Tax 2021.0 hotfix KB66322434 (Australia)

This hotfix is replaced by MYOB Tax 2021.0b SP2—Install guide and release notes (Australia). MYOB Tax 2021.0b SP2 includes the changes from this hotfix.

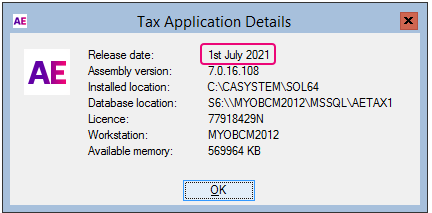

Release date—28 June 2021

This hotfix prevents incorrect data from being lodged with the ATO. We strongly recommend you install this hotfix.

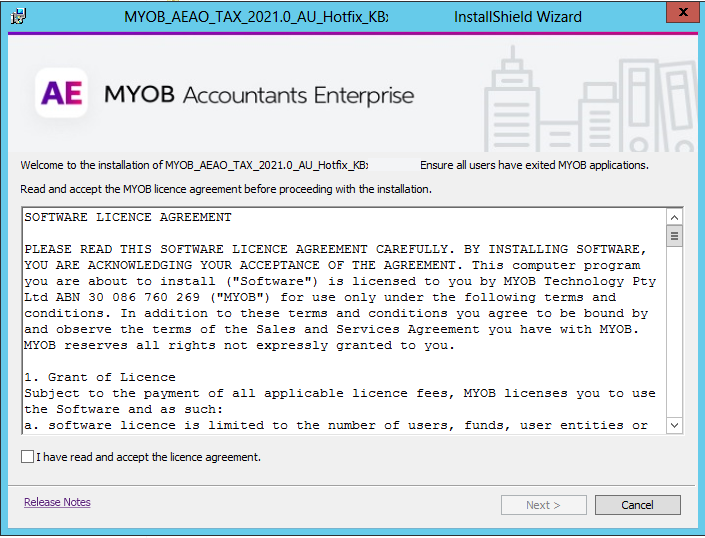

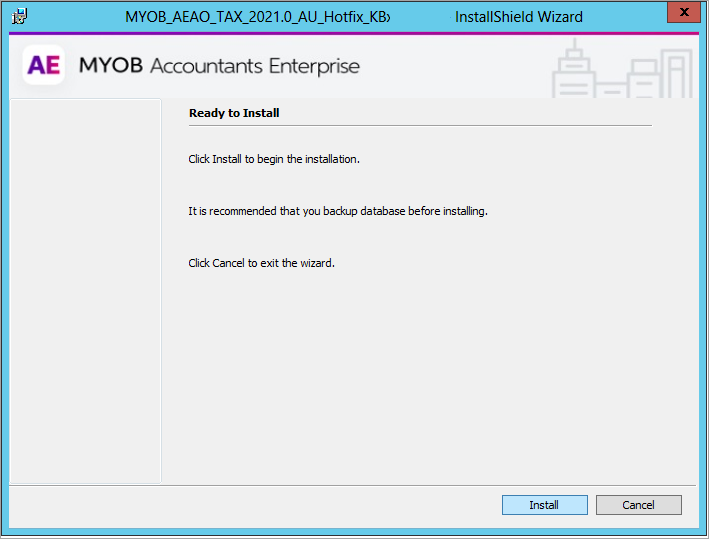

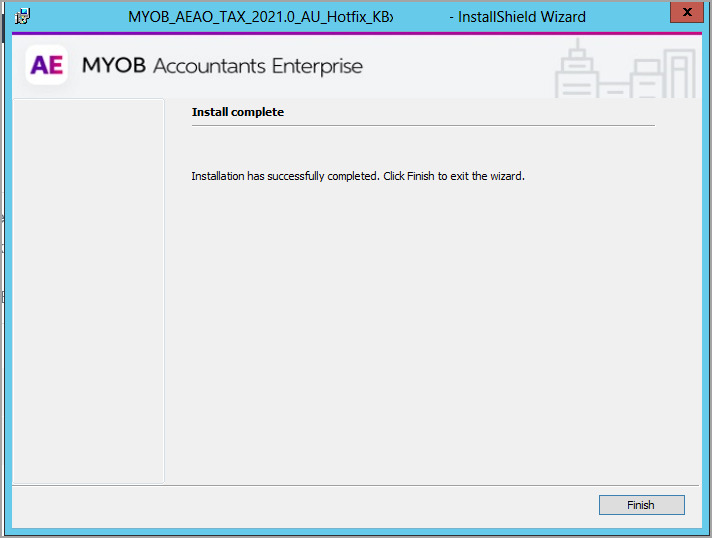

Before installing this hotfix, you must have installed Tax 2021.0. The hotfix takes less than a minute to install.

If you've already installed Tax 2021.0 and created a 2021 tax return with a capital gains worksheet (prior year losses entered), make sure you check the returns after installing this hotfix. See below for the affected items and labels.

This hotfix release fixes the integration issues between the capital gains worksheet(with a prior year loss entered in 2021), with the main labels in the tax return and BW schedule.

Post-installation steps

Make sure to follow the steps below after installing the hotfix

MYOB INTERNAL STAFF ONLY

Insert PR#

SR#