $19,136 to $19,448.

As part of the IR transformation project, IR are changing the back-end processor for E-File.

E-File is a way for tax agents to transmit data from software directly to IR. It's the most significant channel for the submission of income tax returns, typically used for about 75 per cent of all returns filed.

E-File accepts the following return types and attachments:

- IR3—Individual Income Tax Return

- IR3NR—Non-Resident Income Tax Return

- IR4/J/S—Companies Income Tax Return

- IR215—Adjust your income

- IR526—Donation Tax Credit Claim Form

- IR833—Property sale information

- IR6/B—Estate or Trust Income Tax Return

- IR7/L/P—Partnerships and Look-Through Companies (LTCs) Income Tax Return

- IR8/J—Maori Authorities Income Tax Return

- IR9—Clubs or Societies Income Tax Return

- IR10—Financial statements summary

- IR101—Goods & Services Tax Return

- Personal tax summaries

- Correspondence.

If you're an agent, you can also receive your client lists, debt letter reports and summary of earnings reports, as well as notices produced as a result of filing (notice of assessment, return acknowledgement and notice of entitlement).

You won't be able to E-File tax returns for 2012 or earlier, and some return types from 2013 will be affected. You can create returns in AE Tax for all affected years, and you can print and send the C-Series report to IR.

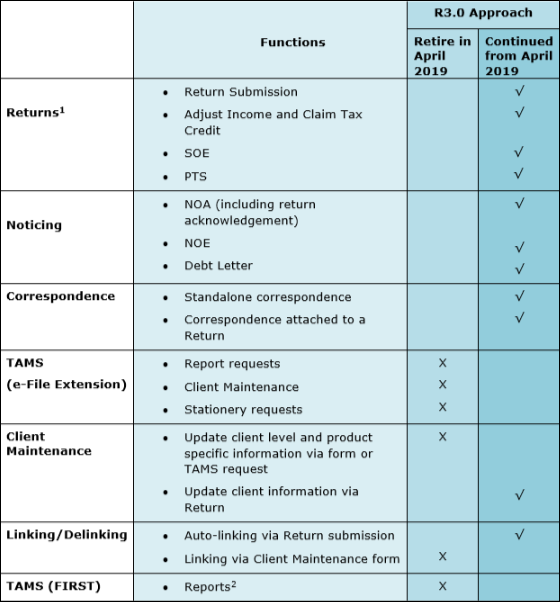

Function changes

When you lodge the return via the E-File system, the return won't be sent to IR and the file will be moved to X:\SOL64\FILES\SQLTAX\RETURNS\OBSOLETE as a record.

To get a report of all returns that are in this folder and the date that the returns were moved, go to E-file > Reports > Obsolete return log.

Updates of status, dates and amounts will continue to flow to Tax Tracking and Tax Manager as usual, but you won't receive notices or assessment details from IR.

Personal Tax Summary (PTS/IR538) is no longer available.

When using Tax Manager

The Client > Tax tab shows return type PTS until you access the 2019 tax return, at which point it will update to become an IR3.

When using Return Preparation

If a 2019 PTS return exists, it'll automatically update to an IR3 and all existing information will roll over.

If you're a Tax Agent, make sure you only file an IR3 tax return for taxpayers who have earned income other than salary, wages, interest, dividends or taxable Maori authority distributions.

IR automatically assesses all other individual taxpayers (formerly PTS). You can add or change automatic assessment information online in myIR.

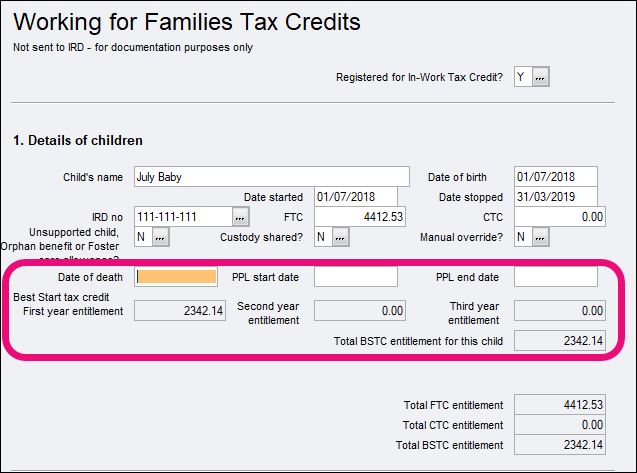

- For the 2019 income year, the rates and thresholds changed from 1 July 2018. This means that the previous year's calculation is the same from 1 April 2018 to 30 June 2018, and new rates take effect from 1 July 2018 to 31 March 2019.

- A new Best Start Tax Credit (BSTC) has been introduced from 1 July 2018. This applies to all families for the first year of a child's life, and to low-income families thereafter.

- Child tax credits (CTC), Parental tax credit (PTC) and In Work tax credit (IWTC) calculations are unchanged for the 2019 tax year. The 2018 rates apply for the full 2019 year.

MFTC thresholds changed from 1 April 2018, and the new thresholds apply for the whole of the 2019 income year. The 2019 thresholds are:

- Annual before-tax equivalent $30,516

- Prescribed amount $26,156.

- FTC Maximum entitlements are calculated on a child-by-child basis in two parts for each child—from 1 April 2018 to 30 June 2018, and from 1 July 2018 to 31 March 2019.

- Rates and thresholds have increased, and the abatement rate for FTC has been increased from 22.5% to 25%.

- FTC entitlements have been simplified. Different age brackets for children (under 13, 13 to 16, over 16) are no longer considered. There are only two levels of entitlement: first child $5,878, and second and subsequent children $4,745.

A new Best Start Tax Credit is a payment of up to $3,120 per year (or $60 per week) per qualifying child.

BSTC applies to children born on or after 1 July 2018.

BSTC will be available to all families in the first year of a child's life. For the second and third year, for families with income over $79,000, the credit will be abated at a rate of 21 cents per dollar of income.

If you're claiming Paid Parental leave (PPL), you can't claim BSTC at the same time. BSTC will start when PPL has finished.

The rules for calculating BSTC are in section MG2 of the Income Tax Act. Section MG2 (1) defines the calculation as prescribed amount × days ÷ 365. As the credit is only available from 1 July 2018, the maximum number of days entitlement for the 2019 year will be 274. The prescribed amount is $3,120.

If a child dies during the year, the entitlement period is extended for 4 weeks (28 days) after the date of death.

Examples

- A family has one child born on 29 June 2018.

- There's no BSTC entitlement, because it only applies to children born on or after 1 July 2018.

- A family has one child born on 31 July 2018.

- In 2019, BSTC will apply for 244 days, and will be $3,120 × 244 ÷ 365 = $2,085.70.

- In 2020, BSTC entitlement will depend on family income. The full BSTC amount will apply from 1 April 2019 until a child's 1st birthday on 31 July 2019 (122 days), after which the entitlement will be abated at a rate of 21 cents per dollar for every dollar of family's income over $79,000.

- A family has twins born on 1st November 2018.

- In 2019, BSTC will apply for 151 days, and will be $3120 x 151 / 365 = $1,290.74 x 2 children = $2,581.48.

New fields

Fields have been added for calculating the BSTC:

- Date of death

- Paid Parental Leave (PPL) start date

- PPL end date

- BSTC entitlement per year

- Total BSTC entitlement.

We've updated the client schedule to include these new fields.

You find the net WFTC entitlement by calculating the maximum entitlement and applying an abatement if annual total family income exceeds the prescribed threshold. This abatement is applied against FTC + IWTC + CTC.

The WFTC abatement calculation is split between the periods from 1 April 2018 to 30 June 2018, and 1 July 2018 to 31 March 2019, taking into account the number of days of entitlement in each period.

The family income is an annual figure, so this needs to be split on a by-day basis with 91/365 applicable to the first period and 274/365 applicable to the second period. Both the threshold and the abatement rate change on 1 July 2018.

- From 1 April 2018 to 30 June 2018, the threshold is $36,350 and abatement rate is 22.5 cents per dollar of family income above $36,350.

- From 1 July 2018 to 31 March 2019, the threshold is $42,700 and abatement rate is 25.0 cents per dollar of family income above $42,700.

For more information, see the IRD WFTC page.

Here are other changes as part of the IR transformation project, apart from START.

Responses through E-File

If you're an agent, you'll continue receiving responses for filed returns, but the type of responses may be different to what you received before. There'll be less Return Acknowledgements, and more Notices of Assessment.

Bank account details

If a refund's due but IR doesn't have the customer’s bank account details, a Notice of Assessment or Return Acknowledgement will be issued with a message requesting that the customer update their bank account details. This will only happen if the customer didn't get an exemption from IR from providing the bank account details. If the customer did get an exemption, a Notice of Assessment with Cheque (NACHQ) or Return Acknowledgement with Cheque (RACHQ) will be issued.

There's a manual workaround you need to be aware of for representing tax credit in the IR3 return.

First, a bit of background.

There are two scenarios which make the IR’s system show a company as having overpaid its provisional tax and the shareholder as having underpaid (unless the shareholder paid provisional tax separately.) A company may either:

- Not include a deduction for the shareholder salary in its AIM Statements of Activity, but make a deduction at the end of the year.

- Include a deduction for shareholder salary in its AIM Statements of Activity, and include an amount to cover the tax on the shareholder salary at the shareholders' marginal tax rate.

With AIM, IR allows the company overpayment to be transferred to the shareholder as a tax credit rather than as a payment. The benefit to the shareholder is that their residual income tax is reduced, and they might be removed from the Provisional Tax regime.

For 2019 tax year, there's no way to represent this tax credit in the IR3 return, and IR have suggested a manual workaround. IR have advised they'll add AIM boxes into the IR4 and IR3 tax returns for future years.

The 2019 manual workaround

You'll need to claim the tax credit in the shareholder tax return. IR can identify through the income profile deductions which credit is related to schedular/AIM company tax and which is from EMS where you paid shareholders schedular payments.

When IR receive the return, they highlight all AIM returns and process them separately. The amounts named in the AIM Credit Recipient notice will transfer through to the individual’s income profile, and can be matched with the amounts claimed on their individual returns.

Attach a document to the AIM company tax return, which will stop the return and stop overpayments in the account being accidentally refunded.

The document must include:

The subject line AIM Credit Recipients notice

shareholders names

shareholder IRD numbers

amounts for each shareholder

total to be transferred.

- In the AIM shareholder tax return, claim the tax credit (as named in AIM credit recipient notice) in schedular tax field (12A) (for company transfers in the individual tax return).

From the end of April 2019, Inland Revenue (IR) will start using the Transaction Data Service (TDS) instead of the Tax Agents Web Service (TAWS) to provide downloadable data.

You'll get income tax, tax credits, and working for families data from TDS.

You need to use Tax Manager to get data from TDS.You won't need the MYOB Account Lookup Scheduler for downloading data from IR anymore, so feel free to remove it from your system.Tax manager only

We've added a validation log warning. To complete or finalise the return, you must have client authority selected.

- When a refund is transferred to next year's provisional tax, two areas on the Client Tax Statement weren't getting updated unless you closed and reopened the return. We've corrected this.

Tax Manager only

You'll no longer use the Tax Tracking System (TTS). Make all future changes in MYOB AE or TRS18. No data will come from or go to the Tax Tracking System for Tax Return System 2018 (TRS18) onwards.

If you're making a change for TRS17 or an earlier year, you still need to make the changes in the relevant TTS year and in MYOB AE.

As TTS isn't being used for any information any more, you don't need to do a TTS year-end rollover. You only need to do a rollover in TRS at the start of the new tax year.

We strongly recommend that you Tax guide 2019—AE Tax.

Individual rollovers compared to bulk rollovers

When you do a rollover on an individual return, there are checks to ensure that the entity type matches the entity type in AE and that the return type you're rolling is relevant for that entity type. You'll see warnings if the checks find an issue. These checks aren't performed for a bulk rollover, so you'll need to correct any issues manually.

When you add a new return, the Return code is now the mandatory field. This code corresponds to the client code in MYOB AE.

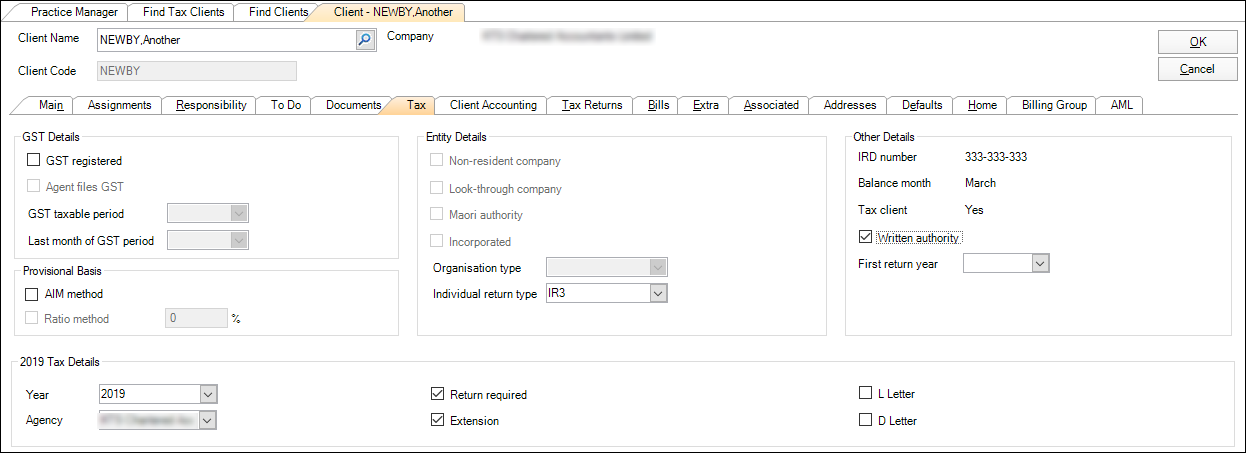

When a return is rolled over from the previous year, the return type will remain the same as the previous year. If you create a new return, or if you don't rollover from the previous year, the return type will be populated based on your AE settings.

If you need to change the return type, you can now change it in the tax return properties to another type valid for that entity type. Tax Manager will be updated with the new return type for that year if it's different.

The tax return is now populated with the following information from the AE Tax tab:

- GST settings

- Balance month

- IRD number

- Entity type

- Non-resident company

- Look-through company

- Incorporated (club or society)

- Organisation type (club or society)

- Written authority

- Extension.

You no longer need to maintain these settings in AE and TTS for 2018 onwards; you only need to ensure AE has the correct information. You can't edit these fields in the tax return, so make any changes in AE.

From 2019 onward, the AE Tax Return tab won't display the tax return information, because the details for this tab come from Tax Tracking.

All of the return information is available on the AE Tax tab. You can access return preparation on the Tasks bar.

Return properties now displays the entity type.

For TRS18, the entity type only displays for returns that are active at the time of the installation and if the properties have been accessed.

For TRS19, the entity type displays for all returns.

You can change the return type based on valid options for that entity type.

We've renamed the Client Authority field to Written Authority. This field is populated from the AE Tax tab. An error displays in the validation log if this field is set to No. To E-File the return, you must change the field to Yes.

We've replaced the On Agents List field replaced with the Extension field. The Extension field is populated from the AE Tax tab.

If you select the Extension field in AE for the same year, Yes displays in return properties, and the Payment Summary displays the later terminal tax due date (7 April for a March balance date).

If you deselect the field, No displays in return properties, and the standard terminal tax due date displays on the Payment Summary (7 February for a March balance date).

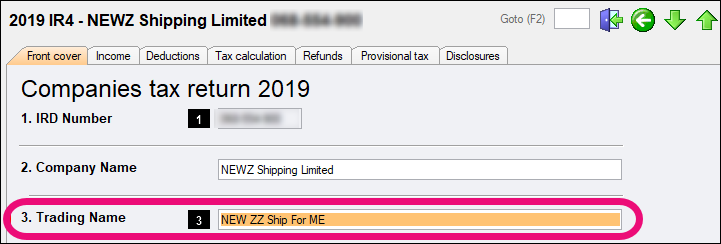

- You can edit the trading name for companies and partnerships in the front cover of an IR4 or IR7 return.

- The KP9 Non-resident field in an IR4 front cover can't be edited. The KP9 Non-resident field is populated based on the setting in the MYOB AE client Tax tab.

Notice of Assessments are now available from the E-File Reports menu. Previously, Notice of Assessments were available from a menu in TTS, and you could access an individual assessment via a link in Tax Manager. The Tax Manager link now also points to the new location when for AE 5.4.30 or later.

- Old Path: TTS > Utilities > Special Routines > Tax Manager integration. (You can still be view but not edit).

- New Path: TRS [most current year] > Control Record > Tax Management.

- TTS integration options have been removed from TRS > Properties when integrated into Tax Manager

For E-File and for TRS18 onwards, the modules menu doesn't include a shortcut to the Tax Tracking System.

- IR3 Front cover KP9A—When you select IR215 Income adjustment form to be filed?, we've updated the setting to remain selected.

- IR4J imputation return—When Autoload values from IR4 is enabled, we've updated the values so that you can't edit them. You could previously edit the values, but the values would change back when you closed the schedule.

- IR4 KP12—We've updated the description to match the form. It now displays Did the company receive any income from schedular payments.

- IR7—In Client tax statement > Owners/Partner attribution schedule, we've updated the Other Income tax credits field to display large numbers correctly.

- IR7—We've updated the grammar relating to RLWT (residential land withholding tax).

- IR8 Client tax statement—We've updated Total tax to pay to include the terminal tax amount.

- IR215—We've corrected spelling mistakes.

- We've updated a calculation to avoid an E-File rejection when salary and wages income is entered with no tax or PAYE withheld. The ACC levy was previously greater than the PAYE amount.

- We've removed a warning. Previously, when deleting a tax return with the status Rolled, the message "WARNING - Return is past ACTIVE status" displayed, even though a rolled return has never been accessed. Now only the message confirming deletion displays.

- Tax Manager only

- If you change the E-File indicator from Y to N in return properties, we've updated the setting to save correctly.

- We've updated the software to automatically remove blank lines from the Agents table, and to prevent them from appearing again. Previously, in some circumstance blank lines may have been created, which could lead to issues with the incorrect agent being associated with a tax return.

- We've made the provisional tax amount in the tax return non-editable, so that Tax Manager is the source of truth for provisional tax. Previously, when you estimated a return, you could edit the provisional tax amount in the tax return. When you exited the return, the value would refresh correctly to the amount in Tax Manager, but it shouldn't be possible to edit the amount in the first place.

We've updated the Client Tax Statement display an estimated amount based on income and a voluntary amount for the student loan. The Client Tax Statement was previously only displaying the voluntary portion.

We've also made the interim payment option and amount fields at the bottom of the Student loan schedule non-editable, as these values are updated from Tax Manager.